It was 380 years ago today that the Massachusetts General Court required all able-bodied men between sixteen and sixty join the militia. The three units created still exist today in one form or another, thus December 13, 1636 is considered the birthday of the National Guard. Guard units around the country have and will be celebrating with parades and concerts. Big "I" Markets offers Event Liability insurance that can cover just about all of these events, including parades, concerts and parties, all of them of any size, even those with fireworks*. It was 380 years ago today that the Massachusetts General Court required all able-bodied men between sixteen and sixty join the militia. The three units created still exist today in one form or another, thus December 13, 1636 is considered the birthday of the National Guard. Guard units around the country have and will be celebrating with parades and concerts. Big "I" Markets offers Event Liability insurance that can cover just about all of these events, including parades, concerts and parties, all of them of any size, even those with fireworks*.

Event Liability doesn't mean just parades and music, but refers to weddings, festivals, parties, conferences, and lectures, just to name a few.

Does the event continue overnight and include camping? No problem. Afraid the event might be too large to find coverage? There is NO LIMIT on event size so you don't have to turn anyone away.

Coverage can be placed for the individual or entity hosting the event quickly. For those providing services to events, such as DJ, caterers, florists, and photographers, we have a product as well. Vendors can secure coverage on a short term or annual basis.

Public liability for single day, short term, and annual policies is available. In addition to GL, HNOA liability, umbrella and liquor liability can be offered. One day events generally can be quoted in a single business day. Let us help you cover:

-

Art Festivals/Shows

-

Auctions (at private residence OK)

-

Auto Shows

-

Business Meetings and functions

-

Campouts

-

Concerts: Indoor/Outdoor (All genres: excluding Rap/Hip Hop)

-

Conferences/Conventions

-

Comedy Shows

-

Consumer Shows: Craft, Boat, Art, Holiday, Home, Fishing, Vacation, Bridal, Consignment

-

Dance Show/ Music Recitals

-

Estate Sales

-

Exhibitions/Exposition (no sports)

-

Fashion Shows

-

Fundraising Events

-

Festivals (all types)

-

Fireworks Display*

-

Instructional classes

-

Job Fairs

-

Parades (any size) and parade participants*

-

Parties: Banquets, Weddings, Anniversaries, Graduations

-

Picnics

-

Religious Assemblies

-

Reunions: Class & Family

-

Seminars

-

Social Receptions: Dinners, Luncheons, Ladies club events

-

Speaking Engagements, Lectures

-

Sports Tournaments / Exhibitions (spectator liability only)

-

Theatrical Events and Musicals

-

Tradeshows

-

Weddings and Wedding receptions

Event Liability is available in all states, so march over to Big "I" Markets and check it out.

*Additional underwriting required.

|

Competencies are bundles of personal attributes that, in conjunction with the work environment, give rise to performance in critical outcome areas. Competencies come together to create a competency model, an organizing framework for aligning human capital with company goals. Caliper's new Competency Library, a comprehensive collection of 49 competencies composed of complex trait formulas and behaviors that can be applied to all manner of leadership, sales, service, and technical roles in any organization. Competencies are bundles of personal attributes that, in conjunction with the work environment, give rise to performance in critical outcome areas. Competencies come together to create a competency model, an organizing framework for aligning human capital with company goals. Caliper's new Competency Library, a comprehensive collection of 49 competencies composed of complex trait formulas and behaviors that can be applied to all manner of leadership, sales, service, and technical roles in any organization.

Click here to test out the new interactive tool or visit www.calipercorp.com/iiaba to take advantage of your exclusive Big "I" member discount on Caliper's suite of talent management solutions.

|

Most real estate agents don't have E&O insurance, presumably thinking only careless agents will get a claim filed against them. The problem with this thinking is that real estate agents get sued for things that are completely out of their control. "Failure to disclose" is the most common type of claim. Buyers will sue when a defect or mold, previously unknown, are discovered after the sale. The threshold to prove that the agent was negligent isn't that they did know, but that they should have known. Even if the plaintiff fails to prove the agent knew or should have known the agent will have to contend with his or her legal bills, which can easily run into the thousands. Losing the case can mean tens or even hundreds of thousands of dollars. Most real estate agents don't have E&O insurance, presumably thinking only careless agents will get a claim filed against them. The problem with this thinking is that real estate agents get sued for things that are completely out of their control. "Failure to disclose" is the most common type of claim. Buyers will sue when a defect or mold, previously unknown, are discovered after the sale. The threshold to prove that the agent was negligent isn't that they did know, but that they should have known. Even if the plaintiff fails to prove the agent knew or should have known the agent will have to contend with his or her legal bills, which can easily run into the thousands. Losing the case can mean tens or even hundreds of thousands of dollars.

Travelers Real Estate Agents/Property Manager E&O provides professional liability protection for claims or suits resulting from real estate agent or broker professional services.

Policy features include:

-

Bodily Injury and Property Damage resulting from a covered professional service(s).

-

Disciplinary proceeding defense expenses reimbursement up to $25,000.

-

Increased liability limits available for those who qualify.

-

Defense expenses related to covered claims in additional to the limits of coverage.

-

Deductible applies to defense expenses, unless endorsed or not allowed by state.

-

Option to provide prior acts coverage without a retroactive date limitation, for those who qualify.

-

Many extended reporting period options, including an unlimited time period endorsement option.

-

No exclusion for fair-housing discrimination committed in real estate professional services as a real estate agent or broker.

-

No exclusion for losses resulting from a real estate agent or broker failing to advise a buyer or seller that pollution, fungi and bacteria exists on a property.

-

No sub-limits for certain types of claims.

-

Coverage for employees and independent contractors of the insured automatically included as protected persons for claims resulting from professional services they perform for the named insured.

Coverage is available in all states with the exception of CA, HI, and LA and is written on admitted paper.

Log in to Big "I" Markets at www.bigimarkets.com and click on "Real Estate Agents and Property Manager E&O" to learn more or to request a quote.

|

| |

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

AIG Private Client Group Homeowner - Overview NEW

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

January 18 - 1:00 - 2:00pm EST. "Cracking the Condominium Conundrum". ". How can a policy generating about $75 in revenue cost you $5,000, $10,000, or more? Believing that writing an HO-6 is quick and easy is the beginning of an E&O storm that can cost you thousands (your E&O deductible). Join newly appointed Big "I" Virtual University Executive Director Chris Boggs as he answers the three KEY questions faced by every agent when analyzing and placing coverage for either a unit owner or a condominium association: who "owns" the property; what value applies to the owned property/what should be used; and who is liable for bodily injury and/or property damage. Click here to register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

Contingencies and CONTINGENCIES

By Paul Buse, President of Big I Advantage®

In a personal umbrella rate filing recently I noticed the insurance department questioned a 6 point contingency load built into loss costs used to justify an 10% overall rate increase. That is, six points or $6 of $100 in projected loss costs was attributed to "contingencies." Actuaries are like CPAs and they have rules to live by. The rule here is found in Actuarial Standard of Practice (ASOP) No. 30 and it says, "The actuary should include a contingency provision in the rates if assumptions used in ratemaking produce cost estimates that are not expected to equal average."

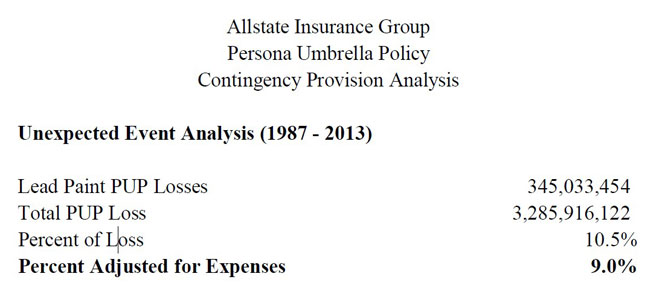

OK, first six points? Second, SIX POINTS! Wow. The justification is astonishing. In the filing the Allstate actuarial team cites the unforeseen costs of lead paint for their "contingency load." See below. According Allstate across their entire company their personal umbrella policies bore the unforeseen costs of lead paint that totaled about $1.25 for every man, women and child in the USA. That is actually 9.0% to 10.5% of all personal umbrellas losses over those 27 years.

|

BIG "I" MARKETS SALE OF THE WEEK

|

|