Does Specific Company Representation Increase Agency Value?

An agency owner at a big state conference was telling everyone in earshot that his agency was now worth 3.0 times revenues because he just got an appointment from “ABC” company. “ABC” company, as part of their sales pitch to agencies, suggests, or at least the agency owner inferred (and I’ve heard others infer the same regarding the same company), that with “ABC’s” contract, his agency will increase in value to 3.0 times revenues! Let’s do the math….

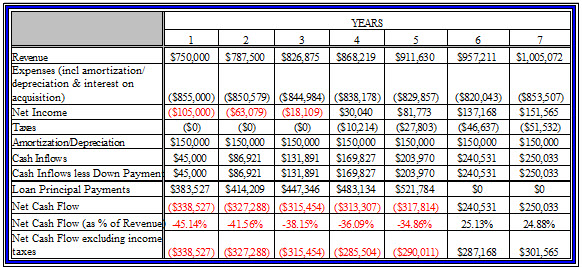

Author: Chris Burand An agency owner at a big state conference was telling everyone in earshot that his agency was now worth 3.0 times revenues because he just got an appointment from “ABC” company. “ABC” company, as part of their sales pitch to agencies, suggests, or at least the agency owner inferred (and I’ve heard others infer the same regarding the same company), that with “ABC’s” contract, his agency will increase in value to 3.0 times revenues! Let’s do the math…. Let’s look at how good an agency must be to be worth 3.0 times revenues. For example, the price paid for an agency with $750,000 revenues would be $2.25 million. Let’s assume the price is guaranteed and not retention based (though hard to believe, many deals are based on a guaranteed price and sometimes a guaranteed price actually is the best option), the buyer is buying the book of business (assets) not stock, and the buyer will achieve a very high 30% EBIDTA (earnings before interest, depreciation, taxes, and amortization). Industry average EBIDTA according to the Academy of Producer Insurance Studies is 11.63%. For tax purposes, the amortization schedule on the acquisition is 15 years which equals $150,000 per year or 20% of revenues. Let’s also use a generous 8%, five year, $0 down loan, 5% growth, and a 34% tax rate. The buyer’s resulting cash flow is:

Note: If the above graphic is not clearly displayed with your current screen or printer resolution, you can download a high resolution copy by clicking here. Even with an EBITDA 2.6 times greater than industry average, after five years, the buyer will have spent $1,612,390 more than it has made. The buyer will need another 3-6 years just to break even in nominal dollars. When the time value of money is considered (which is a definite must), the payback period is even longer. So, how can an agency afford to buy another agency that is supposedly worth a lot more because it represents a specific company? Maybe the company is so great the agency can make more sales and grow faster. How fast would the agency have to grow to breakeven in seven years? The agency would have to grow by 26% per year while maintaining a 30% EBITDA! Another way of putting it, the agency would have to grow the $750,000 in revenue to $2.86 million in seven years. If such a company contract was so valuable and having such a contract did generate considerable additional sales, it seems the company would be growing very fast too. In 1999 (the latest data available), three P&C standard lines companies in the top 250 P&C carriers listed in Best’s Review (representing 95% of all NWP) had 20%+ growth and had achieved consistently high growth over the last five years. (Companies with serious stability problems, workers’ comp. carriers, medical malpractice carriers, reinsurers, carriers not rated by A.M. Best, carriers not directly available to retail agencies, and companies whose net written premium growth was largely due to changes in reinsurance practices were excluded from this comparison.) “ABC” Company is not one of these high growth companies and I am not aware that any of these three have been suggesting to their agents that appointments with them increases an agency’s value. Another possibility is the company is very selective about with which agencies it contracts. Perhaps it only contracts with high profit agencies. To be worth 3.0 times revenues, the buyer in our original example must expect a 55%-60% pretax profit margin (excluding acquisition amortization and interest expense) to break even in seven years! Given the average EBITDA for this seller’s peer group is only 11.63%, 55%-60% is probably not a reasonable expectation. A third possibility is the company believes the buyer will have very little marginal cost related to the acquisition. In other words, they have enough people and space to absorb the seller’s operations without much additional cost. We already know the buyer must achieve 55% pretax profit margin (excluding acquisition amortization and interest expense) to break even in seven years. The only way to achieve such a profit margin is if the buyer or seller has an incredibly inefficient operation prior to the acquisition. For example, assume the buyer is the inefficient operation. The average agency with $750,000 revenue (like the seller) has 9-11 employees. Therefore, to achieve 55% pretax profit margin (excluding acquisition amortization and interest expense), the buyer must have at least 5-10 excess employees and considerable extra floor space and automation capacity. Otherwise, they cannot eliminate enough expense. Even so, my experience suggests that any agency so unproductive will not attain significantly greater productivity with an acquisition because the productivity problem is typically one of bad management and the buyer’s management does not usually change with an acquisition. If the seller were the inefficient agency, the obvious question is, “How can such a poorly managed agency be worth such a high premium?” A fourth possibility is the buyers are simply believing the company’s propaganda and not doing sufficient due diligence and analysis. The company supposedly keeps track of its agencies’ sales prices and then supplies the list to its other agencies. Such a list could be a powerful reason to believe the company. Agency owners begin believing “if this other agency sold for 3.0 times, then mine will sell for 3.0 times.” As long as the agency can find more gullible buyers, their agency might sell for 3.0 times. The situation is no different from Internet stocks. In March 2000, Internet stocks were never logically worth what people were paying but many people ignored logic, followed the other lemmings, and paid the exorbitant prices. A buyer who pays 3.0 times would be trusting the company’s information and disregarding the due diligence and analysis to which every acquisition should be subjected. Is it possible for companies to increase its agencies’ values? Definitely! Certain companies do increase their agencies’ values but those companies do not universally add to all their agencies’ values. Moreover, the increase in value is usually in the range of .05 – .15 times revenues. For example, when agencies have great relationships with very strong companies, their value may increase from 1.3 times revenues to 1.4 times revenues. The increase is never and could never be, in my opinion, from 1.3 to 3.0 times. I have never seen and cannot imagine ever finding any agency worth 3.0 times. An agency that is even worth 2.0 times is very rare and then it is only worth 2.0 times to a very specific buyer. Through the years I have learned that most company people should be absolutely ignored when they begin discussing agency values. They do not have the education and experience required to discuss valuations correctly, they rarely have all the information, and they tend to leave out (or do not know) important details. They also rarely adjust the prices for terms. For example, to the seller, 1.5 times for an asset sale is usually worth much less than 1.3 times for a stock sale. Listen to companies about their pricing, products, underwriting, services, compensation, and company direction. Listen to them about their take on market conditions and street gossip (with a grain of salt). Ignore any blanket advice about agency values! Chris Burand is president of Burand & Associates, LLC, an insurance agency consulting firm. Readers may contact Chris at (719) 485-3868 or by e-mail at chris@burand-associates.com. Copyright 2001 by Chris Burand. Used with permission. |