How a company deals with year-end planning issues can have a significant effect on what kind of surety support Goldleaf can achieve for them in the upcoming year. How a company deals with year-end planning issues can have a significant effect on what kind of surety support Goldleaf can achieve for them in the upcoming year.

Owners/managers whose businesses are profitable and growing sometimes fail to prioritize year-end issues with their future surety support in mind. They may consult other professionals - for example, their attorneys, bankers and tax accounts. However, good advice from these perspectives may not further, and actually can compromise and destroy, a company's surety capacity. Therefore, if continued or expanded surety support is critical to a company's growth next year, they need to weigh surety-oriented considerations against the other considerations that guide their year-end planning.

-

Consider upgrading the company's year-end financial statements. Increased surety capacity depends greatly on the "reliability" of the financial information provided to the surety company. Generally, surety companies prefer to see financial statements prepared by a respected certified public account (CPA) that is familiar with the company's industry. In all cases, you should have your year-end statements prepared on the "accrual basis." Statements prepared on the "income tax basis" or "cash basis" will present the weakest picture of the company's financial position.

-

Build equity. If a company is a "S-Corp," accumulating equity may seem counter-intuitive. After all, owners are paying personal income tax on the company's earnings, and it may seem right to take out what you have been taxed on. However, a company's bonding capacity depends, in large part, on company equity.

-

Do not over-emphasizes tax planning. No one wants to make money and send it all to Washington, D.C. However, if a company has had a profitable year and wants to continue growing with contracts that require bonds, they need to balance their tax planning against the other goals of the company. Reducing taxable income means reducing the net income that otherwise can be used to show profitability and equity growth on the company's financial statements.

-

Owners should check their personal credit scores. Individuals are now entitled to obtain a free copy of their personal credit report from the three major credit reporting agencies each year. Owners should take advantage of this as all surety companies check personal credit when underwriting for surety support.

-

Improve the company's "working capital" position. Positive working capital is a major factor in bonding.

-

Improve the company's "liquidity." Before year-end, clean up as many of the accounts receivable as possible and convert to cash.

-

Obtain an increase on the company's operating line of credit. As a company's revenues grow, its operating credit facilities should be growing as well.

-

Do not undertake ownership changes without considering the surety implications. Depending on how they are financed, buy-outs and other ownership changes can compromise (and, in some cases, can destroy) a company's bonding capacity. Anyone planning to stay in the company should be aware that if an ownership change in not handled properly from the surety company's perspective, the resulting loss of bonding capacity will drastically drop the value of the surviving company.

It is not only at year-end when companies may be making decisions which will impact their financial statement. During anytime of the year when decisions arise which may impact the financial statement, companies should contact Goldleaf to discuss the impact of those decisions on their bonding support. Goldleaf Surety can provide counsel to agents and their insureds - both with year-end considerations as well as other surety considerations - needed to grow and improve the company's surety support. For more information on bonds - or for help with your clients bonds needs - log in to www.bigmarkets.com or email us at bigimarkets@iiaba.net and an underwriter will contact you.

|

SPECIAL FEATURE

A Happy Distribution Force Equals Increased Carrier Profitability

Independent agents represent a "significant growth engine" for insurers that understand how to build strong relationships with their distribution force, according to a new J.D. Power study. But there is room for improvement in the agent-carrier relationship. Independent agents represent a "significant growth engine" for insurers that understand how to build strong relationships with their distribution force, according to a new J.D. Power study. But there is room for improvement in the agent-carrier relationship.

Read the full story in IA magazine.

|

Big “I” Risk Management Resource Roundup

As a Big "I" member, you can secure professional liability insurance for your agency through the Big "I" Professional Liability program. Many Big "I" Markets agents do just that! We insure approximately 2/3 of Big "I" member agencies.

That's why the Big "I" Markets staff wanted to take a moment to share this risk management resource round up with you. Swiss Re Corporate Solutions and Big "I" Professional Liability work hard to ensure the most cutting-edge risk management information is available to policyholders. Please review the links below to see what is offered.

If you're not yet part of our program, your dedicated state program manager would be happy to offer you a proposal. Contact your state association or request a premium estimate today.

Big "I" Risk Management Website - E&O Happens

This web site is our marquee risk management tool for members. It contains comprehensive information and tools such as: the common mistakes that cause E&O claims, real-life case studies for learning, best practice tips, sample disclaimers, procedures and client letters, operational self-assessments, E&O-related articles, and more. Visit www.iiaba.net/EOhappens to login. (FREE)

Big "I" Virtual Risk Consultant ("VRC") Big "I" Virtual Risk Consultant ("VRC")

Powered By Rough Notes

The VRC is a web-based resource providing comprehensive tools such as industry specific client risk exposure questionnaires and checklists. VRC helps agents better understand the coverage needs of customers, helping to reduce the risk of E&O claims from failure to offer. Visit www.iiaba.net/VRC to learn more. (Fee-based)

E&O Claims Advisor Newsletter E&O Claims Advisor Newsletter

Published monthly and emailed to agency staff, this newsletter provides valuable information on agency E&O trends and hot topics. (FREE)

Risk Management Webinars Risk Management Webinars

These quarterly webinars address emerging E&O risk management topics. Less than an hour in length and perfect for all agency staff, the webinars include detailed discussion from industry experts on reducing exposure to E&O claims. View past webinars online anytime at www.iiaba.net/EOhappens. (FREE)

Agency E&O Seminar Agency E&O Seminar

This seminar is the basic foundation of agency E&O risk management and is an excellent way to introduce agency E&O risk management to agency personnel. Agencies with the requisite number of staff attending may qualify for a 10% premium credit and may also qualify for CE credits providing a double benefit. (Fee-based)

In-house E&O Seminar

For larger agencies an in-house seminar can be a good value as it reduces travel and tuition costs. An instructor visits your office and leads a full or half-day seminar for all agency staff. Completion may qualify for a 10% premium credit. These seminars can be very beneficial in creating an awareness and building a culture of E&O risk management. (Fee-based)

Agency Operational Improvement Review Agency Operational Improvement Review

A review of your agency operations is available. Voluntary completion of this review may qualify you for a 10% E&O premium credit good for five years on the next renewal. (Fee-based) Keep ahead of the curve - visit www.iiaba.net/EOhappens to stay plugged in with Big "I" Professional Liability risk management!

|

| |

|

Free Agency Risk Management Webinar

Big "I" Professional Liability

|

Re-Learning Flood: Old Myths & New Realities

Virtual University

|

|

Date: Wednesday, February 21

Time: 2:00 - 3:00 p.m. EDT

Cost: Free

Summary:

Our panelists will take a look under the hood at Uninsured Motorist/Underinsured Motorist (UM/UIM) coverage. We will also provide you with some helpful risk management tips and some claims examples of how bad claims happened to good agents when placing auto coverage.

The panel discussion will feature Bill Wilson, CPCU, ARM, AIM, AAM, Founder & CEO, InsuranceCommentary.com, Matt Davis, Claims Manager, and Jim Hanley Director, Agency Professional Liability Risk Management will moderate. Fasten your seat belts and register today for "Swerve to Avoid Agency Liability: All About UM/UIM."

If you have any questions relating to the topic that you would like addressed during the discussion, please email Big "I" Professional Liability's risk management director Jim Hanley.

Registration:

|

Date: Wednesday, February 7

Time: 1:00 - 2:30pm EDT

Cost: $49

Summary:

Led by Big "I" Virtual University expert John Putnam, the Re-Learning Flood: Old webinar seeks to dispel some misconceptions about flood insurance and help agents better understand:

-

What is flood?

-

Are we facing a new protection gap?

-

What is the current impact of increased frequency and severity of flooding events in U.S.?

-

How are these trends impacting the NFIP and giving rise for increased flood insurance privatization?

-

How might greater privatization change the marketplace and improve protection?

All Big "I" Virtual University webinars include a 'seat' to attend live, a link to the on-demand recording, and a written transcript. Consider presenting conference style for the entire agency to benefit from the information shared. If looking for quick strikes of information on focused topics, take a look at the 20-minute Lightning Learning series for 2018.

Registration:

|

|

STUDENT OF THE INDUSTRY PARTING SHOT

Surplus Lines: Do You Know what Independently Procured Coverage Is?

Many of you probably access surplus lines coverages when the normal coverage channels cannot meet the need of a particular insured (distressed risk, unique coverage or very high limits are needed). What many agents don't realize is that an agent using a licensed surplus lines wholesaler, MGA or program manager is not the only way insureds can access non-admitted insurance coverage. An approach, known independently procured coverage (IPC) is possible. IPC takes place when an insured/risk manager goes to an unauthorized insurer either directly or through a broker not licensed by the jurisdiction in which the risk is located.

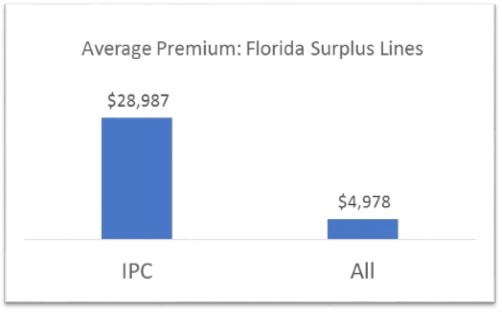

So how often does this happen? To get the answer I turned to one of the leading states for surplus lines placements in the nation, Florida and the Florida Surplus Lines Service Office (FSLSO). FSLSO does a fantastic job of collecting data and making it public on the taxes and fees they collect. The most recent data from Florida assembled in a easily accessible report is 2016. It turns out that, based on 2016 4Q, IPC does not happen very often. About one-tenth of one-percent of Surplus Lines transactions are carried out by an insured on their own. That is about 1,300 times in Florida in 2016 compared with nearly 1,000,000 total policies that year. As you can see below, the average premium of IPC transactions, however, is nearly six-times higher than the average Florida surplus lines transaction.

Click for larger version

Source: Florida Surplus Lines Service Office, 4Q2016 Report, fslso.com

Extra Credit: Taxes? If you are wondering if insureds that "go direct" somehow escape taxes on the transaction, they do not. IPC transactions pay the same 5% surplus lines taxes and associated fees as do transactions executed with the advice and counsel of an independent agent and licensed surplus lines intermediary. IPC taxes, however, are owed by the insured and filed and paid directly. And did you know if they don't pay up they can get caught? FSLSO compares reports by authorized surplus lines insurers in the state against receipts just like the IRS can look at From 1099 to see if a contract paid taxes on that income.

|

BIG "I" MARKETS SALE OF THE WEEK

Congratulations to our agent in North Carolina on an Affluent Homeowners sale of $9,365 in premium!

|

|