What is a surety bond? What is a surety bond?

A surety bond is a three-party agreement between a surety company, an oblige and a principal. The third party (surety company) guarantees to the second party (oblige) the successful performance of the first party (principal). The surety company guarantees that the obligations of the principal to the oblige will be performed in accordance with a contract, statute or regulation. Bonds are used to protect public and private funds from financial loss.

How is a surety bond different than an insurance policy?

A surety bond and an insurance policy are not the same. The cost of assumed losses are calculated into the price of an insurance policy premium. A bond, on the other hand, is an extension of credit with the expectation that the legal obligation will be fulfilled, and subsequently, there will be no loss. Losses are not included in the cost of bond premiums, only underwriting expenses are factored into the rates. A surety company's fiscal results are severely impacted when losses on bonds do occur.

Why do surety bonds need to be underwritten?

A surety company must determine the risk of a loss occurring if the principal is unable to satisfy the obligation under the bond. Since a bond is an extension of credit, the surety company must review the principal's financial information and business experience to determine if certain requirements are met to support the bonded obligation. This procedure is known as the underwriting process. Just as a bank evaluates loan applications, surety company underwriters evaluate risks in a similar way by considering business and personal financial statements, credit reports, credit references and other factors.

What are the benefits of surety bonds?

Surety bonds are a mechanism for transferring risk. The surety company assumes the risk of the principal doing business from the oblige. Federal, state and local governments generally require surety bonds to give certainty that business owners and individuals will adhere with various laws safeguarding public funds. For example, license bonds protect the public from business impropriety. Contract bonds protect taxpayers by pledging that projects are finished appropriately, on time and without liens. Court, public official, government and miscellaneous bonds protect and secure public funds and private interests.

What is indemnity?

Indemnity agreements are a standard of the industry. To indemnify means to make whole. Under common law, the surety company has the right to be indemnified by the principal in the event of a loss. The General Indemnity Agreement (GIA) carries out that right by stating that if the surety suffers a loss while providing a bond to the principal, the principal is obligated to make the surety "whole" by reimbursing any losses and expenses.

Surety companies usually require the president to sign on behalf of the company, all owners with over 10% ownership to sign personally, and the owners' spouses to sign personally. Personal indemnification establishes the principal's private commitment to the business entity and to the surety company.

For answers to all of your bond questions or more information on how Goldleaf Surety Services can assist you with all of your bond needs - log in to www.bigimarkets.com or email us at bigimarkets@iiaba.net and an underwriter will contact you.

|

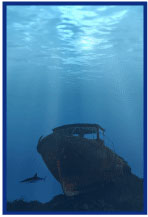

Benjamin Franklin famously said, "Beware of little expenses; a small leak will sink a great ship." Benjamin Franklin famously said, "Beware of little expenses; a small leak will sink a great ship."

Take Mr. Franklin's words to heart and save every dollar you can on unnecessary business expenses. Starting today, don't pay more than you have to for shipping expenses.

As long as you're a Big "I" member in good standing, you can take advantage of competitive shipping savings rates available from UPS. Whether you need your documents or packages to arrive the next day or you're simply looking for the most affordable shipping option, UPS understands the importance of reliability, speed and savings.

UPS discounts can help your bottom line by saving you:

-

Up to 34% on UPS Air letters including UPS Next Day Air

-

Up to 30% on UPS Air packages weighing more than one pound

-

Up to 32% on UPS International imports and exports

-

Up to 16% on UPS Ground shipments

-

70% or more on UPS Freight shipments more than 150 pounds

These discounts are available even if you already have a UPS account. To enroll and start saving, visit savewithups.com/iiaba or call 1-800-MEMBERS (1-800-636-2377) Monday-Friday from 8 a.m.-6 p.m.

|

We are heading into the peak (Aug-Oct) of Hurricane season. The National Oceanic and Atmospheric Administration predicts this year (including Alex in January) we will have: We are heading into the peak (Aug-Oct) of Hurricane season. The National Oceanic and Atmospheric Administration predicts this year (including Alex in January) we will have:

-

10-16 Named Storms

-

4-8 Hurricanes

-

1-4 Major Hurricanes

One big factor is whether El Niño or La Niña is happening and they predict a 71% chance of La Niña, which means a more active hurricane season. Besides the potential loss of life and property damage, hurricanes and other severe weather can seriously affect travel plans by hitting the destination preventing travel in or forcing evacuation. Even if severe weather doesn't hit where a traveler is going, connecting flights can be delayed or cancelled. Travel Insured International has an informative travel blog covering a myriad of subjects, including hurricanes.

Travel Insurance can cover trip delays, cancellation, interruption, missed connections due to severe weather or many other reasons outside the travelers control.

Obtaining coverage is easy:

-

Review the product guide and comparison chart with your client.1

-

When you are ready for coverage to be issued, click on "Request a Quote" in Big "I" Markets and provide the necessary information. A credit card will be required to issue coverage.

-

Coverage will be issued and confirmed in Big "I" Markets.

Travel Insurance is currently available to members in all states.

-

Rates, waiting periods, and coverages can vary in FL, IA, KS, NY & WA.

|

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travelers Select Products (series)

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

July 20. "Fixing Personal Lines Coverage Gaps" Through scores of real-life claims examples and court cases, this program examines common coverage gaps found in many personal lines policies and addresses the remedies for such gaps in the form of insurance products or risk management techniques. CE credit available for attendees in CT, ID, KS, MI, NJ, ND, WA, WY. Click here to learn more and register.

-

August 1. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" in the news and the implications. The August broadcast is in development as subject matter is explored. Click here to learn more and register and here to access the recordings.

-

August 23. "Fixing Commercial Lines Coverage Gaps" Through scores of real-life claims examples and court cases, this program examines common coverage gaps found in many commercial lines policies and addresses the remedies for such gaps in the form of insurance products or risk management techniques CE credit available for attendees in AZ, CT, ID, MI, NJ, ND, WA, WY. Click here to learn more and to register.

|

Be one of the first five with the correct answers and win an envy-inspiring TFT Trivia T-shirt or choose a $5 gift card (Starbucks, Dunkin' Donuts, Baskin Robbins, or Krispy Kreme).

Don't forget to answer the Tie Breaker!

1. What famous comic, born on this day (7/12) in 1908, got the nickname Mr. Television?

2. From where did we get the word hurricane?

3. What is the most popular flavor of ice cream?

TIE BREAKER

Between El Niño and La Niña, which is warmer?

|

BIG "I" MARKETS SALE OF THE WEEK

|

|