Winter has come to the personal umbrella marketplace. As you've already seen on IAmagazine.com, signs of firming marketplace conditions are emerging. You and your personal lines staff should know these trends and consider them in your standalone personal umbrella placements.

Source: A.M. Best Bestlink 2.0 and Best's State Rate Filings for Line (Personal General Liability) and Program (Umbrella) for all states and 2019 Effective Date (over 5,000 filings)

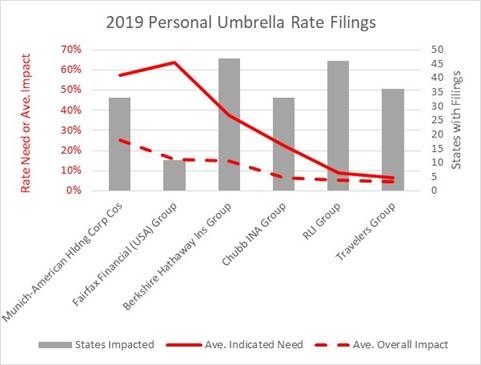

Does this feel like a hard market in personal umbrellas? If you inspect the graph above or table below, you will see signs of major price increases in both the rate needed and the estimated average impact on the insurer books of business in each state.

Included are well-known standalone personal umbrella markets and other standard markets relying on independent agents. Can you imagine the renewal-quote to shopping ratio with an average price change of 25%? Note: RLI's position on rate need and average impact is on par with standard well-known standard writers.

| Rate Increases of Interest | Other Names-PUPs or Frequent | States Impacted | Ave. Indicated Need | Ave. Overall Impact |

| Munich-American Hldng Corp Cos | Amer Alternative Ins Co or AAIC | 33 | 57.20% | 25.20% |

| Fairfax Financial (USA) Group | Hudson, Vault, Allied Word, Crum&Forster | 11 | 63.83% | 15.80% |

| Berkshire Hathaway Ins Group | USLI, Mt. Vernon | 47 | 37.41% | 15.02% |

| Liberty Mutual Insurance Cos | Safeco | 35 | 28.63% | 14.90% |

| American Natl Prop & Cas Cos | | 39 | 19.04% | 14.12% |

| American International Group | AIG, National Union, Lexington | 27 | 19.94% | 7.37% |

| Chubb INA Group | Federal, Bankers, Pacific | 33 | 22.24% | 6.63% |

| RLI Group | | 46 | 8.99% | 5.43% |

| Travelers Group | St. Paul, Standard, Auto Ins Hartford | 36 | 6.41% | 4.70%

|

Here are some actions you should consider to be prepared for the insurance winter:

1) Make sure you and your personal lines team are aware of these umbrella market developments. Distribute this article at your weekly staff meeting. Price increases like these will result in inquiries from insureds placed with markets filing major increases.

Some individuals may see a 50% price increase or higher. Moreover, with price increases come a tightening of other underwriting factors, such as substantial increases in required underlying limits.

2) Evaluate your website and social media. Do you have personal umbrellas and your agency's ability to offer coverage with a quality and stable insurer like RLI highlighted on your agency website? Searches for "personal umbrella" will likely jump in 2020. When your insureds call, will you be prepared?

Also, will your staff be aware of what an opportunity an unsolicited call for an umbrella quote is for your agency? These prospects often own several autos and a home or condominium. Make sure those shoppers find your website. Umbrella clients can be your agency's best personal lines customers.

If you Google "personal umbrella" with your agency zip code, does your agency show up? Take a moment now to review the many umbrella marketing resources available to your agency. Add one of RLI's brief explainer videos to your website, arm yourself with RLI's consumer-facing flyers and download our declination form to use when offering coverage.

RLI is the stable standalone market and word is spreading. The five most productive states in the Big “I" RLI program are seeing new business bind rates of over one policy per member agency.

Also, does the policy you are moving to have a controlled substance exclusion? RLI does not. Look again at RLI placement in the graph between two well-known, standard insurers. There is a reason the Big “I" endorsed RLI as our primary standalone market more than 25 years ago.

3) Exercise errors & omissions caution. The risk of churn is real. When discussing moving an umbrella, make sure your clients know this coverage is not a commodity.

If you have personal umbrellas with less consistently priced insurers, consider that risk. Moving umbrellas placed with insurers who acquired the business on price puts your agency at an E&O risk. Umbrella placements are tricky and it's a high-severity line of business.

4) Gain easy access. Your first step to getting engaged with the Big “I" Personal Umbrella program is to connect with your state's dedicated program administrator. If you have never placed an RLI personal umbrella policy with the Big “I" program but are a Big "I" Markets user, head over to Big "I" Markets for more information.

In many states, you can easily bind your first policy and then gain direct access under your association program and your state's RLI program administrator.

If your agency is a producer of PUPs in more than a few states, email us and we'll investigate how best to serve your agency in all your states. If you are interested in understanding more how competitor filings might affect your state, email Paul Buse.

5) Consider an option for tough risks. Don't forget about the alternative umbrella market program with Anderson & Murrison, the experts on hard-to-place risks, which is available via Big "I" Markets.

Anderson & Murrison's long-term relationships with National Casualty and Scottsdale, among others, have served many members with those challenging risks for many years.