By Meghan Jackson, Business Development Manager, Chubb

Unthinkable crimes like home invasions, child abductions, and carjackings appear in the pages of newspapers, magazines and web sites every day. It's an unfortunate reality that we live in a world where these crimes, along with stalking threats, road rage, air rage and even hijackings occur on a regular basis. What if one of these nightmare situations were to happen to one of your client's family members? How would they recover? Unthinkable crimes like home invasions, child abductions, and carjackings appear in the pages of newspapers, magazines and web sites every day. It's an unfortunate reality that we live in a world where these crimes, along with stalking threats, road rage, air rage and even hijackings occur on a regular basis. What if one of these nightmare situations were to happen to one of your client's family members? How would they recover?

Chubb's Masterpiece Family Protection policy helps cover an insured's expenses if they become a victim of these crimes almost anywhere in the world. By providing expenses related to medical or rehabilitation needs, additional security services, psychiatric care or counseling required after the horrific event, Chubb not only protects the things your clients treasure most; they also cover the people who are most precious to your clients.

Currently available in all states except Arkansas, Hawaii, Iowa, North Dakota, South Dakota, Virginia and Wyoming, Family Protection can be added as an enhancement to any Chubb homeowner policy for a cost of $80-$110. Should a client reside in a state in which the product is unavailable, Chubb can look to attach it to a client's secondary homeowners policy instead.

By the end of 2016, 18 states[1] will have updated Family Protection products that include a new cyberbullying coverage. This coverage provides for up to $60,000 of expenses arising from multiple acts of harassment or intimidation committed against the insured or family members by others through the use of a personal computer, telephone, or a portable device such as a smartphone, electronic tablet or handheld computer. The acts must result in one of the following to the insured or a family member: wrongful termination, false arrest, wrongful discipline in an educational institution, or diagnosed debilitating shock, mental anguish or mental injury leading to the inability of the insured or a family member to attend school or work for more than a week. Covered expenses include:

-

Up to $25,000 for psychiatric services

-

Up to $25,000 for rest and recuperation expenses

-

Up to $30,000 for lost salary ($15,000 per person)

-

Up to $15,000 for temporary relocation expenses

-

Up to $15,000 for educational expenses

-

Up to $30,000 for professional public relations and cyber security consultants ($15,000 per person)

Temporary relocation and security expenses for carjacking and child abduction are also part of the coverage enhancements in these 18 states.

These are the situations that no one wants to think about, but if the unthinkable happens, Chubb will be there.

Chubb has created a few selling aids to help pitch the coverage to your clients:

The Chubb Masterpiece Program is available to registered members in all states except auto in HI, KY, MA, NC, SC and VA as those are being placed in the legacy-ACE system. Additionally, NJ auto and NC home business are being written in the Chubb Non-Masterpiece environment. Learn more by logging into www.bigimarkets.com and clicking on Affluent Program - New Business.

[1] Alabama, Arizona, Colorado, Connecticut, Delaware, Georgia, Idaho, Illinois, Indiana, Massachusetts although cyberbullying coverage not included here, Missouri, New Jersey, New York, Ohio, Pennsylvania, Utah, Washington & Wisconsin.

|

Agency Risk Management Essentials Agency Risk Management Essentials

Is your website doing more harm than good?

Join Big "I" Professional Liability and Swiss Re Corporate Solutions on December 8th at 2 p.m. EST for the free "Agency Risk Management Essentials: Is your website doing more harm than good?" webinar.

This free session will focus on the dos and don'ts of insurance agency website content. For instance, does your website claim that you "specialize" in a certain type of insurance coverage, or provide services you do not provide? If so, then you are likely increasing your agency's standard of care.

The discussion will be presented from viewpoints of an E&O underwriter, an auditor, a claims expert and defense counsel. Panelists will include Angelynn Heavener - Principal, Insurance Training Plus, Inc. and Rick Oldenettel, Esq. Oldenettel & Long, as well as Swiss Re Corporate Solutions staff Annette Ardler, CPIW, DAE, AIAM, Senior Underwriter, Vice President and Ellen A. McCarthy, JD, CPCU, RPLU, Claims Expert, Vice President. The discussion be moderated by Jim Hanley, RPLU, Big "I" Professional Liability, Director of Risk Management.

Topic: Is your website doing more harm than good?

Date: Thursday, December 8th

Time: 2:00PM EST

Click here to register online!

Jim Hanley, director of agency professional liability risk management at the Big "I," will moderate the session. Big "I" Professional Liability welcomes questions related to the topic for discussion during the webinar. Email Jim Hanley at jim.hanley@iiaba.net no later than Dec. 7th with your thoughts. Register for the complimentary session today. No continuing education credits are available.

Learn more about Big "I" Professional Liability risk management initiatives at www.iiaba.net/EOHappens.

|

According to a recent report of U.S. businesses by The Global Entrepreneurship Monitor, 69% of new businesses get their start at home, and 59% of those businesses continue to be run from home after the startup phase. In light of those numbers, it's very likely that some of your customers have a home business exposure that you don't know about. Maybe a homemaker bakes cakes and cookies and sells them locally, a recent college grad has started designing web sites for local businesses, a retired music teacher gives piano lessons, or an accountant offers tax prep services. There's an endless list of possibilities for home business entrepreneurs…and they all need insurance. According to a recent report of U.S. businesses by The Global Entrepreneurship Monitor, 69% of new businesses get their start at home, and 59% of those businesses continue to be run from home after the startup phase. In light of those numbers, it's very likely that some of your customers have a home business exposure that you don't know about. Maybe a homemaker bakes cakes and cookies and sells them locally, a recent college grad has started designing web sites for local businesses, a retired music teacher gives piano lessons, or an accountant offers tax prep services. There's an endless list of possibilities for home business entrepreneurs…and they all need insurance.

Many home-based business owners believe that their homeowners or renters policy will automatically cover any loss or damage to their business equipment, supplies, and inventory, etc., when in fact most policies exclude coverage for business exposures on the premises. As an agent, it's wise to regularly ask each customer about any home-based business exposures, and then review their policies to determine if they need additional coverage.

RLI offers an At Home Business Policy which provides affordable coverage for home-based businesses. Coverage includes up to $1,000,000 in business liability protection, up to $100,000 comprehensive coverage for business personal property, $5,000 per person for medical payments to customers injured on-premises, and coverage for loss of income. The product is targeted to over 100 retail and services risks which present minimal product and/or professional liability. Coverage also extends to business personal property that is in transit or temporarily off-premises…if an insured is offering their products at a county fair, trade show, gallery, etc.

For more information on RLI's At Home Business Policy, or to contact your state's administrator, visit www.iiaba.net/homebusiness.

|

| |

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

AIG Private Client Group Homeowner - Overview NEW

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Markets Product Webinars

Wednesday, December 7 - 2:00 - 2:30pm EST. AIG Private Client Group for affluent homeowners. This webinar will cover what qualifies as a collectible car, (classic, antique, exotic, etc.) plus the features of their Automobile coverage.

-

New Vehicle Replacement

-

High Liability Limits

-

Worldwide Coverage

-

OEM Parts

-

Cash Settlement Option

-

...and more

Click here to register.

+++++

Learn Your Agency Web Site Liability Risks

The Big "I" Professional Liability/Swiss Re Corporate Solutions quarterly risk management webinar has been set for December 8, 2016 at 2 P.M. EDT. "Agency Risk Management Essentials: Is your website doing more harm than good?" will focus on the risks associated with insurance agency Web site content. The discussion will be presented from the viewpoints of an agents E&O underwriter, an auditor, a claims specialist and defense counsel and will include dos and don'ts when it comes to web site content.

Panelists will include senior Swiss Re Corporate Solutions staff, and the session will be moderated by IIABA's Jim Hanley, RPLU, Director Agency Professional Liability Risk Management.

Big "I" Professional Liability welcomes suggested questions related to the topic for discussion during the session. Please email Jim Hanley no later than November 30th with your thoughts.

Register for the complimentary session today. No Continuing Education credits are offered for this webinar.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

December 7 - 1:00 - 2:00pm EST. "What I've Learned in 47 Years In the Insurance Industry". A free webinar with parting thoughts from Bill Wilson who is retiring at the end of 2016 and whose career began in June 1969 when he graduated from high school and worked during the summer for the industry organization that had granted him a 4-year scholarship to college, majoring in fire protection engineering. Over the next 47 years, his career morphed from engineering to management to education, serving largely insurance carriers then independent insurance agents. Over the time, he's learned a few things you might find helpful. Click here to register.

-

January 18 - 1:00 - 2:00pm EST. "Cracking the Condominium Conundrum". ". How can a policy generating about $75 in revenue cost you $5,000, $10,000, or more? Believing that writing an HO-6 is quick and easy is the beginning of an E&O storm that can cost you thousands (your E&O deductible). Join newly appointed Big "I" Virtual University Executive Director Chris Boggs as he answers the three KEY questions faced by every agent when analyzing and placing coverage for either a unit owner or a condominium association: who "owns" the property; what value applies to the owned property/what should be used; and who is liable for bodily injury and/or property damage. Click here to register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

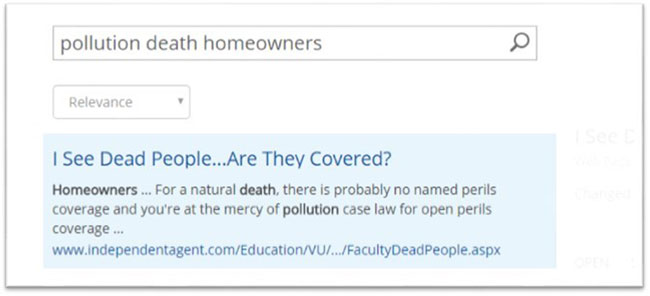

I See Dead People…Are They Covered?

By Paul Buse, President of Big I Advantage®

A question from a Big "I" Markets agent came in through our switchboard this week. A person died in their home and was not discovered for 10 days. It was a southern and warm state, and the agent needed to know what does a homeowners policy cover? Your Big I Advantage staff is comprised of insurance people like you, but for tough questions we turn to the same place you and many members can. The question came to me and I had the answer in about 30 seconds after searching the Big "I" Virtual University. Find VU online at www.iiaba.net/vu or visit our home page www.iiaba.net, then click on "Education and Events" followed by "Virtual University."

Click for larger version

It turns out, it's probably covered. All the usual caveats notwithstanding on blanket statements about any claim situation, of course, but you can rely on the answer probably being addressed on the VU or you can, after logging in, ask a new question yourself using the "Ask an Expert" feature. My favorite Faculty Response to the question above? "An HO 3 Special Form is a named exclusions (open perils) policy. All losses unless specifically excluded, are covered. The pollution exclusion is for the discharge, etc. of pollutants. Dead bodies, although a biohazard, are not pollutants under the policy. I just checked HO 00 03 04 91, as it was the one that I had in this office, and biohazards are not listed, and as such should/would not be excluded in my opinion."

Bonus Webinar Did you know that Bill Wilson, current leader of the Big "I" Virtual University is retiring? Get a glimpse at the brains and wit of this industry legend as he exits the VU after 47 years of research by attending his farewell webinar session: Bill Wilson Shares His Wisdom before Retiring from the Big "I."

Registration link: What I've Learned in 47 Years in the Insurance Industry

Wed, Dec. 7, 2016

1-2 p.m. ET

Cost: FREE

|

Be one of the first five with the correct answers and win a $5 gift card (Starbucks, Dunkin' Donuts, Baskin Robbins, or Krispy Kreme).

Don't forget to answer the Tie Breaker!

Congratulations to this week's winners - Megan Thomas (OK), Darla Menger (CO), Kathy King (MD), Morgan Ellis (PA), & Jane Hamada (CA).

1. D-Flawless is the highest rating given to diamonds. What is the worst? - Z-INCLUDED3 (Color & Clarity)

2. On this date (November 29th) in 2004 this big actor finally got a star on the Hollywood Walk of Fame. His debut was in 1954. Name him. - GODZILLA

3. What is the maximum age of a building under the MiddleOak program? - THERE IS NO MAXIMUM AGE

TIE BREAKER

TB - Mentioned in the Case Study linked in the InsurBanc feature, in what business field was Paul Bassman before insurance? - MUSIC

|

BIG "I" MARKETS SALE OF THE WEEK

|

|