The U.S. government is seeking Engineers and Architects to build a new embassy in Brazil and for security reasons only solicited U.S. companies. This design-bid-build project is estimated to be $300-$350 million. The architects and engineers of the winning company will need to live and work in Brazil for most of the project as will any construction workers hired here to work on the job. One thing they have that might not go with them is the protection of their domestic insurance policies.

The U.S. government is seeking Engineers and Architects to build a new embassy in Brazil and for security reasons only solicited U.S. companies. This design-bid-build project is estimated to be $300-$350 million. The architects and engineers of the winning company will need to live and work in Brazil for most of the project as will any construction workers hired here to work on the job. One thing they have that might not go with them is the protection of their domestic insurance policies.

More and more firms are bidding on projects overseas. Once they land a project, they typically need a comprehensive foreign package policy to cover their insurance needs. ACE International Advantage has that policy, with coverage enhancements specifically tailored for Architects & Engineers. International Advantage can also provide locally admitted insurance policies in more than 200 countries and provides basic options not typically provided by other foreign package providers.

Coverage:

-

Commercial General Liability

-

Employers Responsibility with Executive Assistance® Services

-

ACE Travel AppSM

-

Automatic Emergency Medical Evacuation/Repatriation

-

Automatic Political Evacuation/Relocation

-

Foreign Voluntary Compensation

-

Contingent Employers Liability

-

Contingent Auto Liability

-

Kidnap & Extortion

-

International AD&D and Medical - Employee

-

International AD&D and Medical - Student and Chaperone

-

Commercial Property and Time Element

To access this product visit www.bigimarkets.com and select International Advantage from the commercial products menu.

_______________________________________

"Beyond the Basics: Emerging Personal Lines Issues"

August 26, 2015

1:00 to 4:00 p.m. Eastern Time

$79 - Click here to register

This VU webinar examines a number of critical policy form changes that agents must know and communicate to the consuming public. The first hour focuses on ISO's planned new Personal Auto Program and a major change in their homeowners program. The second hour examines emerging issues, including car and home sharing, hydraulic fracking, and often misunderstood exposures and coverage gaps in ISO's homeowners program involving vehicles of various types. The third hour is devoted to two major auto exposures - family member vehicles and rental cars - and to insuring vacation risks such as motor homes, cruise ships, and overseas travel. Approved for CE in MD, MI, MT, NC, ND, NY, OH, OK, WA with AR, LA and NJ pending. See registration page for details.

Also planned is Certificates of Insurance - 2015 Edition. VU webinar questions can be sent to bestpractices@iiaba.net.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

________________________________________

Legionnaires Disease is Caused by Bacteria

By Paul Buse, President of Big I Advantage®

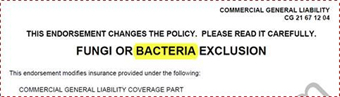

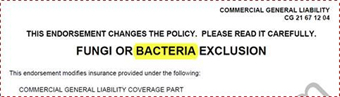

Recently, the South Bronx outbreak of Legionnaire's Disease has made the news with 12 dead and 100+ people diagnosed. Connecting recently headlines and a 2013 headline is something a student of insurance will want to ponder. "Tennessee Health Club Sued Over Legionnaire's Disease," Insurance Journal, July 22, 2013. The situation is that nearly any Commercial General Liability Policy may have the below exclusion added by endorsement.

Click Graph for larger version

Click Graph for larger version

What to do? Use a checklist to ask the question about possible mold/bacteria/pollution exposures. The Virtual Risk Consultant adds a section "Liability-Environmental Impairment" to many commercial exposures automatically but you can add it to every checklist you create. You will find your clients know their business very well but often they've not considered this in an insurance context. As members, know help on anything environmental insurance is available on Big "I" Markets. Just search after logging in for "Pollution" or "Environmental". Of course, if an issue is identified and they decline to ask you to pursue, use DocuSign to send them a short documentation of that declination.

________________________________________

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

-

Travelers WC Price Reduction chart for 37 states

-

Listing of Preferred Classes for Travelers Workers Comp

-

Certificates of Insurance - 2015 Edition

________________________________________

As a pre-eminent insurer of fine homes and possessions, Chubb offers complimentary appraisals for many of the homes they insure. In fact, their industry-leading Home Appraisal Service is a major reason why homeowners around the world choose Chubb.

As a pre-eminent insurer of fine homes and possessions, Chubb offers complimentary appraisals for many of the homes they insure. In fact, their industry-leading Home Appraisal Service is a major reason why homeowners around the world choose Chubb. Maybe you have considered adding life insurance to your product offerings and are hesitant. Maybe you are already writing life insurance through a few select carriers. Whatever the case, many agents imagine that the barriers to selling life insurance outweigh the advantages.

Maybe you have considered adding life insurance to your product offerings and are hesitant. Maybe you are already writing life insurance through a few select carriers. Whatever the case, many agents imagine that the barriers to selling life insurance outweigh the advantages. The U.S. government is seeking Engineers and Architects to build a new embassy in Brazil and for security reasons only solicited U.S. companies. This design-bid-build project is estimated to be $300-$350 million. The architects and engineers of the winning company will need to live and work in Brazil for most of the project as will any construction workers hired here to work on the job. One thing they have that might not go with them is the protection of their domestic insurance policies.

The U.S. government is seeking Engineers and Architects to build a new embassy in Brazil and for security reasons only solicited U.S. companies. This design-bid-build project is estimated to be $300-$350 million. The architects and engineers of the winning company will need to live and work in Brazil for most of the project as will any construction workers hired here to work on the job. One thing they have that might not go with them is the protection of their domestic insurance policies.