Real Estate agents can be sued for a variety of reasons. Most of them start with “Failure to…” followed by Disclose, Recommend, Properly Advise, Identify, Explain, or Comply. Failure to disclose is the biggest of these, easily accounting for half of all buyer initiated lawsuits. Agents that demonstrate their expertise and advise their real estate clients on the top risks they face are better positioned for successful, long-term relationships.

Real Estate agents can be sued for a variety of reasons. Most of them start with “Failure to…” followed by Disclose, Recommend, Properly Advise, Identify, Explain, or Comply. Failure to disclose is the biggest of these, easily accounting for half of all buyer initiated lawsuits. Agents that demonstrate their expertise and advise their real estate clients on the top risks they face are better positioned for successful, long-term relationships.

A comprehensive risk management strategy for real estate agents and brokers includes prevention (risk reduction techniques), early detection (immediate reporting of claims and even potential claims) and treatment (E&O insurance). Common sense risk reduction techniques can lower the chances of a claim happening in the first place. If a claim does occur, treatment comes in the form of immediate reporting and a solid Errors and Omissions policy backed by experienced claims handling; because claims happen, sometimes even to good people who have tried to do everything right.

Top Risks:

Failure to Disclose and/or Misrepresentation: The overwhelming majority of claims against real estate agents and brokers fall into this bucket. The reason for this is simple- there is a natural and innate reluctance on the part of a property seller to reveal facts about a property that might impede the sale or at the very least lower the potential sale price. Examples include: agent-owned property transactions; foreclosed and short sale property transactions; dual agency transactions; and errors in marketing a property.

Other common claims include bodily injury/property damage and acting outside of one’s area of expertise. In addition to having a risk management plan in place, immediate reporting of claims or even potential claims is critical in managing results.

Early Detection- Reporting

Helping clients to understand the importance reporting claims and potential claims immediately is critical. There is an understandable reluctance to report incidents that may give rise to claims for fear that simply reporting an incident will lead to increased insurance premiums in the future (most of the time this is not the case), but letting them fester is a bad call. We have countless examples of claims that were only reported after they blew up, but for which we could have achieved great results if only we had been brought in at the outset. Handling claims and potential claims is an E&O carrier’s job. Report claims and potential claims immediately.

Treatment- Real Estate Errors and Omissions Policy

Despite best intentions, people make mistakes. In the errors and omissions world, the saying “to err is human, to get sued for it, pretty much a given” has a lot of truth. The right Real Estate Errors and Omissions policy will best respond to the claims unique to real estate agents and brokers.

Travelers has been offering real estate agent E&O coverage since 1956. Real Estate Agent / Property Manager E&O is flexible enough to cover a wide variety of clients in an ever-changing environment. On top of the great coverage, service, and experience you expect from Travelers, now they are offering 2 year policies and $0 deductible options.

Check out these flyers and checklists to help you sell coverage to your clients.

The Real Estate Agent / Property Manager E&O program is available through Big "I" Markets in all states except CA, HI, and LA.

_______________________________________

The ISO CGL Property Damage Exclusions

May 6, 2015; 1:00 to 4:00 p.m. Eastern Time

$79 - Click here to register

The purpose of this webinar is to provide information about a very important element of coverage critical to building service providers, contractors, insurance agents, claims adjusters and subrogation units.

At the conclusion, participants should be able to: understand the primary purposes of CGL PD coverage and exclusions; understand the grant of coverage found in the language of these exclusions; understand the distinctions between ongoing vs. completed operations within the context of the exclusionary language; understand the historical significance and current application of "broad form property damage" and better serve insurance purchasers, particularly in the service and construction industries. VU webinar questions can be sent to bestpractices@iiaba.net.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EST we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! Register for the webinar by sending an email with your name and company name to bigimarkets@iiaba.net. Include "Website Navigation Webinar" in the subject line or body of your email. A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

________________________________________

Ratios of PUPs to Homeownerss

By Paul Buse, President of Big I Advantage

Contest: Win Maui Jim © Sunglasses for The Highest Ratio

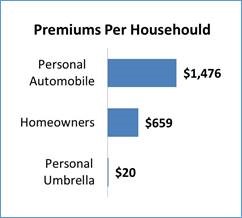

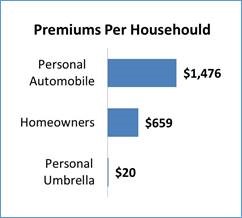

We estimate Personal Umbrella Policy ("PUP") Premiums in USA in 2013 were $2 to $3 billion. That is $15-20 of PUP premium per about 122 million householders in the USA. For comparison, we know premiums for homeowners is $659 per household and personal automobile is $1,476 per household. The average ratio of PUP to Homeowners is just over $3 of PUP to $100 of home.

Click Graph for larger version

Source: A.M. Best Aggregates and Averages and PUP Rate Filings

Click Graph for larger version

Source: A.M. Best Aggregates and Averages and PUP Rate Filings

Maui Jim Sunglasses Contest: We believe, many personal umbrellas go unsold and that not only creates an E&O risk, it creates a sales and service opportunity. We also believe some agents sell a lot more umbrellas than the average. Our partners, RLI Insurance Company who is our primary endorsed PUP provider, has agreed to underwrite a small contest with Two For Tuesday readers. If you feel your agency has a high penetration of personal umbrellas, email me with your 2014 personal umbrella premiums and your homeowners premiums. The winner will receive their choice of any Maui Jim, non-prescription sunglasses. No figures will be published without the express permission of those competing but we will want to also learn what drives the winner's high penetrations. We, of course trust you, and we will use the honor system in the self-reporting of your premiums. We will require the winner to provide a general summary and tips on your agency's approach in offering PUPs.

Email responses to Paul.Buse@iiaba.net

________________________________________

Be one of the first five with the correct answers and win an envy-inspiring TFT Trivia T-shirt. Don't forget to answer the Tie Breaker!

Stephanie Grey (MS), Cathy Crowe (IA), Kay Comeaux (LA), & Ed James (FL)

1. Half of all RVs are manufactured in what single US county? - ELKHART COUNTY, INDIANA

2. What is the oldest commission naval vessel afloat? - USS CONSTITUTION "Old Ironsides"

3. What was the first Federal law to be signed electronically? - E-SIGN ACT (Electronic Signatures in Global and National Commerce Act)

TIE BREAKER

What country was first associated with The Easter Bunny? - GERMANY

Fireman's Fund sold their renewal rights to ACE Group on April 1, 2015. With the sale finalized we're able to communicate how this will impact our Big "I" Markets policies. Please read in its entirety below, paying close attention to the information and any links embedded. If you have any questions please contact me at Aimee.Fawns@iiaba.net or Nancy Doherty at Nancy.Doherty@iiaba.net.

Fireman's Fund sold their renewal rights to ACE Group on April 1, 2015. With the sale finalized we're able to communicate how this will impact our Big "I" Markets policies. Please read in its entirety below, paying close attention to the information and any links embedded. If you have any questions please contact me at Aimee.Fawns@iiaba.net or Nancy Doherty at Nancy.Doherty@iiaba.net. The Caliper Profile is a scientific instrument for in-depth personality assessment and job matching, and it is the foundation of Caliper's work.

The Caliper Profile is a scientific instrument for in-depth personality assessment and job matching, and it is the foundation of Caliper's work.  Real Estate agents can be sued for a variety of reasons. Most of them start with “Failure to…” followed by Disclose, Recommend, Properly Advise, Identify, Explain, or Comply. Failure to disclose is the biggest of these, easily accounting for half of all buyer initiated lawsuits. Agents that demonstrate their expertise and advise their real estate clients on the top risks they face are better positioned for successful, long-term relationships.

Real Estate agents can be sued for a variety of reasons. Most of them start with “Failure to…” followed by Disclose, Recommend, Properly Advise, Identify, Explain, or Comply. Failure to disclose is the biggest of these, easily accounting for half of all buyer initiated lawsuits. Agents that demonstrate their expertise and advise their real estate clients on the top risks they face are better positioned for successful, long-term relationships.