Back to Basics – Lead with Workers Compensation Coverage

Read any insurance trade journal, and you’ll see articles about how agents can “lead with workers compensation insurance.” Savvy insurance agents can increase their business by targeting employers with considerable workers compensation exposures. Often after the sale of the work comp policy, agents don’t stay as involved as they do on other lines of coverage. If you have considered leading with workers compensation coverage, the first step is to ensure you understand the coverage the work comp policy provides. This article highlights the basic coverages under the workers compensation and employers liability policy.

|

Even though as agents, we remind our insureds to read their policies, few do. The workers compensation policy is one of the easiest policies to understand, so take a few minutes to learn more about the policy so you can provide your clients with an overview of this vital coverage. Why Your Clients Need Workers Compensation Coverage Here is the first question your client may ask once you agree to quote his or her business insurance. “Why does my business need workers compensation coverage? I only have a few part-time employees.” Other than a federal statute or two beyond the scope of this article, each state administers workers compensation coverage demands upon employers. In a state like Arizona, Alaska, or California, any employer with one or more employees (full or part-time) must procure workers compensation coverage. The state where the business owner locates his or her business will be the state’s department of insurance that regulates workers compensation. Many business owners who are sole proprietors don’t think they need work comp coverage, or that they may not be able to obtain coverage for themselves. Ask them a few questions to allow them to decide if they may need work comp coverage.

Lost income can quickly drive a small business into bankruptcy. Most sole practitioners and small business owners could benefit from a work comp policy if they sustain a work-related injury. And rates for business owners can be surprisingly affordable if they have desk jobs. The Sections of the Work Comp Policy Let’s review the sections of the work comp policy, one of the easiest policies to understand. We’re going to consider only the National Council on Compensation Insurance (NCCI) policy, which covers a majority of states in the U.S. Under the NCCI policy, here are the policy sections. Part One – Workers Compensation Insurance Part Two – Employers Liability Insurance Part Three – Other States Insurance Part Four – Your Duties if an Injury Occurs Part Five – Premium Part Six – Conditions Starting with the information page, let’s review each section of the NCCI work comp policy.

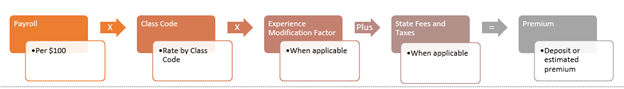

It’s important to note here the importance of educating your client about the “estimated” premium. Some agents refer to it as a “deposit” premium to remind insureds that they are subject to audit. The formula used to estimate premium follows.

However, if your client misreports a class code, for example, puts a roofer into a handy person class code, or underreports estimated yearly payroll, the estimated premium will be incorrect. Your insured, at audit, will owe more money, and he or she often will be upset. Review the Policy Upon Receipt When reviewing the new or renewal policy, ensure the policy correctly lists the job classifications in any states where your client has employees who live, work, or may travel to for work, even if that travel is rare. When employees sustain an at-home injury or are hurt when they travel, they may be able to claim richer benefits in that state than where the business locates its headquarters. Also ensure that your client discloses all subsidiary businesses he or she might operate. The underwriters want to know if Joe Handyman is also operating a small roofing company, because that is an entirely different, riskier, class code. The underwriter wants to ensure he or she understands the total business exposure. If your insured fails to disclose a subsidiary or secondary business, they won’t have coverage for those employees, and it could expose you to an errors and omissions claim. A Deeper Dive into the Policy Parts Part One – Workers Compensation Insurance I was listening to a webcast the other day where a self-admitted “property and casualty (P&C) gal” said she knew nothing about workers’ compensation. The work comp policy is definitely a liability policy and is therefore a commercial P&C policy. Your P&C license should cover you for selling work comp coverage. Part One of the NCCI work comp policy lists benefits the policy provides your client’s injured or occupationally ill workers. You’ll note, however, unlike the commercial general liability policy, Part One does not outline a coverage amount. Each state controls the amounts payable under the policy. The policy will refer to the industrial commission or whatever that state refers to its board or commission that oversees workers compensation coverage. After an injury or occupational illness, the insurer pays benefits according to state-mandated amounts. Some states use a fee schedule in an effort to limit medical costs; others do not. However, the injury (or jurisdictional) state determines the amounts payable for that employee’s medical costs, lost wages and any permanent benefits. When disputed by the employee, administrative law judges at administrative hearings adjudicate the claim. Part One says the insurer pays any benefits owed for either injury or industrial illness, as required by the states listed in Part Three of the policy. Of course, the loss must occur during the policy period listed on the information page. Part Two – Employers Liability Insurance Employers liability insurance may cover a claim for injury or illness that may occur that the state’s workers compensation laws do not cover. Although injured workers waive their rights to sue their employers in exchange for the insurer paying medical care, lost wages, rehabilitation and some other statutory benefits, situations may arise that allow the employee or his family to sue for negligence. This claim or suit can trigger employers liability coverage. Here are some examples of situations that can create additional liability.

Employers’ liability claims may occur if your client’s employee is injured by a machine used in the business, or even a vehicle. Suppose your client’s employee is in an auto accident as a result of a brake failure on one of the company’s work trucks. If the employee pursues Ford Motor, for example, the manufacturer can then sue the employer, alleging the shop’s mechanic negligently modified the braking system, contributing to the injury. Insurers call this type of claim a third-party-over action. This section contains a liability limit. Those limits are usually $100,000 per accident, $500,00 per policy, and $100,000 per employee. Those lower limits do not go far in today’s world. Depending on your insured’s operation and any contractual needs they have with their vendors, they may need higher limits. Always offer higher limits and document your insured’s declination to buy higher limits. Part Three – Other States Insurance If your insured operates in states other than those listed in Part Three, your insured must obtain coverage in that state. If employees routinely travel to other states, you’ll want to list those states, as well. This travel can cause two issues to arise: 1. Extraterritoriality and 2. Reciprocity. This article explains it much better than I can in this limited article. Rest assured, travel and work in other states can cause a lot of problems for your insureds. This is an important coverage issue, so be sure to read that linked article if you have time. There are also monopolistic states where that state is the only provider of work comp coverage. Your insured must buy coverage through those states. These states are North Dakota, Ohio, Washington, Wyoming, Puerto Rico and the U.S. Virgin Islands. Monopolistic policies pay only state-mandated benefits, not employers liability. Your insured can obtain coverage directly from those states for their Part One benefits. Their general liability carrier may offer stop-gap coverage that covers the insured for employers liability. At a minimum, however, state laws may not synchronize, and agents must act to add those states to the policy as described in the above-linked article. Part Four – Your Duties if an Injury Occurs Like any policy you sell, the work comp policy requires your insured to comply with certain conditions. Providing immediate medical care, cooperating with the insurer after an incident, and preserving evidence after a loss for potential subrogation are all policy duties your insured must adhere to for coverage. Part Five – Premium This part of the policy outlines the calculation method used by the insured to set premiums. It includes the following.

Here’s an important tip. As we saw during COVID-19, payrolls fluctuated wildly in many instances. Plumbers, general contractors, and other trades saw their revenues and payrolls boom as many who worked from home upgraded their home offices and remodeled. Many restaurants closed, shrinking payroll. Reaching out to your insureds mid-year, or quarterly for larger concerns, means that your insured can provide updated payroll and sales figures to reset their estimates. This prevents a year-end shock audit where they may owe thousands of dollars. Remind your clients, as well, that if their employee changes class codes, they should update their payroll for that class code. Promoting a dispatcher to a field job will change that employee’s class code. Your insured should break out the included earnings for each class code at audit. For an article on what insurers include in payroll, and it’s almost everything, click the link. Part Six – Conditions This policy section outlines your insured’s and the insurer’s rights and obligations under the policy contract. Here are some of the key points. Inspection – The insurer retains the right to inspect the workplace to determine conditions. At audit, the auditor can check any relevant records to verify payroll and class codes. Policy transfer – The insured cannot transfer the policy to a new business owner. Cancellation – Unless conflicting state statutes apply, the insurer must provide at least ten days’ notice of cancellation. The insured, too, must provide advance notice; however, no set number of days applies to the policyholder. Sole representation – Your insured can request more than one name on the policy. However, only the first-named insured can act on behalf of all insureds. In Conclusion This is an overview of the workers’ compensation policy. Many agents today avoid writing work comp coverage or write it and don’t understand the importance of updating payroll and class codes. With a little practice, and by expanding your workers’ compensation coverage knowledge, you will find that you can fill a niche many agents avoid. Last Updated: March 31, 2023 |

Copyright © 2026, Big “I” Virtual University. All rights reserved. No part of this material may be used or reproduced in any manner without the prior written permission from Big “I” Virtual University. For further information, contact nancy.germond@iiaba.net.