By April Shrewbury, Manager, RLI & Personal Umbrella Markets

In our Personal Umbrella Mythbusting series, we've busted 3 myths so far:

|

Myth #1: |

A personal umbrella is something agents only need to offer to wealthy customers. |

|

Myth #2: |

Millions of dollars in liability coverage must be really expensive. |

|

Myth #3: |

You can't obtain an affordable umbrella for a police officer, doctor, pro athlete, or politician. |

Let's move on to more mythbusting…

|

MYTH: |

You have to have a good driving record to have an umbrella. |

|

TRUTH: |

A good driving record isn't required, and drivers with accidents can be an easier sell. |

Umbrella carriers certainly recognize that today's drivers aren't perfect. Both new business applicants and existing policyholders can have a not-so-great driving record and still have a personal umbrella. In fact, RLI Insurance will accept most households with up to 4 violations and 3 at-fault accidents, without even requiring an MVR. DUI convictions are also acceptable with some carriers.

Just like with their auto policy, a driver with incidents is going to pay more for an umbrella than the perfect driver in the other lane…rightfully so. However, umbrella carriers typically only count incidents for 3 years (major violations may be 5 years), so if your customer's quote or existing umbrella premium is high now because of a driving record, they'll have the opportunity to pay less in the future.

Don't let a bad driving record deter you from offering an umbrella. You'll find that a driver with a few tickets or a couple of accidents is likely to recognize their need for additional liability coverage more than a driver who has never been in an accident.

As an IIABA member, you have access to two highly-rated personal umbrella carriers. RLI Insurance is IIABA's endorsed personal umbrella carrier, with broad underwriting guidelines and a self-underwriting application. Anderson & Murison is IIABA's alternative umbrella market, available when a customer won't qualify with RLI. Access both at www.bigimarkets.com or www.iiaba.net/umbrella.

|

By Elif Wisecup, Director of Marketing and Big I Advantage® Publications By Elif Wisecup, Director of Marketing and Big I Advantage® Publications

We realize that protecting the future of your agency is a major priority. You trust us to represent your interests at the highest political level and as your association we also want to provide you with the security of knowing you are getting the best overall E&O value in the marketplace-not just a policy, but a comprehensive program. The Big "I" Professional Liability program offers just that, with comprehensive risk management resources and coverage from industry leader Swiss Re Corporate Solutions.

Visit our contact page today to locate your state program manager and click the green "Get E&O Premium Estimate" button to begin a quick and easy process to connect with your state association and learn more about how to join our program.

Learn more about the Big "I" Professional Liability program at www.iiaba.net/EO. Already a policyholder? Take advantage of exclusive information and resources available from our Risk Management Web Site E&O Happens.

|

Do you have a fire escape plan for your house? The Red Cross has a simple page for plotting one out that may save a life. For your pets you can get a free animal rescue sticker (to alert the fire rescue team) from the ASPCA or your local pet store probably carries them. The best way to survive a fire is not to have one and AIG can help out with that. They have prepared handy flyers you can use to reduce the risk of a fire as well as preparing just in case. Do you have a fire escape plan for your house? The Red Cross has a simple page for plotting one out that may save a life. For your pets you can get a free animal rescue sticker (to alert the fire rescue team) from the ASPCA or your local pet store probably carries them. The best way to survive a fire is not to have one and AIG can help out with that. They have prepared handy flyers you can use to reduce the risk of a fire as well as preparing just in case.

Review some examples of the exceptional service your clients can get from AIG Private Client Group.

AIG's Private Client Group homeowner coverage is available for dwelling replacement cost coverage valued at $500k or more in most states.

Included are:

-

Guaranteed replacement cost - Included

-

Back-up of sewers and drains - Included; up to dwelling value

-

Business property - Up to $25,000

-

Deductible options - Up to $100,000 available

-

Primary flood - Available

-

Equipment breakdown - Available

-

Identity fraud restoration expenses, ATM robbery, and financial fraud, embezzlement or forgery - Available

-

Traumatic threat or event recovery - Available

-

Green rebuilding expenses - Available

-

Waiver of deductible on losses over $50,000 - Available

-

Replacement cost cash out option - Included

-

Lock replacement - Included; no deductible

-

Food spoilage - Included

-

Loss prevention devices following a claim - Included; up to $2,500 available

The AIG Program is available to registered BIM members in all states. Log into Big "I" Markets to learn more.

|

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travelers Select Products (series)

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

June 6. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" (drones, car sharing, concealed weapon laws, legalized marijuana, legislative issues) and the implications. May topics are pending as information is seen in the news. Click here to learn more and register and here to access the recordings.

-

June 22. "Drones AKA Unmanned Aerial Vehicles" One of the most fluid issues in insurance today involves drones. The technology, regulations, exposures, and coverages seem to change on a daily basis. This webinar is designed to bring the participant completely up to date with regard to the technology, laws and regulations, evolving exposures/uses, and what coverages (both personal and commercial lines) are available in the marketplace. It will also dispel some of the myths about coverage (or lack thereof), especially in the area of privacy. Click here to learn more and to register.

-

July 20. "Fixing Personal Lines Coverage Gaps" Through scores of real-life claims examples and court cases, this program examines common coverage gaps found in many personal lines policies and addresses the remedies for such gaps in the form of insurance products or risk management techniques Click here to learn more and register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

Frequency Times Severity

Automobile Insurance Inflation

By Paul Buse, President of Big I Advantage®

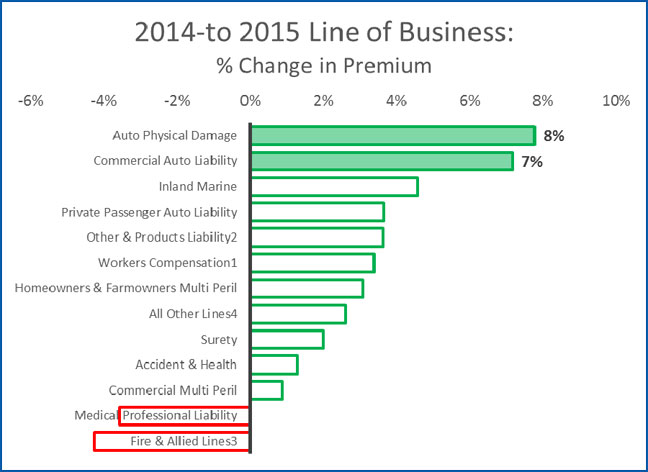

Recently a headline from CNBC caught my eye: "Auto insurance rates rising at fastest rate in almost 13 years." The report was based on federal government Consumer Price Index (CPI) monthly data and it shows a 6% increase, basically twice the rate of inflation. Well, being students of insurance and knowing the 2015 insurance year is now on the books, we don't have to guess or do a survey. We just go look it up. It's not April to April, year-over-year, but calendar year 2014 to 2015...but the answer looks like insurance premiums on auto lines went up by more than 6% actually.

Click for larger version

Source: A.M. Best and Company

So, what's going on? The CNBC article cites increasingly (a) dangerous behavior, (b) cheaper gas means more miles driven and (c) all those expensive gadgets in cars now a days. It's a well written article on the topic of insurance, and in the non-insurance media. Read it here.

Now, for a second student of insurance insight of this news. Causes "a" and "b" are intuitively associated with increased Frequency of loss and "c" is associated with increased Severity. Yes, "a-c" can influence both frequency and severity but actuaries never lose site of the fact that it is the combination of frequency AND severity, working together, that drives loss cost inflation.

Contest: For this week's puzzler the winner's reward is deck of playing cards, yes, emblazoned with a Big "I" classic logo. What is the exact increase in Frequency of claims from 2014 to 2015 that when combined with an increase in Severity of claims of 3.141592% would result in claims in 2015 being exactly 106% more than they were in 2014? That is, 6% higher, just like that cited by CNBC. First in wins but give the percentage and provide the figure to the same number of places as Severity (3.141592%). Email me your percentage carried to six-places to paul.buse@iiaba.net.

|

BIG "I" MARKETS SALE OF THE WEEK

|

|