Chubb's Fine Art Practice

By Laura M. Doyle, North American Collections Management Specialist

From online sales platforms to international museum exhibitions, collectors of fine and decorative art face a number of evolving risks. Chubb's Fine Art Practice has developed a suite of complimentary services to respond to these risks and ensure our clients' collections are preserved for future generations. From online sales platforms to international museum exhibitions, collectors of fine and decorative art face a number of evolving risks. Chubb's Fine Art Practice has developed a suite of complimentary services to respond to these risks and ensure our clients' collections are preserved for future generations.

Established in May 2014, the Chubb Fine Art Practice has access to fine art and collector specialists in the United States who provide consulting and other services to clients who have a Chubb Valuable Articles insurance policy. The specialists, many of whom have degrees and other training in art and have worked in museums, galleries and auction houses, have extensive knowledge in assessing risks in homes, offices, galleries, art warehouses and other locations where collections may be kept.

Services offered by the fine art practice include:

-

Referrals to Fine Art Service Providers: Chubb's fine art specialists can provide referrals to experts worldwide, including fine art packers, transporters, conservators, advisors and appraisers. These vendors are considered best in class and many offer discounts to Chubb clients.

-

Guidance on Packing and Transit: Whether shipping a painting or sculpture, collectors shouldn't be fooled into thinking the usual carriers will suffice. Collectors should use vetted art-handling companies that understand the intricacies of working with fine and decorative art. Chubb specialists can provide guidance on appropriate packing, crating, and transit based on an object's fragility and value.

-

Off-Site Storage Assessments1: As the art market continues to grow, so too has the number of warehouses dedicated to the storage of rare and valuable objects. As collectors increasingly utilize fine art warehouses, a firm understanding of construction, protection, security, storage conditions, and the expertise of management is more important than ever. Chubb's fine art specialists can complete risk assessments of fine art storage facilities, or refer clients to a pre-approved location.

-

Fire, Security, and Loss Prevention Advice: Chubb's fine art specialists are available to review alarm plans, recommend monitoring companies, consult on environmental controls appropriate for a collection, and provide tailored advice to protect valuable assets.

-

Review of Museum Loan Agreements: With more collectors lending works to domestic and international museum shows, it's important to understand the risks. Chubb's specialists can review museum facility reports and loan agreements to evaluate the acceptability of the borrowing institution from a loss control perspective.

To take advantage of any of these complimentary service offerings, contact Nancy Doherty of Big "I" Markets for the name and contact information of the Chubb Collections Management Specialist in your territory.

1 - Available on collections valued at $1,000,000 and up.

|

SPECIAL FEATURE - A New Look for BIM and TFT

By Elif Wisecup, Director of Marketing and Big I Advantage® Publications By Elif Wisecup, Director of Marketing and Big I Advantage® Publications

As you can see, Two for Tuesday has a fresh new appearance! Our new layout features improved readability on mobile and tablet devices as well as a cleaner layout designed to be easier on the eyes. The new layout comes on the heels of our recent redesign of the Big "I" Markets landing page. We will still be coming to your inbox weekly, with three articles, once a month trivia and Paul Buse's insightful "Parting Shot" for students of the insurance industry. We'd love to hear your thoughts on the new look of both Two for Tuesday and www.bigimarkets.com! Email bigimarkets@iiaba.net and let us know what you think.

|

It wasn't until I formed a friendship with an architect that I began to take note of the artistry and engineering involved in the buildings around me. Once I did, I couldn't believe the wonders I had been skipping over by simply trudging through daily life without pausing to take in the buildings that make up our cities and our world. I'm so glad my friend sparked this interest or I never would have taken note of the gorgeous work of architects such as recently deceased Zaha Hadid, an Iraqi-born British architect who was the first woman to win the Pritzker Prize. Check out this slide show of her work to see some truly original and beautiful work. It wasn't until I formed a friendship with an architect that I began to take note of the artistry and engineering involved in the buildings around me. Once I did, I couldn't believe the wonders I had been skipping over by simply trudging through daily life without pausing to take in the buildings that make up our cities and our world. I'm so glad my friend sparked this interest or I never would have taken note of the gorgeous work of architects such as recently deceased Zaha Hadid, an Iraqi-born British architect who was the first woman to win the Pritzker Prize. Check out this slide show of her work to see some truly original and beautiful work.

When it comes to covering the architects in your community, where do you turn? Did you know that you have access to comprehensive professional liability coverage for architects, engineers and surveyors?

CBIC Design Professionals Insurance, an RLI Company, provides comprehensive professional liability coverage for architects, engineers, and surveyors. CBIC has deep knowledge in the professional services and construction industries, which means when you work with a CBIC underwriter, risk manager or claim manager, you're speaking with a longtime veteran who has both the expertise to understand a firm's needs and the decision-making authority to get the job done.

Here are some product features:

POLICY FORM:

-

Defendants' reimbursement of expenses - $500 per day subject to $12,500 maximum (reimbursement applies day one)

-

ADA/FHA/OSHA regulatory or administrative action reimbursement - $30,000 per policy period

-

Free pre-claims assistance

-

Disciplinary proceedings reimbursement - $5,000 per proceeding

-

Definition of "Insured Person" includes temporary or leased personnel and retired personnel

-

Predecessor firm coverage, including joint ventures

-

Worldwide coverage

-

Liberalization clause

-

Blanket waiver of subrogation provision

-

Punitive damages extension where allowable by law

-

Deductible mediation credit of 50% subject to a $12,500 maximum

-

Automatic 90-day coverage for acquired or merged entities

-

5 Year Extended Reporting Period

-

Innocent insured provision

-

Consent to settlement provision - 50/50 co-share between "Insured" and "Insurer"

-

60-day automatic extended discovery period

-

Automatic excess coverage for separately insured projects

-

Management Pack Enhancement Endorsement (Directors & Officers, Fiduciary and Employment Practices Liability Insurance Coverages)

-

High Self Insured Retention Program (Top & Drop)

ADVANTAGES OF WORKING WITH CBIC:

-

A steady, consistent, reliable admitted market since 1979.

-

Knowledgeable underwriting and claim staff has deep expertise in the professional services and construction industries.

-

Outstanding service and efficient claims handling.

-

A+ (Superior) financial strength rating by A.M. Best Company, a leading insurance rating and information source.

Learn more by logging into Big "I" Markets and clicking on Big "I"--RLI Design Pros--Architects, Engineers & Surveyors from the commercial products menu.

|

DocuSign for Big "I" Members: Keeping Business Digital with eSignatures

Join us to learn more about DocuSign for your agency. We'll show you how you can use DocuSign for everything from new policy applications to coverage election forms. We'll cover the basics, including how to take advantage of your exclusive Big "I" member price discount, and leave plenty of time for you to ask us questions:

-

Legality and security: We'll show you how DocuSign is a best practice in keeping you and your clients safe

-

Ease and convenience: See what your clients will see when you send documents through DocuSign, and learn just how easy it is to sign

-

Sending, templates and account management: We'll get you up to speed on setting up your account, short cuts with document templates, and account management 101

We'll see you there!

Click the date to learn more and to register:

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travelers Select Products (series)

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

May 11. "The Dumb Things We Do" We all can make mistakes in our understanding, advice and actions when it comes to insuring the public. These coverage and procedural mistakes become problematic when they adversely impact consumers and businesses, leading to inadequately covered losses and all too often, litigation. This program taps into a file accumulated by Bill Wilson and David Thompson over the past decade of over 500 real-life incidents that imperiled the financial condition of consumers and businesses. Click here to learn more and to register.

-

June 6. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" (drones, car sharing, concealed weapon laws, legalized marijuana, legislative issues) and the implications. May topics are pending as information is seen in the news. Click here to learn more and register and here to access the recordings.

-

June 22. "Drones AKA Unmanned Aerial Vehicles" One of the most fluid issues in insurance today involves drones. The technology, regulations, exposures, and coverages seem to change on a daily basis. This webinar is designed to bring the participant completely up to date with regard to the technology, laws and regulations, evolving exposures/uses, and what coverages (both personal and commercial lines) are available in the marketplace. It will also dispel some of the myths about coverage (or lack thereof), especially in the area of privacy. Click here to learn more and to register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

What is a "Reserve Release?"

or Maybe More Importantly...Reserve Strengthening?

By Paul Buse, President of Big I Advantage®

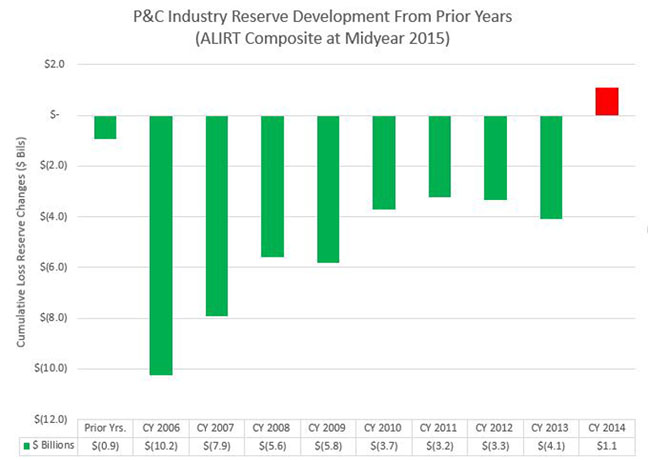

Recently, some early information on P&C industry results for 2015 came to my inbox. One industry watcher we follow at Big I Advantage, ALIRT Insurance Research of Windsor, CT, sent out their 2015 Property & Casualty Review Letter. The first sentence caught my attention. That sentence included "...underwriting results deteriorated in 2015 as the industry strengthened reserves after 9 consecutive years of releases... (emphasis added)." What does "strengthening reserves" mean?

Reserves, and references to them with the P&C industry, are looking at estimates of loss costs on insurance policies. Estimates are essentially never perfectly accurate and so too is it with estimates of insurance policy loss costs. As the estimates (aka "reserves") age, the estimates get better and eventually the estimates become facts as losses are fully paid. In the interim years, between first estimates and known facts, the insurers revise estimates and increases (strengthening reserves) or decreases (releasing reserves) result. Each year as estimates are revised, the cumulative impact of decreases ("releases") become an addition to current income and increases ("strengthening") become a deduction from current income. To give you a sense of something changing, ALIRT provides a composite of 50 major insurers they can look at for trends before all the data on all the insurers can be analyzed. That graph is below.

Congratulations to last week's winners on the term used to describe when reinsurers buy reinsurance: the answer is "retrocession."

Click for larger version

Source: ALIRT Property & Casualty Review Letter for Mid-Year and Year-End 2015.

|

BIG "I" MARKETS SALE OF THE WEEK

Congratulations to our agent in North Carolina on a contractor bond sale of $31,927 in premium!

|

|