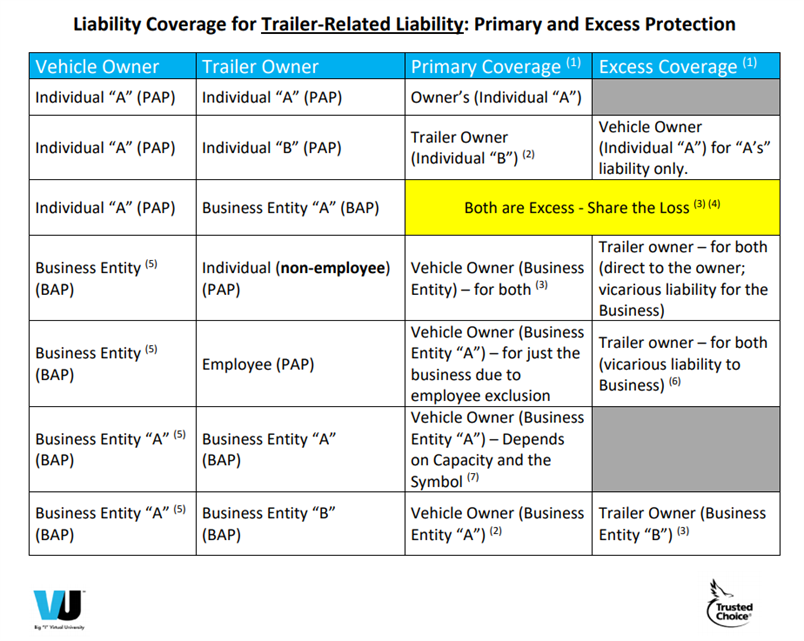

Trailer-Related Liability Chart

Here’s your one-stop-shop for Liability Coverage for Trailer-Related Liability: Primary and Excess Protection.

Liability Coverage for Trailer Liability: Primary and Excess Protection

(1) The concepts of “Primary” and “Excess” coverage in this spreadsheet relate to liability coverage on the trailer, not the auto pulling the trailer.

(2) When a PAP covers a trailer, the PAP on the trailer is primary. Insurance follows the vehicle (trailer). However, this applies only if a “natural person” owns the vehicle pulling the trailer. When a vehicle owned by a “legal person” is pulling the trailer, the BAP is primary and the PAP is excess.

(3) This can be altered by contract. The trailer owner can contractually agree to provide coverage on a primary basis. If this is done contractually (via an “insured contract”), the trailer owner’s BAP is primary.

(4) The PAP and BAP share the loss based on limits available. For example, BAP $1 M and PAP $100/$300 and two or more people are injured. The BAP pays 77% of the loss, the PAP pays 23%. If one person is injured, the BAP pays 91% and the PAP pays 9%.

(5) Anytime a business entity owns the power unit, its coverage (the BAP for the power unit) is primary when a non-owned trailer is attached due to the Symbol definitions. Symbols 1, 2, 4 and 7 all state that a non-owned trailer attached to the insured unit are covered autos. Symbol 9 also covers non-owned trailers. This order of protection can be altered by an “insured contract” as referenced in (2) above.

(6) BAP carrier may be able to subrogate against the employee if he/she is liable for the injury/damage. For instance, failure to properly maintain the trailer causes the injury/damage. Can be “fixed” by attaching the Employees as Insured Endorsement (CA 99 33).

(7) If the trailer has a capacity of 2,000 pounds or less – automatically covered regardless of the symbol and whether or not listed. If capacity is greater than 2,000 pounds – the trailer must be listed for premium purposes and automatic coverage depends on the symbol:

- Symbols 1, 2 and 4 – does not have to be listed if acquired during the policy period (but must be listed at renewal or is considered concealment or misrepresentation of a material fact).

- Symbol 7 – the insured has 30 days to notify, if the carrier insures all the insured’s vehicles.

|

Last Updated: January 9, 2026 |

Copyright © 2026, Big “I” Virtual University. All rights reserved. No part of this material may be used or reproduced in any manner without the prior written permission from Big “I” Virtual University. For further information, contact nancy.germond@iiaba.net.