Evidence of early horse domestications dates back at least 5,000 years, occurring first on the Eurasian steppes. Used for millennia for war and work, modern horses still perform these duties in many areas of the world. In the U.S. working horses are used as mounted police, on cattle ranches, in historical re-enactments, and for physical/mental therapy, not to mention the Clydesdales seen in the Super Bowl ads every year. Sporting uses include riding, racing, rodeos, and hunting. Recreational and show owners account for about 2/5 of the estimated 9.2 million horses in the United States.

That's a lot of horses.

High-value homeowners own many horses, boarded either on their own property or at nearby facilities. For your clients that own horses, " Have you asked the right questions?" AIG understands the unique needs associated with horse ownership and has experienced risk management specialists to assist in lessening risk and getting the proper coverage.

Coverage for equine is not excluded from the home or excess policy with AIG unless it would exceed the definition under incidental farming. Every carrier is different and some may exclude coverage. When an insured is in that situation involving their own personal horses, an Equine Liability Insurance Endorsement may be offered.

Equine Liability Insurance Endorsement

-

Endorsement to Personal Excess Liability policies of $5,000,000 or more.

-

Available countrywide.

-

This will provide "clear" equine liability coverage for qualifying equine owners eliminating the grey area of coverage under Incidental Business.

Coverage Highlights:

-

Bodily injury or property damages arising out of horse ownership, use or care.

-

Gross annual revenue and hours worked by farm employees is eliminated.

-

Limits offered in $1m increments up to $5m.

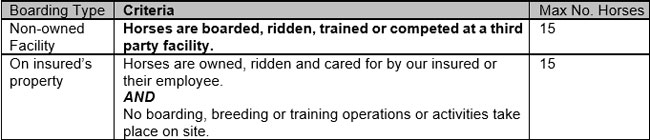

Boarding Arrangements:

Pricing is based on whether horses are boarded onsite or off and the number of horses. Pricing will be provided upon account submission and review of Equine Liability Submission form.

AIG can also provide coverage for the Trust or LLC that owns the horse on their home and excess policies.

AIG has a specialized home endorsement for Tack and Equipment (which is considered personal property) which will carry a $500 AOP deductible and some coverage for having to board horses off premises due to covered loss and veterinary coverage. This has been approved in Kentucky and AIG will roll it out to other states in 2017.

AIG also has specialized Risk Management personnel that reviews the pricing on the locations with barns and equine operations to make sure they are providing the correct replacement cost for these state-of-the-art facilities.

AIG's Private Client Program and is available to registered members in all states. Gallop over to Big "I" Markets and click on Affluent Program - New Business to learn more!

BONUS - AIG Private Client Group Webinar

Wednesday, December 7 - 2:00 - 2:30pm EST.

This webinar will cover what qualifies as a collectible car, (classic, antique, exotic, etc.) plus the features of their Automobile coverage.

-

New Vehicle Replacement

-

High Liability Limits

-

Worldwide Coverage

-

OEM Parts

-

Cash Settlement Option

-

...and more

Click here to register.

|

The Big "I" Professional Liability/Swiss Re Corporate Solutions quarterly risk management webinar has been set for December 8, 2016 at 2 P.M. EDT. "Agency Risk Management Essentials: Is your website doing more harm than good?" will focus on the risks associated with insurance agency Web site content. The discussion will be presented from the viewpoints of an agents E&O underwriter, an auditor, a claims specialist and defense counsel and will include dos and don'ts when it comes to web site content. The Big "I" Professional Liability/Swiss Re Corporate Solutions quarterly risk management webinar has been set for December 8, 2016 at 2 P.M. EDT. "Agency Risk Management Essentials: Is your website doing more harm than good?" will focus on the risks associated with insurance agency Web site content. The discussion will be presented from the viewpoints of an agents E&O underwriter, an auditor, a claims specialist and defense counsel and will include dos and don'ts when it comes to web site content.

Panelists will include senior Swiss Re Corporate Solutions staff, and the session will be moderated by IIABA's Jim Hanley, RPLU, Director Agency Professional Liability Risk Management.

Big "I" Professional Liability welcomes suggested questions related to the topic for discussion during the session. Please email Jim Hanley no later than November 30th with your thoughts.

Register for the complimentary session today. No Continuing Education credits are offered for this webinar.

|

Big "I" Flood partner Selective knows writing flood insurance business is complex - and agents already have a lot on their plate, so any time saved means more time for them to capture new business.

For this reason, Selective offers QuoteitNow - a self-service flood quoting tool that can be easily added to Selective appointed agency Web sites. In just a few simple steps, QuoteitNow walks customers through a flood application up to binding and directs them to contact the agency to finalize the process.

Why not maintain a personal touch with customers, while empowering them to start the flood quote process on their own - and at their convenience? Work with Selective to save time, save money and drive business. To learn more watch a brief overview video here. For additional questions or to become a Selective appointed flood agent, contact Quoteitnow@selective.com or visit www.iiaba.net/Flood.

Available in all states except AK, CO, DE, HI, MA, ND, NM, OH, PA, WA & WY.

|

| |

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

AIG Private Client Group Homeowner - Overview NEW

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Markets Product Webinars

Wednesday, December 7 - 2:00 - 2:30pm EST. AIG Private Client Group for affluent homeowners. This webinar will cover what qualifies as a collectible car, (classic, antique, exotic, etc.) plus the features of their Automobile coverage.

-

New Vehicle Replacement

-

High Liability Limits

-

Worldwide Coverage

-

OEM Parts

-

Cash Settlement Option

-

...and more

Click here to register.

+++++

Learn Your Agency Web Site Liability Risks

The Big "I" Professional Liability/Swiss Re Corporate Solutions quarterly risk management webinar has been set for December 8, 2016 at 2 P.M. EDT. "Agency Risk Management Essentials: Is your website doing more harm than good?" will focus on the risks associated with insurance agency Web site content. The discussion will be presented from the viewpoints of an agents E&O underwriter, an auditor, a claims specialist and defense counsel and will include dos and don'ts when it comes to web site content.

Panelists will include senior Swiss Re Corporate Solutions staff, and the session will be moderated by IIABA's Jim Hanley, RPLU, Director Agency Professional Liability Risk Management.

Big "I" Professional Liability welcomes suggested questions related to the topic for discussion during the session. Please email Jim Hanley no later than November 30th with your thoughts.

Register for the complimentary session today. No Continuing Education credits are offered for this webinar.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

November 16 - 1:00 - 3:00pm EST. "Builders Risk". Builders Risk insurance is meant to provide protection against the financial consequences of accidental losses which occur during the course of construction, renovation, or installations. This area of the insurance industry is largely misunderstood by many insurance professionals, including those that advise on the procurement of such insurance. This is further complicated by the fact that many insurers use differing proprietary coverage forms. Increase your knowledge in this two-hour webinar. Click here to learn more and register.

-

December 5 - 2:00 - 2:30pm EST. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" in the news and the implications. The December broadcast is in development as subject matter is explored. Click here to learn more and register and here to access the recordings.

-

December 7 - 1:00 - 2:00pm EST. "What I've Learned in 47 Years In the Insurance Industry". A free webinar with parting thoughts from Bill Wilson who is retiring at the end of 2016 and whose career began in June 1969 when he graduated from high school and worked during the summer for the industry organization that had granted him a 4-year scholarship to college, majoring in fire protection engineering. Over the next 47 years, his career morphed from engineering to management to education, serving largely insurance carriers then independent insurance agents. Over the time, he's learned a few things you might find helpful. Click here to register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

RLI Personal Umbrellas Penetration Varies By State. Why?

By Paul Buse, President of Big I Advantage®

This week we did some analysis of the states we administer the RLI Personal Umbrella program for. Your Big I Advantage licensed agency operation administers 14 of the 51 states in the RLI PUP program. (Access your administrator information for the program here.) When we looked at the personal umbrellas per agency in these states, I was astounded by the variance in the average number of personal umbrellas per sub-producer. Below are the figures for our above average states.

RLI Personal Umbrella Policies Per Sub-Producing Agency

Click for larger version

Source: The Book of RLI Personal Umbrella Business of IIAA Agency Administrative Services, Inc.

Props to South Dakota, Alaska, North Dakota, West Virginia and Rhode Island agents for the high policy count results. These states all have average policy counts per agency more than the national average of less than 5.0.

What are participating agencies in these states doing differently? Are they using coverage checklists on new business and forcing the question of the need for an umbrella and Uninsured Motorist from each new customer? I know some do--many take advantage of the robust checklist tools available exclusively to Big "I" members via a subscription to Virtual Risk Consultant. Do the agencies have a standard renewal process that requires a declination of an umbrella quote? Again, I know some do. This is a great risk management practice as outlined by Big "I" Professional Liability at EOHappens.

In fact, our umbrella staff has developed a "PUP Decline" form that we hope all members are using with each personal lines client. Download your copy here.

If you have an insight, please let me know at paul.buse@iiaba.net and we will get the news out to everyone. Also, stay tuned as we seek tips to share with you on earning more commissions, increasing your customer relationships and reducing your E&O risk with RLI PUP. We are reviewing our entire nationwide book of PUPs and will be looking at the agencies with the most RLI Personal Umbrellas and sharing anything we learn from that.

P.S. Last week we raised a discussion about the need for all "all other" insurance program. If you missed that, review that posting here.

|

BIG "I" MARKETS SALE OF THE WEEK

|

|