InsurPac.

Fuelling the advoacy that defines your agency’s independence.

Promote. Protect. Perpetuate.

Working closely with the Big “I” advocacy team, InsurPac, the Big “I” federal political action committee (PAC), supports efforts to promote, protect and strengthen the independent agency system.

Each election cycle, InsurPac raises and distributes around $2.6 million , making it one of the largest small business PACs in the nation.

Established in 1974, InsurPac stands as one of the largest small business PACs in the nation and the most well-known PAC in the insurance industry.

How does insurPac Work?

Agents, brokers, carrier executives, and Big “I” staff protect their business by contributing to InsurPac.

InsurPac distributes funds to campaigns for political candidates seeking federal office who support the independent agents.

InsurPac allows Big “I” federal lobbyists and agents to attend fundraising events where they develop relationships with members of Congress and their staff.

Those relationships help open doors to advocate for or against legislation that directly impacts the independent agency system.

How to Get Involved with InsurPac

Meet Our Chair of the InsurPac Board of Trustees.

Known to many as the ultimate cheerleader for InsurPac, Jana Foster was recently appointed chair of the InsurPac Board of Trustees.

Jana owns and operates Nevada Insurance Agency Co. in Carson City, Nevada. A longtime agent leader, she has served on the NIIA Board since 2017 and recently became the IIABA Board Director for Nevada. She is also the former chair of the National Young Agents Committee.

Jana was the recipient of NIIA’s Young Agent of the Year in 2015 and IIABA’s National InsurPac Young Agent of the Year in 2020.

Joining Jana on the InsurPac Board of Trustees is Will Infantine (NH), Will Lemanski (MI), Scott West (TX), Tara Purvis (KY), Bill Bishop (OH), Mike McCarron (CO), David Cummard (AZ), Jeff Morris (ID), & Jesse Konold (SD).

InsurPac Drives Results

In the 2025 election cycle, the Big “I” government affairs team and agents throughout the country used InsurPac funds to attend over 1,600 fundraising events supporting federal officials and candidates for federal office.

InsurPac also disbursed over $2.6 million to 278 federal campaigns, winning 268 of them, recording a 96% victory rate.

Success Stories

We are risk managers. We are as well-known as anyone in our communities, towns and cities. We are trusted and looked to for advice by MBAs, CPAs, CEOs, CFOs, MDs and PHDs; yes, everyone needs us. We are great supporters of our communities, and we operate our offices with an open-door policy. We only need to answer the phone or open the door and there stands a person representing every social organization known to rotary, chamber, scouts, little leagues, and many more.

Quote from Former North Carolina Agent Leader Don Evans

We are excellent at managing those things in front of us; those personal things we see and touch daily that affect our sales and operations. But what we do not do a very good job at is protecting our backs from the government by supporting InsurPac. It seems that there are those, for whatever reason, who do not want to participate in PACs. For those people there is a test: if you can simultaneously walk the corridors of Congress and have the ear of every Representative and Senator on every issue near and dear to your heart, and at the same time stay home and do your job, then you do not need InsurPac.

States “Leading the Pac.”

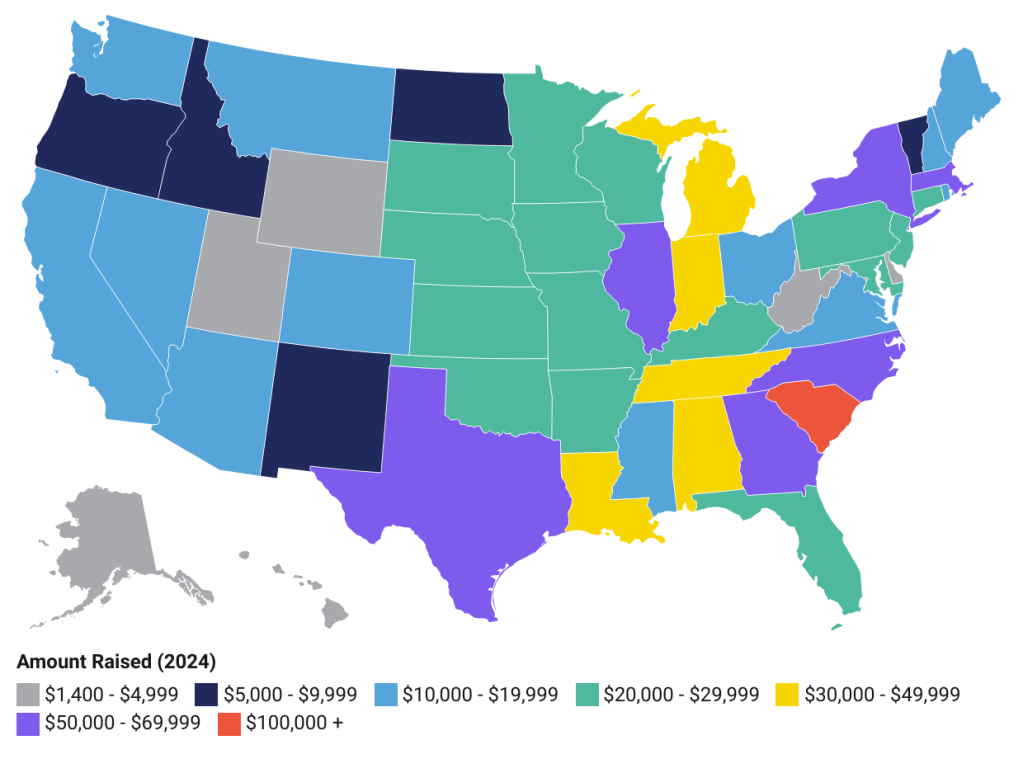

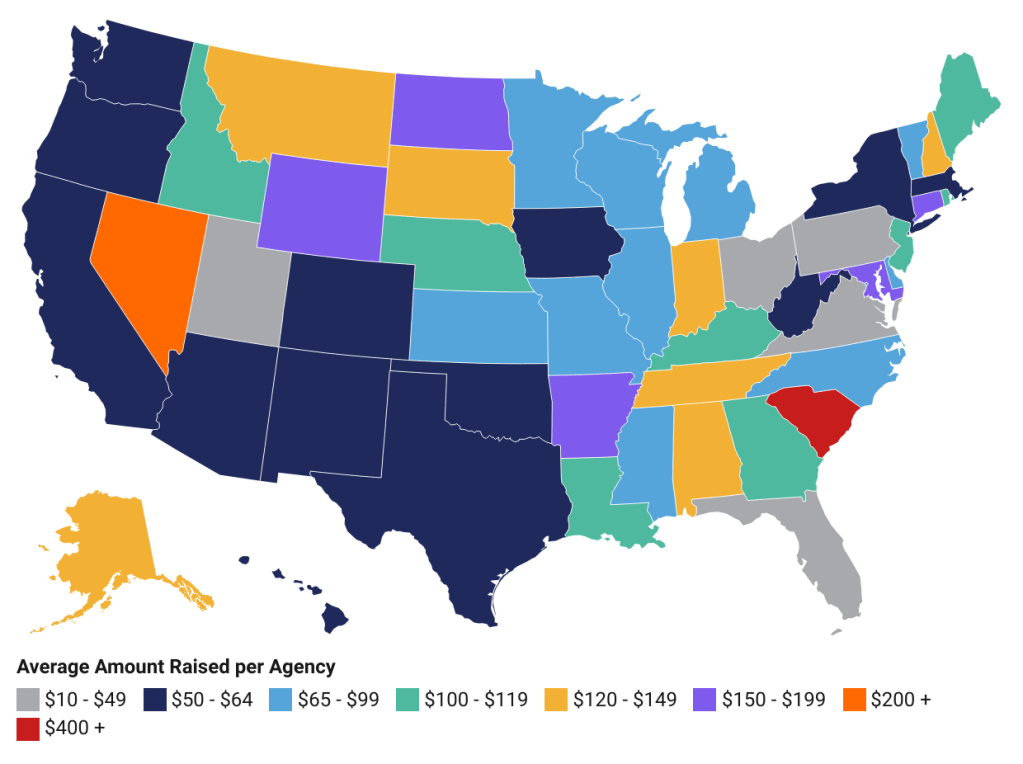

Last year, InsurPac raised a total of $1,292,543.72 from 3,227 donors. A record 22 states received the Eagle Award, which is presented to any Big “I” state association that surpasses a fundraising average of $100 per member agency. This gives every state a chance to earn the distinction, regardless of size. In fact, if every state reached that mark, InsurPac would be a $4 million PAC.

Amount Raised in 2024

Average Raised Per Agency

Save the Date for the 2026 Legislative Conference!

The Look Ahead.

The Big “I” has worked to reintroduce “The Main Street Tax Certainty Act,” which would make the 199A small business deduction permanent.

The deduction allows small businesses organized as pass-throughs the ability to deduct up to 20% of qualified business income. It is currently set to expire in 2025.

The Big “I” has successfully worked to increase the number of sponsors for these two bills and there are currently 127 cosponsors in the House and 21 cosponsors in the Senate.

The NFIP is set to expire on Sept. 30, 2025, which is tied to federal government spending.

The Big “I” is advocating for the NFIP to be reauthorized. The Big “I” also opposes any policies that would harm the Write-Your-Own (WYO) Program, including WYO reimbursement reductions, and undercut the valuable and trusted role that independent agents play in the sale and servicing of flood insurance.

The Farm Bill is passed by Congress every five years and includes a range of programs related to food, nutrition, and agriculture.

The 2023 Farm Bill is projected to cost approximately $1.5 trillion and crop insurance is anticipated to be the second-largest allocation of funding, trailing only the Supplemental Nutrition Assistance Program.

The Big “I” is weighing in with Congress to make sure there are no cuts to the Federal Crop Insurance Program (FCIP).

Questions?

Contact Nathan Riedel.