Icicles are an iconic symbol of winter. Reproduced in crystal, plastic, and lights as decorations on trees and houses. They are both beautiful and dangerous at the same time. Falling icicles have been used to take out the bad guy in books and film. Ralphie blamed an icicle falling from the roof for breaking his glasses in A Christmas Story when we all know he almost shot his eye out. Icicles are an iconic symbol of winter. Reproduced in crystal, plastic, and lights as decorations on trees and houses. They are both beautiful and dangerous at the same time. Falling icicles have been used to take out the bad guy in books and film. Ralphie blamed an icicle falling from the roof for breaking his glasses in A Christmas Story when we all know he almost shot his eye out.

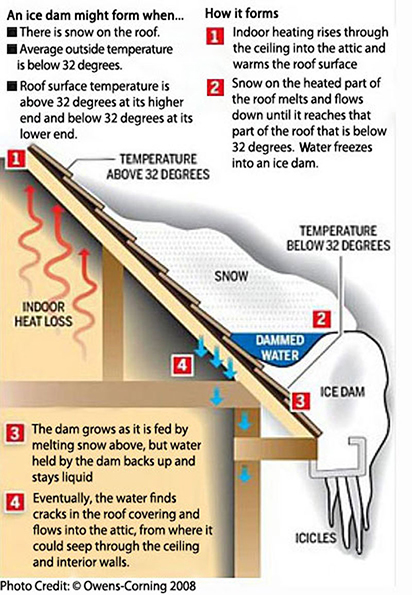

In reality icicles hanging from a gutter may be a sign of a much bigger problem especially during times of the daily temperature being around freezing. Inadequate insulation and poor airflow can cause escaping heat to collect in the attic which can melt the underlying snow closest to the top of the roof. The water runs down until it reaches the unprotected eaves and gutters where it refreezes before it can go down the spout. When enough ice accumulates it can actually prevent subsequent water from reaching the cooler section and refreezing. This water can then back up under shingles and start working its way into the house. You can click the diagram for a larger version.

This can be mostly prevented with proper insulation and improved airflow. AIG offers this brochure to share with your homeowner clients to inform them of the danger and how to avoid it.

AIG's Private Client Group homeowner coverage is available for dwelling replacement cost coverage valued at $500k or more in most states.

Included are:

-

Guaranteed replacement cost - Included

-

Back-up of sewers and drains - Included; up to dwelling value

-

Business property - Up to $25,000

-

Deductible options - Up to $100,000 available

-

Primary flood - Available

-

Equipment breakdown - Available

-

Identity fraud restoration expenses, ATM robbery, and financial fraud, embezzlement or forgery - Available

-

Traumatic threat or event recovery - Available

-

Green rebuilding expenses - Available

-

Waiver of deductible on losses over $50,000 - Available

-

Replacement cost cash out option - Included

-

Lock replacement - Included; no deductible

-

Food spoilage - Included

-

Loss prevention devices following a claim - Included; up to $2,500 available

AIG's Private Client Program and is available to registered members in all states. Skate on over to Big "I" Markets and click on Affluent Program - New Business to learn more!

|

By Elif Wisecup, Director of Marketing and Big I Advantage® Publications By Elif Wisecup, Director of Marketing and Big I Advantage® Publications

'Twas the day before New Year's,

(Which seemed beyond belief)

So I thought to myself,

I'll turn over a new leaf!

As a proud member of my amazing Big "I" state association,

I get national membership, too! What a great realization.

Spent 2016 growing my book as best I was able…

But was it possible that I left some member benefits on the table?

I shipped packages all year, but I paid full price!

With my UPS discount, that expense can be sliced.

I saved for retirement but paid high plan fees,

Next year, I'll wise up, and get a quote from Christine!

I sent out applications the old-fashioned way…

That's about as efficient as taking a sleigh.

In 2017 I'll switch to DocuSign,

And by 2018 I'll have improved my bottom line.

I hired some staff but forgot to use Caliper…

With my next addition, I'll use personality testing for sure!

I banked with a random bank I saw on TV,

This year I'll try Insurbanc, a bank designed for me!

What else can I do to make money and grow?

Is there more I can access? I'm feeling gung ho!

I'll get a fresh quote from Big "I" Professional Liability,

Then to help avoid claims, I'll subscribe to VRC.

I'll offer personal umbrellas to every client,

I'll visit E&O Happens to ensure I'm compliant,

I'll roll my flood book to Big "I" Flood now,

So that in the event of a storm my clients won't have a cow.

And before the year starts, I'd be wasting my dues,

If I skipped Big "I" Markets for a quick product review…

On affluent homeowners! On non-standard, ho!

On bonds, on marine, on events! LRO!

On travel insurance and on, vacant dwelling!

On commercial, on bicycles, let's go and get selling!

Yes, 2017 is the year I'll take advantage

And maximize every Big "I" benefit I can manage.

And this time next year, you'll hear me say with delight,

"Big I Advantage offered it all, and helped my agency take flight!"

|

By Herb Decuers, Insure Response, LLC Underwriter

The home and condo rental market is booming, and peer-to-peer leasing is leading the charge. With the rise of the home sharing economy and online services such as Airbnb, HomeAway, and FlipKey, it is easier than ever for home and condo owners to earn rental income and for "guests" to land accommodations that fit their needs and budgets. The home and condo rental market is booming, and peer-to-peer leasing is leading the charge. With the rise of the home sharing economy and online services such as Airbnb, HomeAway, and FlipKey, it is easier than ever for home and condo owners to earn rental income and for "guests" to land accommodations that fit their needs and budgets.

While home (and room) sharing can be lucrative for homeowners, it exacerbates the typical homeowners risks. Recognizing this, Lexington Insurance Company has introduced the latest in its series of enhancements to LexElite® Homeowners Insurance: LexShareSM HOME Rental Coverage (LexShare HOME), explicitly designed to respond as the sharing economy reshapes the home and condo rental market. LexShare HOME extends homeowners protection expressly where short- and long-term landlords need it - providing coverage certainty with an expanded definition of "residence premises" and raising the roof on protection for losses from property damage, theft, and more.

Key coverage highlights include:

-

A broad definition of "residence premises" that eliminates any grey areas in coverage for primary and secondary rental properties, and expressly encompasses both short- and long-term rentals regardless of whether they are secured through online peer-to-peer websites or traditional real estate brokers.

-

Protection for rental of other structures on the "residence premises," such as a converted garage apartment - deleting the exclusion of other structures rented or held for rental in the standard homeowners policy.

-

Increased coverage for damage to landlord's furnishings, including appliances, carpeting, and other household furnishings, in each apartment on a "residence premises," eliminating the $2,500 coverage cap in a standard homeowners policy.

-

Enhanced protection for personal property, tripling - or more - the standard Special Limits of Liability in key areas. For example, LexShare HOME provides limits of $10,000 on watercraft of varying types; $5,000 for loss by theft of jewelry, watches, precious, and semiprecious stones; $7,500 for loss by theft of silverware, goldware, platinumware, and firearms; $7,500 on property used primarily for "business" purposes; and $4,500 on trailers or semitrailers as well as $4,500 on certain electronic apparatus and accessories.

-

Coverage for theft of personal property from that part of a "residence premises" rented to others.

-

$100,000 Watercraft Liability coverage for certain watercraft rented to others, such as jet skis, small sailboats and powerboats, canoes, kayaks, and rowboats. Standard homeowners policies provide no coverage whatsoever for watercraft rented to others.

-

Express coverage for tenant-caused damage to trees, shrubs, plants or lawns on primary and secondary rental properties.

LexShare HOME Rental Coverage is the newest addition to Lexington's suite of enhancements to LexElite® Homeowners' Insurance - each enhancement is designed to help consumers keep pace with the fast-moving risks of today's world. Additional endorsements include: Lex CyberSafetySM Coverage, Upgrade to Green® Residential, Eco-Homeonwer® Mandatory Evacuation Response Coverage, and LexElite® Pet Insurance.

The Non-standard Homeowners or Rental Dwelling is available all states except Hawaii. To learn more visit Big "I" Markets or contact Herbert Decuers at 866-450-7241 or hdecuers@insureresponse.com.

1 Airbnb is Inc.'s 2014 Company of the Year, Inc., www.inc.com/magazine/201412/burt-helm/airbnb-company-of-the-year-2014.html.

2 Inside Airbnb's Grand Hotel Plans, Fast Company, www.fastcompany.com/3027107/punk-meet-rock-airbnb-brian-chesky-chip-conley.

3 Peer-to-Peer Rental: The Rise of the Sharing Economy, The Economist, www.economist.com/news/leaders/21573104-internet-everything-hire-rise-sharing-economy.

|

| |

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

AIG Private Client Group Homeowner - Overview NEW

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

January 18 - 1:00 - 2:00pm EST. "Cracking the Condominium Conundrum". ". How can a policy generating about $75 in revenue cost you $5,000, $10,000, or more? Believing that writing an HO-6 is quick and easy is the beginning of an E&O storm that can cost you thousands (your E&O deductible). Join newly appointed Big "I" Virtual University Executive Director Chris Boggs as he answers the three KEY questions faced by every agent when analyzing and placing coverage for either a unit owner or a condominium association: who "owns" the property; what value applies to the owned property/what should be used; and who is liable for bodily injury and/or property damage. Click here to register.

-

February 15 - 1:00 - 3:00pm EST. "Understanding Commercial Property Underwriting - COPE in all its Glory". Today's commercial property underwriters use the same information their predecessors used nearly 400 years ago: Construction, Occupancy, Protection, and Exposure. Combined, these four elements are known as "COPE underwriting." Join Big "I" VU Executive Director Chris Boggs as he instructs participants in the purpose of and methodology for gathering all necessary commercial property underwriting information. In addition, this course discusses what can be done to reduce and control losses using "COPE" data. Click here to register.

|

Be one of the first five with the correct answers and win a $5 gift card (Starbucks, Dunkin' Donuts, Baskin Robbins, or Krispy Kreme).

Don't forget to answer the Tie Breaker!

1. According to the Society Research Foundation approxiamately how many people are killed by icicles in the U.S. each year?

2. On this day (December 27) in 1947, a childrens television show debuted on NBC. Name it.

3. The ball that will drop in New York's Times Square this Sunday weighs almost six tons and is covered by 2,688 _________ ________?

TIE BREAKER

TB - The Non-standard article above references additional LexElite enhancements. Name at least three of them.

|

| |

BIG "I" MARKETS SALE OF THE WEEK

|

|