Avoiding Agency Errors and Omissions Claims by Offering Flood Insurance and Excess Flood Coverage

While our Virtual University communications often recommend that you to offer a flood insurance quote with every property policy you write, whether that property is in a FEMA-designated flood zone or not, we may not remind you frequently enough of the importance of also offering an excess flood policy. This article can help you prevent an errors & omission claim for failure to offer flood coverage or failure to offer excess flood insurance.

Insurance agents work hard to protect their clients while safeguarding their own operations against the very real risk of errors and omissions (E&O) claims. Coverage gaps, including “failure to offer” E&O claims, lead the list of common E&O litigation. A frequent cause of E&O claims in the insurance industry arises from coverage gaps, particularly in high-risk areas such as flood-prone zones. By offering comprehensive flood insurance and explaining excess flood insurance options, agencies can reduce their liability, improve customer satisfaction, and build trust with their clients.

Your role in educating your insureds and potential clients on the limitations of standard flood insurance policies during the sales-funnel process can help avoid E&O claims and increase revenue. Offering your clients solutions for additional but not yet considered insurance coverage is critical in mitigating risks for both the policyholder and your agency.

The Importance of Addressing Flood Insurance Coverage Limits

Flood damage is one of the most costly and devastating risks property owners face, especially in high-risk areas. However, in today’s volatile climate environment, it becomes harder and harder to determine which property is at risk of flooding. According to the Federal Emergency Management Agency (FEMA), “More than 40% of NFIP claims come from outside the high-risk areas.”

Standard flood insurance policies, including those offered through the National Flood Insurance Program (NFIP), come with, by today’s standards, low coverage limits. For example, the NFIP limits residential building coverage to $250,000 and personal property contents to $100,000. While this may be sufficient for some clients, after a disaster, construction costs often escalate due to supply-chain issues, increased labor costs and scarcity of contractors.

Not educating your clients about these limitations can mean your agency faces an E&O claim. Even if you warned your client verbally, they may later argue you did not advise them of their options for added insurance protection. Including excess flood insurance in all client discussions shows your commitment to their financial well-being and reduces liability risks for your agency. Also, using our handy flood coverage declination form (available only to Big “I” members at this link) can help protect your agency against these allegations.

How Excess Flood Insurance Helps Protect Agencies

Excess flood insurance, like most excess policies, offers coverage protection over the limits of standard flood policies. This additional layer of protection can be especially valuable for clients with high-value properties, unique possessions, or high mortgage balances. In fact, mortgage companies may insist on excess flood coverage to protect their interests.

By proactively offering excess flood coverage and explaining its benefits to your clients and potential insureds, you can minimize the risk of an agency E&O claims while maximizing your status as a trusted insurance resource in the eyes of your clients.

Key benefits for agencies include the following.

- Fewer Coverage Gaps

- By addressing the limitations of standard flood policies and recommending excess coverage where needed and available, you can avoid your clients facing an underinsurance claim, a common basis of E&O disputes.

- Improved Client Trust

- Offering solutions that demonstrate a thorough understanding of your clients’ risks shows that you are a trusted partner in their protection. This builds confidence in your expertise, while reducing the likelihood of complaints or claims. There is little worse than a phone call from an angry customer once they realize there was available coverage that may have covered their claim.

- Compliance With Lender Requirements

- In today’s world, mortgage lenders may flood insurance coverage beyond the standard policy limits. Offering, with your client’s acceptance, excess flood insurance helps to ensure compliance with these requirements, protecting both your clients and your agency from liability.

Educating Clients to Mitigate E&O Risks

Frequent and clear communication can help reduce the potential for flood-related E&O claims. Incorporate the following practices into your client interactions regarding flood insurance and excess coverage options.

Explain the Underlying Policy’s Coverage Limits

Emphasize to your clients the coverage limits of standard flood insurance policies. Whenever possible, use examples to illustrate how these limits can leave them underwater in the event of significant flood damage.

Recommend a Flood Policy and Higher Limits at Each Renewal

When writing new clients and at each renewal, be sure to explain the benefits of an excess flood policy.

Evaluate Your Client’s Risk Factors

Discuss your clients’ specific needs, including property location, value, and likelihood of flooding. For clients in high-risk areas or with valuable assets, emphasize the importance of considering excess flood insurance. Recommend they go onto First Street’s flood factor risk calculator for a more realistic risk assessment. They simply enter their address and receive a free analysis of five factors: flood, fire, wind, air quality and heat. This model, according to many experts, outperforms today’s FEMA flood maps.

Discuss the Client’s Mortgage Obligations

When a client’s mortgage balance is higher than the maximum building coverage available through a standard flood policy, explain how an excess floor policy can help protect the financial gap.

Document Your Recommendations

Keep detailed records of your coverage recommendations, including discussions around standard and excess flood insurance. Presenting detailed documentation if you face an E&O claim can be priceless evidence should an E&O claim arise.

If Possible, Talk to Your Insured Live

Nothing beats face-to-face communication, even if it is only by Zoom. Encourage clients to ask questions about their policies and voice their uncertainties. This ensures they fully understand their coverage and reduces the likelihood of misunderstandings later and allows you to build value in the product.

Use the Big “I”s automated social media marketing assistance or your own internal communication programs to regularly educate insureds about the need for flood insurance, even if the home or business is outside a flood zone. These can include blog posts, emails, advertising in local papers, and more.

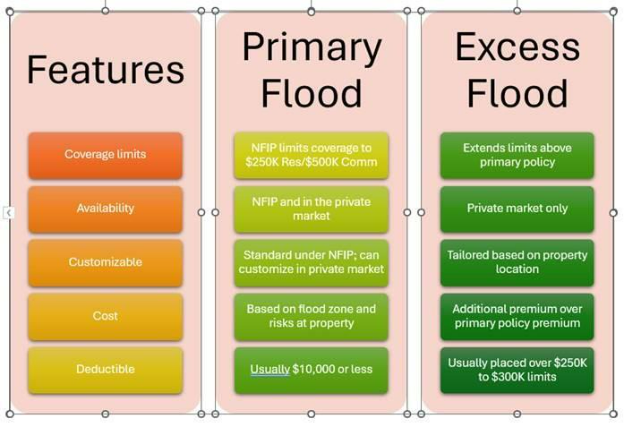

This chart highlights the main features and differences between primary and excess flood insurance.

Overcoming the “You Just Want to Increase Your Commissions” Argument

Explain that your commission on these types of policies does not factor into your offering. In fact, the paperwork it takes to complete flood insurance often outweighs the time spent ensuring correct information and sending the application to the insurer. Explain that you simply want to ensure they are well protected in case of our increasingly volatile weather patterns.

Premium Factors for Excess Flood Insurance

To educate your clients on how insurers calculate excess flood insurance premiums, explain the client’s individual factors such as the following.

- Property location

- Construction type

- Coverage limits and deductible options.

- Unusual features such as sunken living rooms

Helping your clients value a cost-benefit analysis will help ensure they make the best decision they can to promote their homes or businesses.

Proactive Protection for You and Your Clients

By explaining that simply because your clients are not in a flood zone doesn’t mean they may not need flood insurance and then providing flood and excess flood insurance information, you take steps to protect your agency and your clients from losses arising from no or inadequate flood coverage. You can easily position yourself as a trusted adviser without ever using those dangerous words or phrases that can create additional E&O risks.

Positioning yourself as a trusted advisor on flood coverage builds client loyalty and reinforces your reputation for diligence and professionalism. This article from Swiss Re explains more on the dos and don’ts of flood coverage.

Copyright © 2026, Big “I” Virtual University. All rights reserved. No part of this material may be used or reproduced in any manner without the prior written permission from Big “I” Virtual University. For further information, contact nancy.germond@iiaba.net.