3. Minnie Mangum stole nearly $3 million dollars (~$37.5 million today) from her employer, Commonwealth Building & Loan Association, starting in 1933 until it was discovered in what year?

TIE BREAKER

March Madness Tiebreaker: In 1990 Loyola-Marymount beat Michigan in the highest-ever combined score in an NCAA tournament. What was the final score?

________________________________________

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

-

E&O Printable Wallet Card

-

Bizarre Christmas Claims

-

Family Spring Break Travel Tips

________________________________________

Employment Practices Liability Insurance covers a lot of ground and that ground is expanding. The past couple of decades have brought new challenges and exposures to what falls under EPLI.

Employment Practices Liability Insurance covers a lot of ground and that ground is expanding. The past couple of decades have brought new challenges and exposures to what falls under EPLI. Time to watch your mailbox for the latest edition of the Big I Advantage Newsletter! Click here to preview the newsletter, which features updates and articles from all Big I Advantage areas. The cover story penned by Big I Advantage president Paul Buse highlights the value of long-term business relationships and overviews the lengthy and fruitful partnerships with the companies we work with to bring Big "I" members essential value-added programs. To learn more about any of the programs highlighted in the newsletter, visit www.iiaba.net and click on "Products."

Time to watch your mailbox for the latest edition of the Big I Advantage Newsletter! Click here to preview the newsletter, which features updates and articles from all Big I Advantage areas. The cover story penned by Big I Advantage president Paul Buse highlights the value of long-term business relationships and overviews the lengthy and fruitful partnerships with the companies we work with to bring Big "I" members essential value-added programs. To learn more about any of the programs highlighted in the newsletter, visit www.iiaba.net and click on "Products."  A fidelity bond is a bond which indemnifies an employer against financial loss due to the dishonesty of an employee or protects a business from certain types of damage caused by employees. This type of protection is not mandatory in most states, but it does shield a company from expenses that are not covered by other policies.

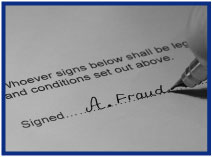

A fidelity bond is a bond which indemnifies an employer against financial loss due to the dishonesty of an employee or protects a business from certain types of damage caused by employees. This type of protection is not mandatory in most states, but it does shield a company from expenses that are not covered by other policies.