By: Bill Tuttle, Explorer Agency Manager

As fifth wheels, travel trailers, and horse trailers are getting longer, larger, and heavier, a typical pickup truck becomes less safe and less capable of pulling the weight. As a result, medium-duty trucks are becoming more popular in the RV and equine cultures.

As fifth wheels, travel trailers, and horse trailers are getting longer, larger, and heavier, a typical pickup truck becomes less safe and less capable of pulling the weight. As a result, medium-duty trucks are becoming more popular in the RV and equine cultures.

The term "medium-duty" may be unfamiliar to you, so here are some examples* of common medium-duty trucks:

-

Freightliner, Peterbilt, Kenworth, International, or Volvo single-rear axles

-

Ford 450's and 550's

-

GMC & Chevrolet 4500 and larger pickups with single-rear axles

-

Gross vehicle weight of any of these vehicles must be less than 26,000 pounds

Many RVers who would like to purchase a medium-duty truck to pull their RV or horse trailer are confronted with a stark reality: difficulty finding proper insurance. Of the few companies offering coverage for these units, most require the trucks to be on commercial policies which are often expensive as well as confusing for the insured. Also, commercial policies usually have strict mileage limits from the garaging address listed on the policy.

The National Interstate RV Insurance program was one of the first to realize that the medium-duty trucks were being used more frequently as personal vehicles pulling towable units. In this program, the medium-duty truck is insured for personal use and not as a commercial vehicle, as long as the intended primary use is to tow the fifth wheel trailer, travel trailer, or horse trailer for recreational purposes. The underwriters understand that the use of the truck is recreational, as its purpose is to pull an RV, so it is insured as such.

Through this program, the medium-duty truck can be insured as a standalone vehicle with the standard auto coverages, or combined on one policy with the towable unit. However, there is a significant premium difference if the fifth wheel or travel trailer is included on the same policy. The specialty RV coverages are still available to the recreational trailer in this case. The ability to place both vehicles on one personal policy simplifies everything for the insured with one policy and one bill.

The Recreational Vehicles - Personal or Commercial can be found on www.bigimarkets.com

* While some of these truck links are advertisements they are for representation only. We are not endorsing the vehicle or seller.

_______________________________________

"Beyond the Basics: Emerging Personal Lines Issues"

August 26, 2015

1:00 to 4:00 p.m. Eastern Time

$79 - Click here to register

This VU webinar examines a number of critical policy form changes that agents must know and communicate to the consuming public. The first hour focuses on ISO's planned new Personal Auto Program and a major change in their homeowners program. The second hour examines emerging issues, including car and home sharing, hydraulic fracking, and often misunderstood exposures and coverage gaps in ISO's homeowners program involving vehicles of various types. The third hour is devoted to two major auto exposures - family member vehicles and rental cars - and to insuring vacation risks such as motor homes, cruise ships, and overseas travel. Approved for CE in MD, MI, MT, NC, ND, NY, OH, OK, WA with AR, LA and NJ pending. See registration page for details.

Also planned is Certificates of Insurance - 2015 Edition. VU webinar questions can be sent to bestpractices@iiaba.net.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

________________________________________

Penetration by Business Insurance Top 100

By Paul Buse, President of Big I Advantage®

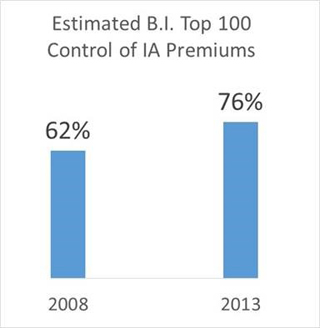

Recently, I was pondering the pace of large agency acquisitions of members I have known and the question arose over the average penetration of the agent/broker sector controlled by the biggest insurance agencies and brokers. Of course, no exact figures exist like they would for insurance companies but one can get an estimate. In order to do, one can take the Business Insurance Directory of the Top 100 Agents and Brokers and apply some simple ratios to their listing of the reported Top Brokers U.S. brokerage revenue. If one assumes an average 15% revenue to premiums and then adjusts industry premiums for average penetrations of commercial and personal lines as reported by IIABA's Market Share Rerport, one gets the below for the penetration of two years of the Business Insurance data. The years are somewhat random and happened to be what was readily available. As you can see, not only a significant penetration of the potential premiums but also a fast growing one if the various assumptions hold.

Click Graph for larger version

Source:

Click Graph for larger version

Source:

2014 and 2009 Business Insurance Director of Agents and Brokers

IIABA Market Share Report for 2014

A.M. Best Aggregates and Averages

________________________________________

Be one of the first five with the correct answers and win an envy-inspiring TFT Trivia T-shirt. Don't forget to answer the Tie Breaker!

Tracey DeAngelis (FL), Nancy Ruggiero (NY), Linda Davidson (WA), Gabe Mudd (TN), & Karen Rowland (IN)

1. What medieval system in England was an alternative to a surety bond? - FRANKPLEDGE

2. On this day (July 28th) in 1933 the first of these was delivered to Rudy Vallee. What was it? - SINGING TELEGRAM

3. The RLI Personal Umbrella allows how many At-Fault Accidents per household for the Standard II Rate Tier? - TWO

TIE BREAKER

Who said this: "Poor people have more fun than rich people, they say; and I notice it's the rich people who keep saying it." - JACK PAAR

________________________________________

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

-

Certificates of Insurance - 2015 Edition

-

Bicycle vs. Homeowners policy comparison chart

-

Customizable Bicycle Sell Sheets

________________________________________

Great news for our Big "I" Markets agents with commercial clients. Travelers is lowering Workers Compensation rates for over 100 classes of business. Effective July 6th, 2015 prices dropped by up to 30% in 37 states. While the actual reduction will vary based on the state, the class of business, and the characteristics of the specific risk this is exciting news.

Great news for our Big "I" Markets agents with commercial clients. Travelers is lowering Workers Compensation rates for over 100 classes of business. Effective July 6th, 2015 prices dropped by up to 30% in 37 states. While the actual reduction will vary based on the state, the class of business, and the characteristics of the specific risk this is exciting news. In case you missed InsurBanc's webinar on perpetuation for young agents, you're in luck! You can now listen to the webinar by clicking on the link below. Listen to InsurBanc's President and CEO, David Tralka discuss the process of perpetuation from a young agent's perspective. Start thinking like a buyer by learning how to access capital and understanding agency valuation. If becoming an agency owner is in your future, then this webinar is for you.

In case you missed InsurBanc's webinar on perpetuation for young agents, you're in luck! You can now listen to the webinar by clicking on the link below. Listen to InsurBanc's President and CEO, David Tralka discuss the process of perpetuation from a young agent's perspective. Start thinking like a buyer by learning how to access capital and understanding agency valuation. If becoming an agency owner is in your future, then this webinar is for you. As fifth wheels, travel trailers, and horse trailers are getting longer, larger, and heavier, a typical pickup truck becomes less safe and less capable of pulling the weight. As a result, medium-duty trucks are becoming more popular in the RV and equine cultures.

As fifth wheels, travel trailers, and horse trailers are getting longer, larger, and heavier, a typical pickup truck becomes less safe and less capable of pulling the weight. As a result, medium-duty trucks are becoming more popular in the RV and equine cultures.