The Future of Risk: Verisk Navigates an Evolving Risk Landscape

Today’s insurance agents and brokers must recognize new and emerging risks and rapidly evolving coverage limitations to help best protect their customers. For over two decades, Verisk, or ISO as we old-school agents know it, has been a leader in identifying and analyzing emerging risks. Beginning in 2006 with the emergency of SARS, communicable diseases such as sexually transmitted diseases and green construction upgrades, Verisk’s emergency Risk team has been on the forefront of new hazards. This article provides an overview of an article they published last

Because Verisk leads in developing policy forms, it is critical that they stay abreast of emerging risks. As insurance agents, understanding emerging trends and determining ways to provide coverage for those trends can help you better protect your clients and shield your agency from allegations of negligence. By signing up for Verisk’s emerging trends collateral, you can start to track these emerging risks and better prepare your clients for a future that is only certain to get more complex.

In this article, we will cover the following.

- Provide Verisk’s definition of an emerging risk.

- Cover the key challenges and opportunities presented by these risks.

- List specific examples of high-impact emerging risks.

- Learn how to leverage risk intelligence for a competitive marketing advantage.

However, to read their article in its entirety, please click this link.

Understanding Emerging Risks

How do experts define emerging risks? Verisk uses this definition: “We at Verisk consider an emerging risk to be a new or developing trend that can potentially cause injury or damage and is difficult to properly quantify using traditional data.”

Because of the novelty of the risk that can cause injury or damage, insurers lack sufficient data to model the ways these risks will affect potential insureds and society at large. Additionally, even if one could model the risk and its outcomes, there is little to no cost data associated with past events for actuaries to use to develop rates.

Consider when states began to legalize cannabis. There were little or no historical loss or underwriting data available to develop costs. In that case, according to one expert highly skilled in the then-emerging cannabis insurance space, carriers considered the following to set rates. “What is the closest type of risk that could cause similar outcomes to risk associated with cannabis sales?” They decided that jewelers’ block had the closest risks, including the risk of robbery since cannabis was initially a cash business because banks did not want to handle cannabis money.

However, it is not always easy to find a similar risk when dealing with something like space weather risks, for example. Emerging risks can be highly disruptive and can evolve quickly and unpredictably (consider COVID-19). Consider generative artificial intelligence (AI), for example, AI to generate content. We must now ask ourselves many questions as we watch videos. Are they real or are they AI? Did this actor really say this, or was this AI-generated?

Consider the risks associated with generative AI, and you may see why Verisk recently developed commercial general liability exclusionary endorsements to limit coverage for generative AI.

Emerging risks may be systemic, affect many industries and nations, and affect multiple lines of insurance coverage. Expect to see these gen AI exclusions created for other lines of liability coverage such as directors’ and officers’ or the businessowners policy.

Sometimes it may feel as if addressing emerging challenges takes a shotgun approach to risk management rather than a rifle approach. However, enterprise risk management goes beyond identifying these risks early. Once identified, insurers must evaluate their potential impact and then prioritize them effectively.

Verisk has taken the approach that the more they can understand these risks, the better equipped insurers will be to adapt their products and practices or develop innovative solutions to address them. Unfortunately, sometimes those solutions are coverage limitations or outright exclusions.

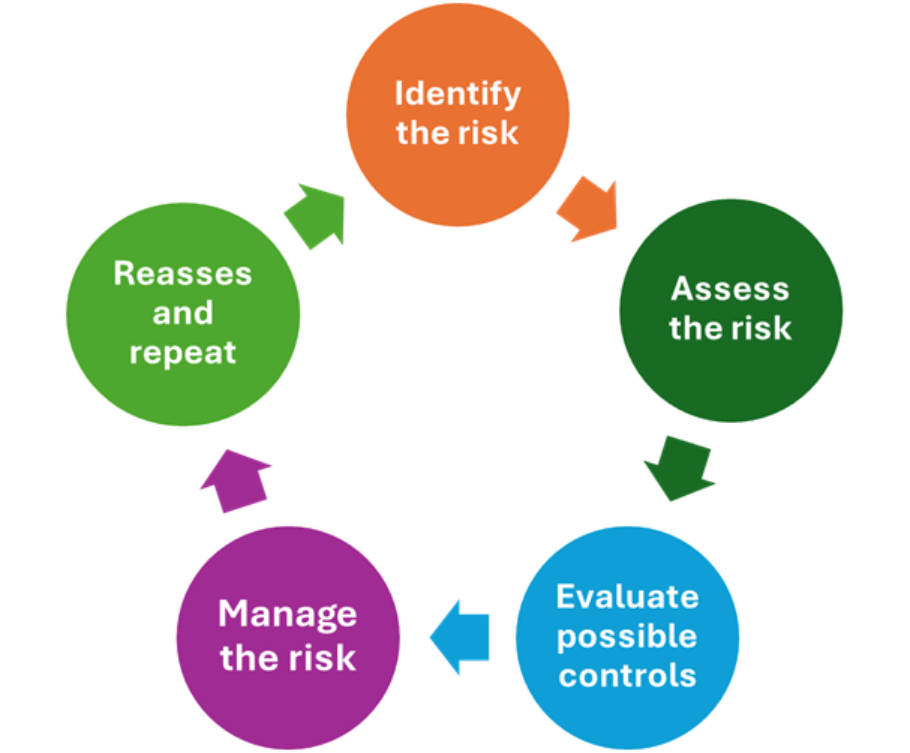

The Risk Management Process

Here are the steps risk managers take to evaluate risks, whether new or emerging.

Emerging Risks Influences on Insurance Products

Research into emerging risks is not just an academic exercise. This research directly impacts the insurance industry as well as insurance consumers. For more than 20 years, insights from Verisk’s Emerging Issues team have directly influenced the evolution of ISO Forms and other insurance products. This ensures that coverage remains responsive to a constantly changing risk landscape, often years before a risk becomes mainstream.

However, it is not only Verisk that impacts the insurance coverage arena. Your Big “I” Technical Affairs Committee meets twice a year to suggest coverage enhancements and to learn more about these risks and upcoming coverage changes. Every spring we meet with Verisk staff in their New Jersey headquarters to discuss a hefty agenda of proposed coverage enhancements. Some of these items stay on our agenda for years while the carrier panels consider these requests.

To learn more about the Technical Affairs Committee, reach out to me.

Key Emerging Risks in Verisk Focus

To understand the real-world impact of emerging risks, let’s review some of the most notable emerging risks tracked by Verisk and consider their consequences for the insurance industry.

Let’s look at five key emerging risks identified by Verisk.

1. PFAS “Forever Chemicals”

Per- and polyfluoroalkyl substances (PFAS) have been in use for decades, but increasing litigation surrounding these “forever chemicals” created action by Verisk. The pervasive nature of PFAS contamination, particularly in drinking water, signals a potentially massive liability event.

- The Financial Impact: Verisk’s Arium liability analytics team estimated potential ground-up losses from PFAS litigation could be from a low of $123 billion to $165 billion.

- The Scope: A U.S. Geological Survey (USGS) study reported that at least 45% of the nation’s drinking water is likely contaminated with PFAS, highlighting the widespread exposure.

In response to PFAS risks, ISO rolled out exclusions to exclude coverage for the expected risks associated with PFAS.

2. The Evolving Cannabis Market

The cannabis economy continues to grow (I simply could not resist) as more states permit recreational and medical use. This growth, though, presents a unique set of risks. The market is evolving with new, often unregulated synthetic products like Delta-8, which may pose potential health problems and certainly will pose liability concerns. Here are some issues raised by Verisk.

- Supply Chain Disruption: State-regulated cannabis must be grown, tested and sold within state borders. Any natural catastrophe such as a wildfire or flood could have a significant impact on that state’s entire supply chain.

- Regulatory Uncertainty: The possibility that the federal government will reclassify the drug adds another issue for insurers navigating this budding industry.

There will undoubtedly be uncertainty after Congress placed hemp restrictions as part of its latest funding bill. And one thing insurers do not really like is major uncertainty.

3. Vehicle Cybersecurity

As Arizona will now allow Waymos on our already dangerously overcrowded freeways, vehicle cybersecurity matters only continue at full speed.

The technology shifts in recent years have introduced new vulnerabilities. The embrace of software and computing components has made vehicles a growing target for cyberattacks.

- Cyberhacks a Growing Threat: Since 2010, there has been a 344% increase in cyberattacks targeting vehicles, according to Verisk.

- New Attack Vectors: Electric vehicle (EV) charging stations now present a vulnerability. Researchers found security flaws in all 16 charging stations they studied, and these stations accounted for 4% of all vehicle cybersecurity incidents in 2022, Verisk finds.

In 2022, Verisk introduced a new optional auto hacking expense coverage endorsement, along with an associated rating rule, to help insurers respond to emerging risks in vehicles. They designed the endorsement to provide coverage for certain expenses related to diagnosing, restoring, and repairing a private passenger vehicle or light/medium truck following a hacking incident.

4. Space Weather

Apparently, not all risks originate on earth. Solar flares and other extreme space weather events can cause catastrophic disruptions to our technology-dependent society. A powerful geomagnetic storm has the potential to damage electrical grids, interfere with satellite and radio communications, and disrupt air travel. As I wrote this, severe geomagnetic storms are causing visible auroras throughout the U.S. NOAA’s Space Weather Prediction Center issued a geomagnetic storm watch for sever conditions in mid-November 2025.

- Massive Potential Losses: Verisk’s research indicates that an extreme space weather event could trigger insured losses in the United States alone ranging from $53.2 billion to $323.9 billion.

In 2024, Verisk announced they were considering optional space weather exclusions.

5. E-Bikes and Lithium-Ion Batteries

The popularity of e-bikes and other micro-mobility devices is cruising right along. While these alternate vehicles offer convenience, their increased speed and where riders travel raise the risk of serious accidents. In addition, the lithium-ion batteries that power them present a significant fire risk.

- Increased Severity: Studies show that e-bikes generally carry a higher risk of severe injuries compared to traditional bicycles. Undoubtedly, claim frequency and severity will increase as sales continue to grow.

Verisk continues to monitor developments regarding e-bikes and their impact on both personal and commercial coverage lines.

Practical Applications for Insurers

For the best results, staying updated about these and other emerging risks are not just knowledge for knowledge’s sake; they are integral to helping protect your clients as these risks grow in impact.

Insurers and advisory organizations use this threat research in the following ways.

- To revise underwriting guidelines

- To enhance forms and endorsements, most notably in my opinion exclusionary endorsements

- To improve claims-handling guidance and adjusting procedures

- To enhance risk classification and develop and/or adjuster pricing

- To help guide strategic planning and product development

Stay Ahead of the Future of Risk

In today’s era of complex and interconnected threats, using market intelligence about emerging risks is vital to your agency’s success. Verisk’s frequent updates, including newsletters, webinars and events on emerging risks, is one of the easiest ways for you to stay current and has helped insurers and agents stay at the forefront of these threats.

Sign up for the Verisk Emerging Issues Weekly Newsletter today to join thousands of property/casualty insurers and risk management professionals who are staying ahead of the competition. Read the entire White Paper at this link.

Copyright © 2026, Big “I” Virtual University. All rights reserved. No part of this material may be used or reproduced in any manner without the prior written permission from Big “I” Virtual University. For further information, contact nancy.germond@iiaba.net.