The future belongs to those who prepare for it.

- Ralph Waldo Emerson

Plan for the Future

There’s no denying that the world of insurance is changing at an extraordinary pace. With the widespread reach of all things Internet, the vast array of technology tools and myriad access points for the latest information, a profound shift has occurred for agencies. Your insureds and future customers have more power than ever before, as they come to you having done research about the coverages they need, and having read reviews about your agency. Your employees are using new tools to service clients, improve workflows and simply sell insurance. They are also working more collaboratively and using the latest technologies to communicate with your clients and with each other. Social media has created the expectation that the workplace will be transparent, and that the use external resources will not only be allowed, but also required.

The Future Is NOW!

The War For Talent

Did you know that the number of professionals age 55 and older is 30% higher in the insurance industry than the rest of the economy and that by 2020 our industry will have an estimated 400,000 job openings? Agencies over the next 10 years will see a large number of retirements as the agency workforce ages. You must start now to find and hire the most promising and smartest workers to keep your agency competitive and relevant and able to provide the service your clients using efficient and techno-savvy means.

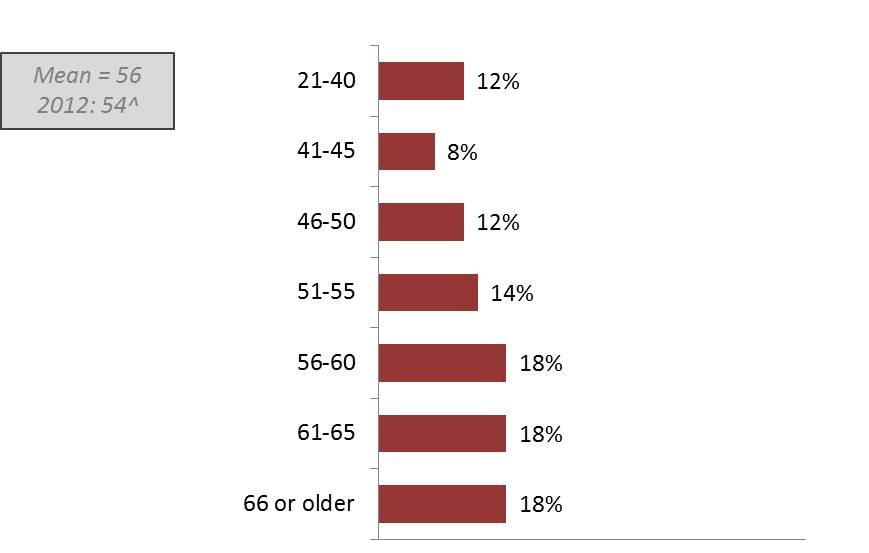

Age Of Principals With 20+% Ownership

The average age of principals with 20% or more ownership in their agencies is 56 years old, with 18% of those principals age 66 or older.

Your Customers Are Going To Be Different

A key to your agency’s future success is understanding that your customer base will change and evolve as the U.S. demographics change. Your customer service team needs to be able recognize and work effectively with customer diversity, which will include woman, the five generations (matures, Boomers, GenX, GenY and GenZ, as well as racial and ethnic groups, such as Hispanics, Asians, and African Americans. Also, included are new customers that may be defined by key lifestyle attributes, such as the LBGT community. Acknowledging and creating a customer experience to meet the needs of a diverse client pool will help you create a competitive advantage over agencies not addressing customer diversity.

People are more diverse than ever before and our differences manifest themselves in a number of ways. It may mean differing expectations about the speed of getting information-within seconds or by the end of the day. It may mean differing preferences for communication-text versus

a phone call or face-to-face meeting. Even racial, ethnic, religious, generational, and geographic differences come into play when

satisfying customers’ service expectations.

- Kelly McDonald

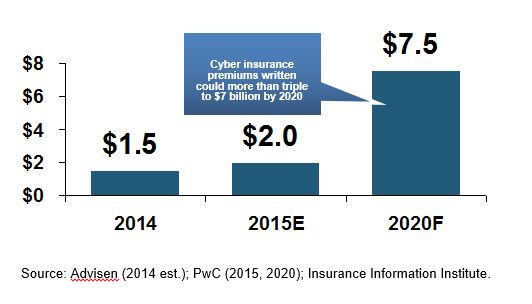

Learn about Industry Disrupters

Telematics, the Internet of things, driverless cars, drones, cybercrimes, on-demand everything! Is your service staff up-to-speed on these things and can they help current and new customers effectively navigate the marketplace for the proper coverage? What about things like ridesharing or homesharing? Do they know the underwriting criteria of each of your markets and how these issues are handled company by company? The insurance industry is addressing some of these issues head-on and adding new product lines, endorsements, exclusions and sending out reams of information. Education is critical to protecting your clients and your errors and omissions exposure.

Please see information and educational materials addressing these topic in the

Big “I” Virtual University.

Staying Social

Agencies must be vigilant to catch the next wave before it passes by, taking customers with it. Consider just these latest online trends:

- While Facebook continues to lead the social media pack with 1.15 billion active monthly users, Google+ is quickly gaining steam, and now has the second highest number of monthly users—343 million. (www.cosida.com)

- Visual content is vitally important. Is there application for your agency on Pinterest, Slideshare, Tumblr, Path and Mobli? If you don’t know what these sites entail, get online and investigate what your customers and competitors are doing there.

- Be sure to include video content when appropriate. From longer format options via YouTube to six second mini-videos via Vine, remember that a picture can say a thousand words. Yes, you’re in insurance, but you can have fun; be creative.

Between the time this information was written and you are reading it, it’s likely something new has come to the forefront. Stay engaged.

And, don’t forget that even if you aren’t using every technology or communication tool for your own agency, your client might be. You better know what they are using in order to recommend steps for managing their risks.

Monitor and Measure

Many firms are frustrated by social media, in particular, because it can be difficult to capture a monetary ROI. But there are other important measurements you can use to gauge effectiveness (be sure to start with a baseline measure.)

- Website traffic

- Number of new business partnerships

- Exposure

- Search ranking

- Number of qualified leads captured

- Number of likes, follows, comments etc.

- Number of successful closed business leads

- Reduction in marketing expenses