Choosing the Right E&O Coverage for Your Insurance Agency

Not all agency errors & omissions carriers and policies are alike. While it’s always tempting to use price as the primary factor in selecting coverage, this information can help you thoroughly evaluate the carriers you consider. Remember, your agency’s reputation is one of your most valuable assets. This article explores the key factors to consider when selecting an E&O provider and highlights the distinct advantages of the IIABA-Swiss Re Corporate Solutions (“Swiss Re”) Agents E&O Program, a benchmark in the industry. In today’s world, your E&O policy can save you time, money, emotional energy and reputational harm.

As an insurance agency owner, you recognize the importance of comprehensive insurance protection. Your clients rely on your expertise to safeguard their assets, and in turn, you need a partner to protect yours. Errors and Omissions (E&O) insurance is not just a policy; it’s a foundational shield that protects your agency’s stability and reputation. Of course, all carriers’ E&O coverages are not the same. When evaluating your agency’s E&O options, it’s critical to evaluate not only the amount of the premium but to consider the scope of coverage, the carrier’s stability, the claim department’s expertise and the strength of the defense attorneys engaged.

Stability and Experience: The Bedrock of Reliable Coverage

Any professional line of business, including agency E&O, can be complex and volatile. Carriers may see Agents E&O as an opportunity to write larger premiums but may not have the necessary expertise and infrastructure to support the line of business. For example, they may not have adjusters skilled at handling agency E&O claims, nor a pre-selected bench of outside counsel skilled in the ins and outs of agency E&O litigation. Your claim handler and defense attorney are key to a successful claim resolution.

A few years down the road, a new carrier to Agents E&O may leave the market with their collective tails between their legs, leaving agencies scrambling for coverage. If you place challenging lines of business (e.g. aviation, long haul trucking, etc.) or have had the misfortune of a claim, you may find it difficult to find a new carrier. When the solvency of your agency is on the line, you need a carrier with a proven track record of stability and commitment to that market.

Here are some of the benefits of the IIABA agency E&O program, backed by Swiss Re Corporate Solutions.

- Over 50 Years of Continuous Service: Demonstrates unparalleled experience. This program has been providing continuous Agents’ E&O coverage since the 1960s, with no market withdrawals. This history signifies their commitment to the independent agent channel.

- Exceptional Financial Strength: Swiss Re Corporate Solutions is an admitted carrier with an “A+” rating from AM Best, ensuring it has the financial chops to pay claims when you need it most.

- Endorsed by Your Peers: For over 30 years, the program has been endorsed by the IIABA and all Big “I” state associations. This endorsement reflects the trust and confidence of fellow agents who understand your unique risks.

- Highly skilled claims examiners and counsel: Some of the claim examiners at Swiss Re have their law degrees, and most have been with the E&O program for more than a decade. Additionally, Swiss Re’s panel of attorneys have deep expertise in specifically handling agency E&O claims.

Beyond the Basics: What Comprehensive E&O Coverage Includes

A standard E&O policy might cover the basics, but today’s agent owners face a complex and evolving risk landscape. IIABA-Swiss Re program designs their coverage with a tailored coverage form that addresses today’s emerging agency exposures, providing a level of protection that many other carriers do not.

Key Program Features and Policy Strengths

Here are some of the excellent features that offer a broader shield for your agency.

- Broad Duty to Defend: The policy commits to defending you even if a claim is groundless, false, or fraudulent.

- Defense Costs Outside Limits: An important consideration in an E&O policy is how the policy covers defense costs. Swiss Re pays defense costs in addition to your limit of liability, preventing legal fees from eroding the coverage limits you need to pay a settlement or judgment.

- Comprehensive “Professional Services” Definition: The policy’s broad definition covers a wide range of activities, which include advertising, notary public services, and may include the marketing of PEOs.

- Built-in Cyber and Data Breach Coverage: With data security a growing concern, the Swiss Re policy form includes coverage for both first-party and third-party data breaches. Other carriers usually charge more for this coverage.

- Regulatory Defense: While you may never need it, Swiss Re provides a $100,000 limit for regulatory defense, in addition to the policy limit. These costs can quickly escalate, and this coverage can help cover the costs associated with government or regulatory proceedings.

- Catastrophe Extra Expense: This provides a limit of $25,000/$50,000 (with options to increase) to help your agency get back on its feet after a natural disaster, paid in addition to your policy limit. In today’s world of volatile weather, this benefit alone stands out from most other E&O carriers.

Many other E&O carriers exclude or include a sub-limit on these costs. The IIABA-Swiss Re program’s inclusive approach provides a more robust safety net without the need for many endorsements.

A Partnership in Risk Management

The best way to handle a claim is to prevent it from occurring. The IIABA-Swiss Re program is more than your insurance policy; we offer a risk management partnership dedicated to helping your agency operate more safely and profitably. With decades of claims data, we know what causes claims and exactly what you need to do to prevent them. We provide access to free quarterly risk management webinars and a plethora of agency tools developed by the Big “I” Virtual University. These are just a few of those tools.

- A sample procedures manual, the best way to bulletproof your agency against negligence allegations

- Coverage checklists

- Coverage declination forms

- Technology information through the Big “I” Agents Council for Technology

- Record retention guidance

- Form letters you can customize to your agency

- Various special publications, including key insights on mergers and acquisitions, book rolls and more

- Agency self-audit tools

- Risk management training that provides benefits that go above just reducing your premiums

- The Big “I” Insurance Illustrated, a bi-weekly newsletter full of coverage advice and agency management tips

Swiss Re demonstrates its commitment through great benefits and resources.

- Significant Premium Credits: Agencies can earn up to a 20% premium credit for attending risk management seminars and an additional 20% credit for maintaining a loss-free record.

- E&O Audit Credit: Completing a voluntary E&O operational audit can earn you a five-year 10% premium credit.

These features not only reduce your premium; they also actively help you mitigate risks, strengthening your agency’s operational health and reducing the likelihood of a claim and the reputational and financial damage that can occur after an incident.

A Program Built for Agents, by Agents

One of the most unique aspects of the IIABA-Swiss Re program is its oversight structure. The IIABA’s Professional Liability Committee, composed of member agents like you, provides direct input and guidance. This ensures the program changes to align with today’s issues threatening independent agencies.

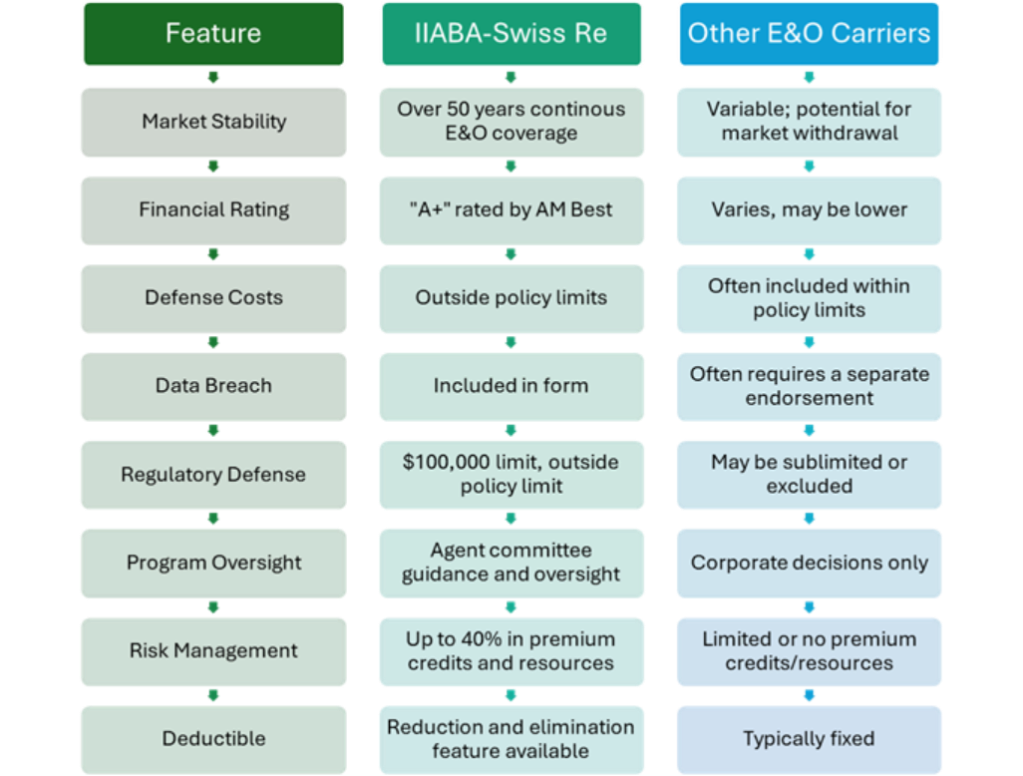

A Clear Comparison

Making the Right Choice to Protect Your Valuable Agency Assets

Choosing your E&O coverage partner is one of the most important decisions you will make as an agency owner. That decision impacts your financial security, your reputation and your peace of mind. By opting for a program with decades of stability, comprehensive built-in coverages, and a true partnership approach to risk management, you are making a strategic investment in your agency’s long-term success.

Think Your “Too Small” for Swiss Re Coverage?

The IIABA and Swiss Re Corporate Solutions agents’ E&O program is uniquely designed to protect the largest brokerage to the smallest agency. Small agencies have formed the bedrock of our program since the beginning. We want to partner with you to help your agency grow. With the confidence of a strong E&O carrier backing you, you can confidently expand into new lines of business. The Big “I” Hires program can help you acquire new talent to do so.

The Big “I” program offers a combination of historical data, stability and expertise that is a benchmark in the industry. Its coverage is designed for agents, with input from agents, to protect you from the complex risks you face every day.

When Choosing E&O Coverage, Always Ask Yourself These Questions

- “What is this carrier’s long-term commitment to the agency E&O market?

- Does this carrier offer comprehensive policy features, and commitment to risk management? The IIABA-Swiss Re program excels in these areas, offering a strategic investment in an agency’s security and long-term success, setting it apart from standard market offerings.

- Are their claim professionals top-notch, including their panel counsel?

- If you have a problem but no claim has been filed, can you call and get advice on how to proceed?

These are just a few of the questions you want to ask when considering an agency E&O carrier. Top-notch agency E&O coverage goes far beyond price. If you’re interested in a quote or simply want more information on the Swiss Re and other options for agency E&O coverage, reach out to your state’s Big “I” team for more information.

Copyright © 2025, Big “I” Virtual University. All rights reserved. No part of this material may be used or reproduced in any manner without the prior written permission from Big “I” Virtual University. For further information, contact nancy.germond@iiaba.net.