From simple things like crawl-proof shrubs planted around buildings to the demolition and redesign of crooked Paris streets making it easier for the police to chase thieves, the threat of criminal activity helps determine a city's architecture. Even the maddeningly complex overlapping wagon wheel street layout of Washington, D.C. was designed to slow down an invading army! From simple things like crawl-proof shrubs planted around buildings to the demolition and redesign of crooked Paris streets making it easier for the police to chase thieves, the threat of criminal activity helps determine a city's architecture. Even the maddeningly complex overlapping wagon wheel street layout of Washington, D.C. was designed to slow down an invading army!

Author and blogger Geoff Manaugh has written a serious book about the effect of criminal activity on building design. A Burglar's Guide to the City covers nearly 2,000 years of criminal activity using (and forcing changes to) the building designs made by architects.

The buildings they design are not the only target of thieves as architects, engineers, and surveyors are also robbed, sometimes of the specialized equipment they possess. These professionals are not immune to the accidents, loss, fire, and other things that happen to everyone and a typical BOP may not be enough to cover their unique exposures and risks. Endorsements can be patchy or not available. That's where Big "I" Markets comes in.

CNA Connect® Architects, Engineers and Surveyors Choice Endorsement offers these endorsements at a nominal cost in one package including:

-

Accounts Receivable $225,000 limit

-

Business Income - Newly Acquired Constructed Property Additional $250,000

-

Business Personal Property at Unnamed Locations $25,000

-

Extended Business Income Additional 30 days

-

Claim Data Expense Additional $10,000

-

Computer Fraud $10,000

-

Contract Penalty Clause $5,000

-

Electronic Data Processing (Off Premises) Additional $50,000

-

Electronic Data Processing (On Premises) Additional $50,000

-

Fine Arts Additional $75,000

-

Limited Building Coverage - Tenant Obligation $10,000

-

Lost Key Consequential Loss $500

-

Newly Acquired or Constructed Business Personal Property Additional $250,000

-

Ordinance or Law - Increased Period of Restoration Additional $25,000

-

Outdoor Trees, Shrubs, Plants and Lawns Additional $7,000

-

Owned Watercraft less than 20 feet long $7,500

-

Rental Expense - Temporary Substitute Equipment $5,000

-

Unauthorized Business Credit/Debit Card Use $10,000

-

Utility Services - Direct Damage $10,000

-

Valuable Papers $150,000 limit

It also includes these expanded definitions specifically for architects, engineers and surveyors:

-

Business personal property (BPP) - Expanded definition to include surveyor equipment, defined as instruments, images and electronic media and data.

-

Valuable papers and records - Expanded definition to include designs and plans, architectural drawings and videotapes.

-

Fine arts - Expanded definition to include architectural models, replicas, or sculptures and artistic renderings.

You can find CNA Small Business under Small Commercial Standard Markets on Big "I" Markets.

If you also seek professional liability for these clients, check out Architects & Engineers Professional Liability by CBIC an RLI Company.

|

SPECIAL FEATURE

Keep Your Big "I" Membership Current to Maintain Full BIM Commission

Beginning in April, non-IIABA members will see changes in commission level on business placed through Big "I" Markets. This includes Big "I" Markets products, Eagle Agency, Eagle Express and RLI if placed with IIAA Agency Administrative Services, Inc. Agencies whose membership has lapsed will earn 50% of commission previously earned. In addition, non-members will be paid on a quarterly basis. Beginning in April, non-IIABA members will see changes in commission level on business placed through Big "I" Markets. This includes Big "I" Markets products, Eagle Agency, Eagle Express and RLI if placed with IIAA Agency Administrative Services, Inc. Agencies whose membership has lapsed will earn 50% of commission previously earned. In addition, non-members will be paid on a quarterly basis.

Membership status is confirmed at time of payment, i.e. monthly if registered for EFT and quarterly if not. Keep your membership current to avoid this reduction and to continue receiving the many valuable benefits offered by the Big "I" and your state association, including Big "I" Professional Liability, E&O Happens Risk Management, Big "I" Flood, Big "I" Retirement Services, member discounts on DocuSign electronic signature processing and your free IA magazine subscription.

Has your membership lapsed? Contact your Big "I" state association to sign-up.

|

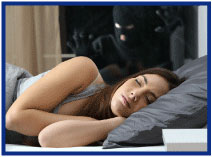

Sleep Safe & Sound While Traveling

One night in the early 1960s while my parents lived in Japan burglars broke in while they were sleeping but my parents didn't wake up. The police discovered a slit in the screen of the bedroom window and informed them the crooks probably cut the screen and pushed a hose through, then filled the room with a sleeping gas to keep my parents unconscious as they ransacked the bedroom. The youngest of my sisters had just been born and since most new mothers sleep lightly that is most likely what happened. Fortunately they didn't gas the rooms of my other sisters or the baby. The thieves got off with some cash and sadly, my mother's engagement and wedding rings from her jewelry box. One night in the early 1960s while my parents lived in Japan burglars broke in while they were sleeping but my parents didn't wake up. The police discovered a slit in the screen of the bedroom window and informed them the crooks probably cut the screen and pushed a hose through, then filled the room with a sleeping gas to keep my parents unconscious as they ransacked the bedroom. The youngest of my sisters had just been born and since most new mothers sleep lightly that is most likely what happened. Fortunately they didn't gas the rooms of my other sisters or the baby. The thieves got off with some cash and sadly, my mother's engagement and wedding rings from her jewelry box.

Fast forward 50+ years to France where Formula One racer Jenson Button and his wife were robbed in a similar way while vacationing in Saint-Tropez. The criminals got over $300,000 in loot including an engagement ring as well.

Unfortunately criminals love tourists. Robbing hotel rooms is one of their more invasive tactics but they have many more, from pickpockets loving "Beware of Pickpocket" signs, snatch & grab teams, to more involved scams in and around businesses.

Big "I" Markets partner Travel Insured International has a highly informative blog post about keeping your money safe while traveling.

The TII travel blog covers a myriad of travel related subjects, including sleeping on flights, honeymoon planning tips, using a cellphone abroad, and picking the right hotel, just to name a few.

Travel Insurance can cover accident and sickness medical expense, emergency medical evacuation/repatriation, trip delays, cancellation, interruption, missed connections due to severe weather or many others reasons outside the traveler's control.

Obtaining coverage is easy:

-

Review the product guide and comparison chart with your client.1

-

When you are ready for coverage to be issued, click on "Request a Quote" in Big "I" Markets and provide the necessary information. A credit card will be required to issue coverage.

-

Coverage will be issued and confirmed in Big "I" Markets.

Travel Insurance is currently available to members in all states.

1 - Rates, waiting periods, and coverages can vary in FL, IA, KS, NY & WA.

|

| |

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

AIG Private Client Group Homeowner - Collections CoverageNEW

-

Chubb Masterpiece Homeowner - Overview NEW

-

CBIC Architects & EngineersNEW

-

AIG Private Client Group Homeowner - Automobile NEW

-

AIG Private Client Group Homeowner - Overview NEW

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Product Webinars

-

Wednesday, March 29 - 2:00 - 3:00pm EDT. "Chubb Masterpiece for High-Value Homeowners - Automobile Coverage". Ray Crisci, SVP & North America Auto Product Manager for Chubb Personal Risk Services, will present “Safety First” which compares and contrasts the way Chubb settles auto claims differently than other auto insurers. The second webinar in Chubb’s educational series, Ray will explain why a high level of claim adjustment expertise is required to ensure that today’s increasingly complex vehicles are fixed correctly in order to ensure their safety systems perform as designed in the event of a subsequent accident Click here to register. Cost: Free.

-

Thursday, March 30 - 3:00 - 4:00pm EDT. "AIG Private Client Group Coverages - Personal Umbrella". Join Lisa Gelles, AIG Private Client Group Business Development Manager as she breaks down AIG's Private Client Group's umbrella coverage. In today's litigious society, one lawsuit can do significant damage to even the wealthiest of individuals. Adequate liability protection is more important than ever.

The liability coverage included within homeowners, auto and yacht policies is considered primary insurance; it responds first in the event of a claim. Excess liability (also known as "umbrella") insurance responds after primary coverage limits are exceeded. For example, the liability limit on many homeowners' policies is $300,000. If someone is injured on your property and awarded damages above that, you're personally responsible for the remaining balance, including legal fees.

To learn more about AIG Private Client Group's umbrella program, please Join Lisa Gelles, AIG Private Client Group Business Development Manager on March 30 at 3:00pm EDT. Click here to register. Cost: Free.

-

NEW - Wednesday, April 19 - 2:00 - 3:00pm EDT. "Big "I" Swiss Re Corporate Solutions Quarterly Risk Management Webinar". The Big "I" Professional Liability/Swiss Re Corporate Solutions quarterly risk management webinar is approaching. Agency Risk Management Essentials: Preparing for a Catastrophic Event is scheduled for April 19, 2017 at 2 P.M. Eastern and will discuss effective ways insurance agents and brokers can reduce their risk of catastrophic E&O claims. The discussion will be presented from the viewpoints of an insurance agent, a Swiss Re Claims specialist, an E&O defense counselor and a Selective Insurance Company of America representative. The session is free to Big "I" members.

Please register today. More promotional materials are forthcoming in state news in the coming weeks.

If you have any questions relating to the topic that they would like addressed during the discussion, please email Jim Hanley no later than April 1, 2017. Cost: Free.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

April 19 - 1:00 - 2:30 EDT. "Untangling the Work Comp Mess" - Part 1 of 2. Workers' compensation is a relatively easy coverage to understand. Work comp is work comp is work comp. The difficulty in work comp does not arise out of the policy but rather from the myriad statutes that surround and control how a work comp policy responds. April and June webinars combine to untangle many of these laws that cause problems. Two key questions to be answered during in the April webinar include: What makes an injury or disease compensable under workers' compensation? Who is covered by the work comp policy? Plus more. Click here to register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

Who Are the A++ Insurers Anyway?

By Paul Buse, President of Big I Advantage®

Recently I noted in conversation that several insurers being discussed in the same sentence are rated "A++" by A.M. Best Company and I said I was pretty certain that was less than 5% of all insurers. Specifically, that is, their financial strength rating is A++ as rated by A.M. Best. A.M. Best describes this rating on their website as "Assigned to insurance companies that have, in our opinion [that is, A.M. Best Company] a superior ability to meet their ongoing insurance obligations."

It turns out I was wrong. When I ran the report close to publication deadline for this Student of the Industry column, there were 137 insurance companies out of 3,826 so that is 3.6% of all insurance companies. That is, less than 5%. These insurers do represent, however, a much bigger portion of all Direct Written Premium (DPW) in 2016 at 28.3%. They are also much more concentrated in personal lines than the average in the industry and if you look at the insurer groups, that becomes clear as the names are all major players in personal lines.

Click for larger version

Source: A.M. Best Company Bestlink Advantage 2.0. Results are inclusive of the companies that are members in the AMB Group Name with written premiums in 2016: Auto-Owners Insurance Group, Berkshire Hathaway Insurance Group, Chubb INA Group, Munich-American Holding Corp Companies, State Farm Group, Tokio Marine US PC Group, Travelers Group, and USAA Group

|

BIG "I" MARKETS SALE OF THE WEEK

Congratulations to our agent in Louisiana on an Affluent Homeowners sale of $31,076 in premium!

|

|