By Bill Hall, MiddleOak National Marketing Manager

Recently MiddleOak introduced a new smoke-free discount for habitational risks. Now that smoke-free calculator is up and running and MiddleOak is looking to prepare reports for your prospects or clients. The client can be insured with a different carrier, too, or not with you at all. Recently MiddleOak introduced a new smoke-free discount for habitational risks. Now that smoke-free calculator is up and running and MiddleOak is looking to prepare reports for your prospects or clients. The client can be insured with a different carrier, too, or not with you at all.

Each building report includes estimates on the following:

-

Cost to switch to a smoke-free apartment policy

-

Annual Reduction in Operating Costs

And includes additional benefits:

-

Increased Resale Value

-

Net Benefit while Owned

-

Present Value of Net Benefit

Request your value added reports by forwarding this handy webpage: www.middleoakinfo.com/smokefreesavings Request your value added reports by forwarding this handy webpage: www.middleoakinfo.com/smokefreesavings

You can find all of our smoke-free information and marketing sheets here: www.middleoakinfo.com/smokefree

MiddleOak is excited to be able to reward and support the owners/managers of smoke-free properties, and is looking forward to showing you how competitive MiddleOak can be on your "best in class" habitational business!

The Habitational - Apartment Program and Habitational - Condominium Program from MiddleOak are available in Big "I" Markets in AR, AZ, CO, GA, IA, ID, IN, KY, MD, ME, MI, MO, MT, NH, NJ, NY, NV, OH, OR, PA, SC, TN, UT, VA, VT, WA, and WI. Smoke-free discount availability varies by state.

|

DocuSign and the Big "I" have partnered to bring you a three-part webinar series on digital insurance. Have you been attending these valuable sessions? DocuSign and the Big "I" have partnered to bring you a three-part webinar series on digital insurance. Have you been attending these valuable sessions?

Technology has changed the way businesses interact with their customers. Customers are on their digital devices and expect immediate service from the companies they do business with. Stay ahead of the competition by providing services the way your customers live - on digital devices.

Webinar Date: October 13, 2016 - 10:00 AM PDT ( 1:00 PM EDT)

Don't wait, register today for part three of this three-part series and learn how other insurance agents and brokers are using DocuSign to meet the needs of the digital consumer.

|

Most real estate agents are willing to go the extra mile for their absent clients, which sometimes means coordinating non-traditional projects. This could be as simple as lawn care to more complicated items like replacing the water heater or furnace. Real estate agents that routinely work with bank-owned properties are usually equipped to handle these, but an agent who does so occasionally needs to be careful about what the scope of his or her duties really entail. Simply offering to "check on" the property occasionally leaves a lot of room for an exposure. How often and what will be checked should be worked out ahead of time. Most real estate agents are willing to go the extra mile for their absent clients, which sometimes means coordinating non-traditional projects. This could be as simple as lawn care to more complicated items like replacing the water heater or furnace. Real estate agents that routinely work with bank-owned properties are usually equipped to handle these, but an agent who does so occasionally needs to be careful about what the scope of his or her duties really entail. Simply offering to "check on" the property occasionally leaves a lot of room for an exposure. How often and what will be checked should be worked out ahead of time.

A once-a-week drive by isn't likely to reveal a failed sump pump, faulty furnace, or spot evidence of a break-in, all problems which can only get worse the longer they remain undiscovered. Water damage only increases the longer it goes on, including the risk of mold and mildew. A faulty furnace can allow the temperature to drop below freezing increasing the risk of ruptured pipes. A natural gas leak can cause catastrophic damage if it explodes. Given enough time thieves can strip a house of not only possessions but also plumbing and wiring which may or may not be covered depending on whether it is considered vandalism (which is covered) or theft (which is not). Additionally the thieves may not take the time to shut off the water, flooding the house, or damage gas lines resulting in an explosion.

Travelers Real Estate Agents / Property Manager E&O provides professional liability protection for claims or suits resulting from real estate agent or broker professional services.

Policy Features:

-

Bodily Injury and Property Damage resulting from a covered professional service(s).

-

Disciplinary proceeding defense expenses reimbursement up to $25,000.

-

Increased liability limits available for those who qualify.

-

Defense expenses related to covered claims in additional to the limits of coverage.

-

Deductible applies to defense expenses, unless endorsed or not allowed by state.

-

Option to provide prior acts coverage without a retroactive date limitation, for those who qualify.

-

Many extended reporting period options, including an unlimited time period endorsement option.

-

No exclusion for fair-housing discrimination committed in real estate professional services as a real estate agent or broker.

-

No exclusion for losses resulting from a real estate agent or broker failing to advise a buyer or seller that pollution, fungi and bacteria exists on a property.

-

No sub-limits for certain types of claims.

-

Coverage for employees and independent contractors of the insured automatically included as protected persons for claims resulting from professional services they perform for the named insured.

Coverage is available in all states with the exception of CA, HI, and LA and is written on admitted paper. Log in to Big "I" Markets at www.bigimarkets.com and click on Real Estate Agents and Property Manager E&O to learn more or to request a quote.

|

| |

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Part 3 of 3: DocuSign Webinar Series Continues on 10/13

Digital Insurance: Meeting the Needs of the Digital Customer – Part 3 of 3

DocuSign and the Big "I" have partnered to bring you a 3-part webinar series on digital insurance.

Technology has changed the way businesses interact with their customers. Customers are on their digital devices and expect immediate service from the companies they do business with. Stay ahead of the competition by providing services the way your customers live - on digital devices.

Webinar Date: October 13, 2016 - 10:00 AM PDT ( 1:00 PM EDT)

Don't wait, register today for part three of this 3-part series and learn how other insurance agents and brokers are using DocuSign to improve workflows.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

October 17. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" in the news and the implications. The September broadcast is in development as subject matter is explored. Click here to learn more and register and here to access the recordings.

-

October 27. "NFIP: Change, Chaos and Confusion" In this two-hour session, David Thompson of the Florida Association of Insurance Agents teams up with Chris Heidrick of Heidrick and Company in Sanibel Island, Florida to bring you up to speed on where we were and (as best as anyone knows) where the NFIP is going. Subjects such as subsidized rates, grandfathering, refunds, surcharges, lapses, and the ever-popular robust private flood insurance market will be discussed. Click here to learn more and register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

Suing Your Own Insurer for Uninsured Motorist?

By Paul Buse, President of Big I Advantage®

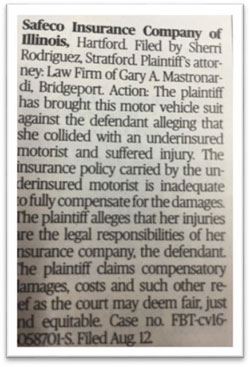

Well, hopefully not, but it's possible that is what could happen. As you can see the below situation did end up with an insured of a policy providing underinsured motorist coverage filing a law suit against their own insurer. I know of no easily available data on the number of uninsured motorist claims that involve a law suit but as students of the industry you should be aware of that possibility.

Click for larger version

Source: Westchester & Fairfield County Business Journals, August 29, 2016, pg. 35

What is the logic in this? Many consider uninsured motorist (UM) and underinsured motorist (UM or SUM for Supplemental Uninsured Motorist) a "Reverse Golden Rule" policy. That is, by purchasing this coverage you are insuring you or your family for what the other person DID NOT provide with their own liability coverage. In essence, your insurer steps in "to insure the other guy's liability." That puts the injured person's insurer into a ticklish situation of providing liability coverage for the person that injured their insured. Often this is a straightforward payment from the UM/UIM insurer for the injured party's medical bills and related personal injuries with little fanfare. Sometimes, however, a dispute as to liability or amount of damages arises and that is settled via arbitration, or, as is in the case above, in a court of law.

Sales Tip: I carry the maximum in UM/UIM on my automobile policy and an additional $1 million as part of my personal umbrella policy. Why? Because I bike a lot on roads with uninsured and underinsured motorists. Granted I have to get hit by an underinsured or hit-and-run driver to collect but the risk is real. Do you know any avid road bikers? If you do, have you told them they can get high limits of uninsured motorist via a personal umbrella policy like that available to you from RLI? I have never spoken with a biker on this topic who then didn't call their agent to find out how much UM/UIM they have. I assume after talking to me they buy a similar amount. You have access to this coverage via a RLI PUP. Information on RLI Personal Umbrellas is on Big "I" Markets and readily available from your Big "I" State Association.

|

BIG "I" MARKETS SALE OF THE WEEK

Congratulations to our agent in Maryland on a non-profit D&O sale of $5,114 in premium!

|

|