Author: James Felton Keith

The International Organization for Standards (ISO) has published the new ISO-30415 standard for Diversity & Inclusion (D&I) that spans corporate governance, human resources, product delivery and supplier diversity. We finally have a uniformed way to answer the question, “what is D&I?" This is a huge opportunity for the oldest industry of advisors humankind has ever known: insurance agents!

Multiple insurance carriers are working on D&I specific insurance premiums, but they'll interact similarly to the risks identified in current day directors & officers (D&O), errors & omissions (E&O), and employment practices liability insurance (EPLI) policies. Similar to cybersecurity audits that became available after the ISO-27001 standard for cybersecurity, D&I is the next wave of risk management, because it has big financial implications for the next 10 years of workforce change management.

“Courage contagion" seems to be the most relevant phrase to use when reviewing the trend that we see from employees at complex organizations that have a history of D&I complaints. The usual scenario goes: One employee speaks out about the disregard for their life experience's influence on their work performance, and other employees start to rethink how they've been valued.

Over the past 20 years of corporate change management, we've seen this trend start to snowball into new types of internal corporate policy and financial risks.

In 2020, insurance companies started to dig into their client's corporate D&I practices. The regulatory landscape is also changing as large states like California mandate diversity on corporate boards, and even the NASDAQ seeks to mandate board diversity for listed companies.

In 2020, insurance companies started to dig into their client's corporate D&I practices. The regulatory landscape is also changing as large states like California mandate diversity on corporate boards, and even the NASDAQ seeks to mandate board diversity for listed companies.

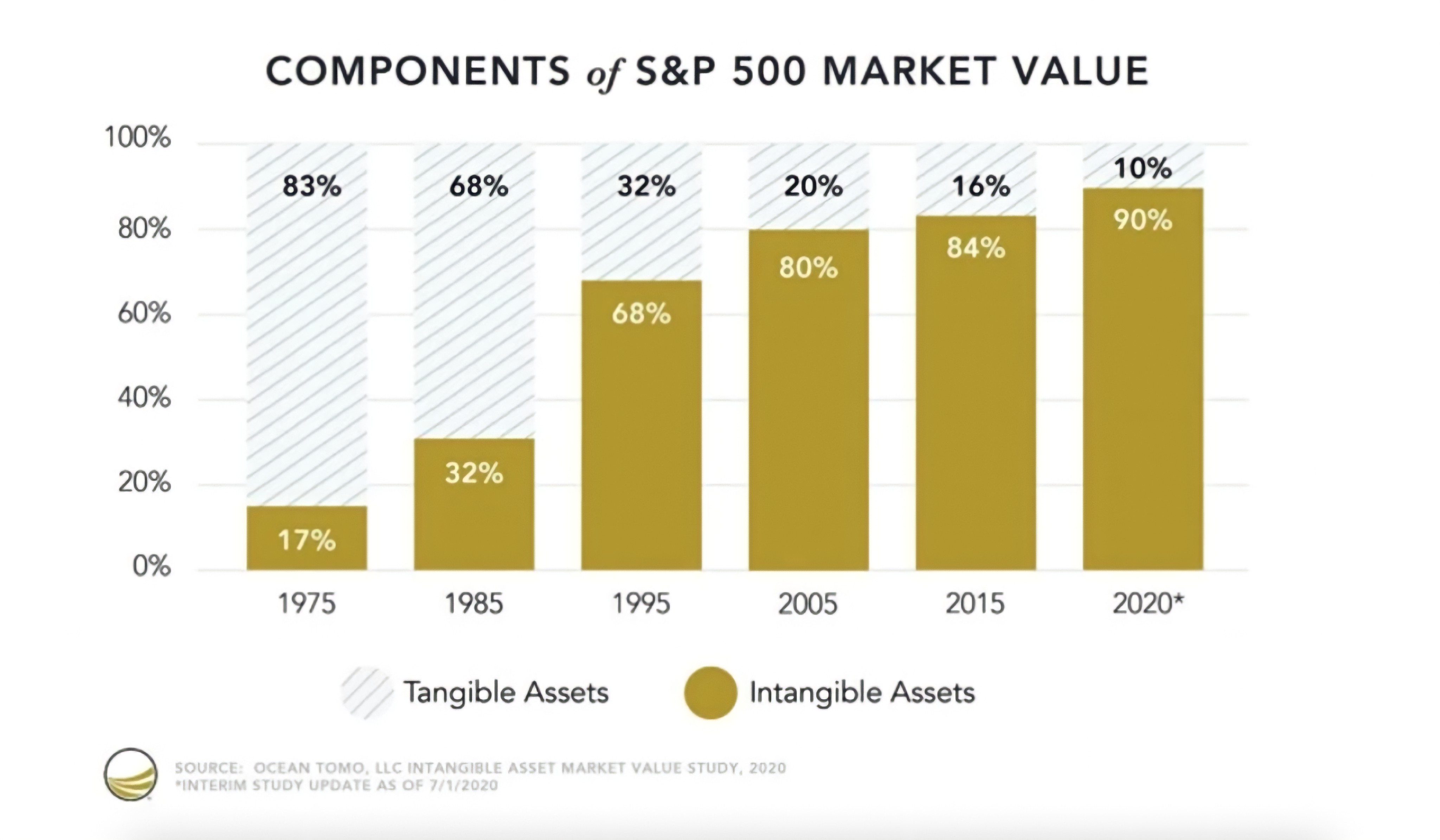

In the modern world, inclusion is a tangible risk of intangible assets. Over the past 45 years, S&P 500 companies with intangible assets have grown from 17% in 1975 to 90% in 2020. To put it another way, companies in aggregate claim that 90% of what makes them valuable is intangible. That's a people premium.

Per our new reality, it is time for a more rigorous evaluation of intangible risks to our bottom line.

Making Good on the D&I Promise

The corporate diversity market has been one of reactionary spending, based on what we usually consider corporate crisis management. The day after George Floyd was murdered, we were overwhelmed with calls from mid-sized companies in the greater New York area across the healthcare, manufacturing, advertising and technology sectors to inquire about consulting. They couldn't clearly explain what their company's problem was, other than “emails of frustration."

The vague research in the D&I market suggests that diversity is an $8 billion spend by American corporations annually. But, as New York University professor and author Pamela Newkirk elaborates in Diversity, Inc., we haven't benefited much from the spend—not just with diversity quotas. The corporate world has not created adequate evidence of growth in this area for the rate of increase in financial productivity.

Formal D&I has evolved to diversity, equity, inclusion & belonging, and as we like to sum it up:

Diversity is a reality,

Equity is a choice,

Inclusion is an act!

Belonging is a result.

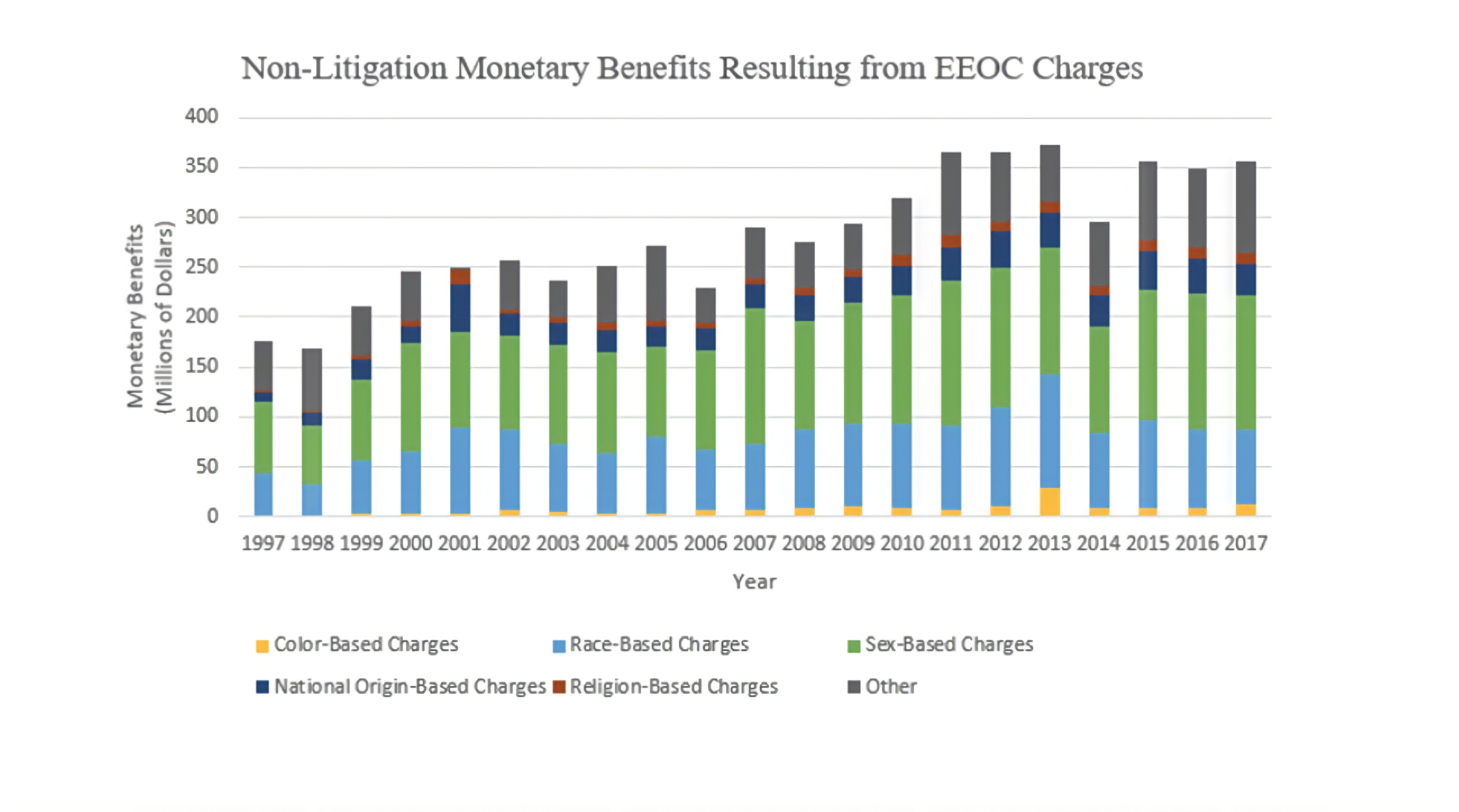

The last items—equity, inclusion and belonging—are a target on a much larger, more tangible, market risk. The $500–600 billion market of corporate turnover is regularly correlated to a lack of satisfaction in one's corporate environment, and it is more expensive than the lawsuits and even the $300 million market of non-litigation monetary benefits paid out from EEOC filings.

Still, 21st century solutions are on their way. An evolution in D&I or DEI or just plainly inclusion standards has been created by the ISO. This is serving as the new framework for structuring a new brand of inclusion insurance, based on parametric insurance that is designed to incentivize an execution of more internal corporate D&I policies with regular examination and execution.

When crises of diversity arise, [AM2] a fix-indemnity (or parametric) insurance is a new fixture in figuring out how to pay for either crisis management, which could mean staffing and consulting, or capital management, which could mean revenue loss or reduction in market capitalization. In a world where trending on Twitter can risk multiple percentage points of in market cap or failing to win a request for proposal (RFP) due to reputation, parametric triggers provide a more dynamic type of risk management.

D&I in 2021 is an Act of Reducing Insurance Premiums

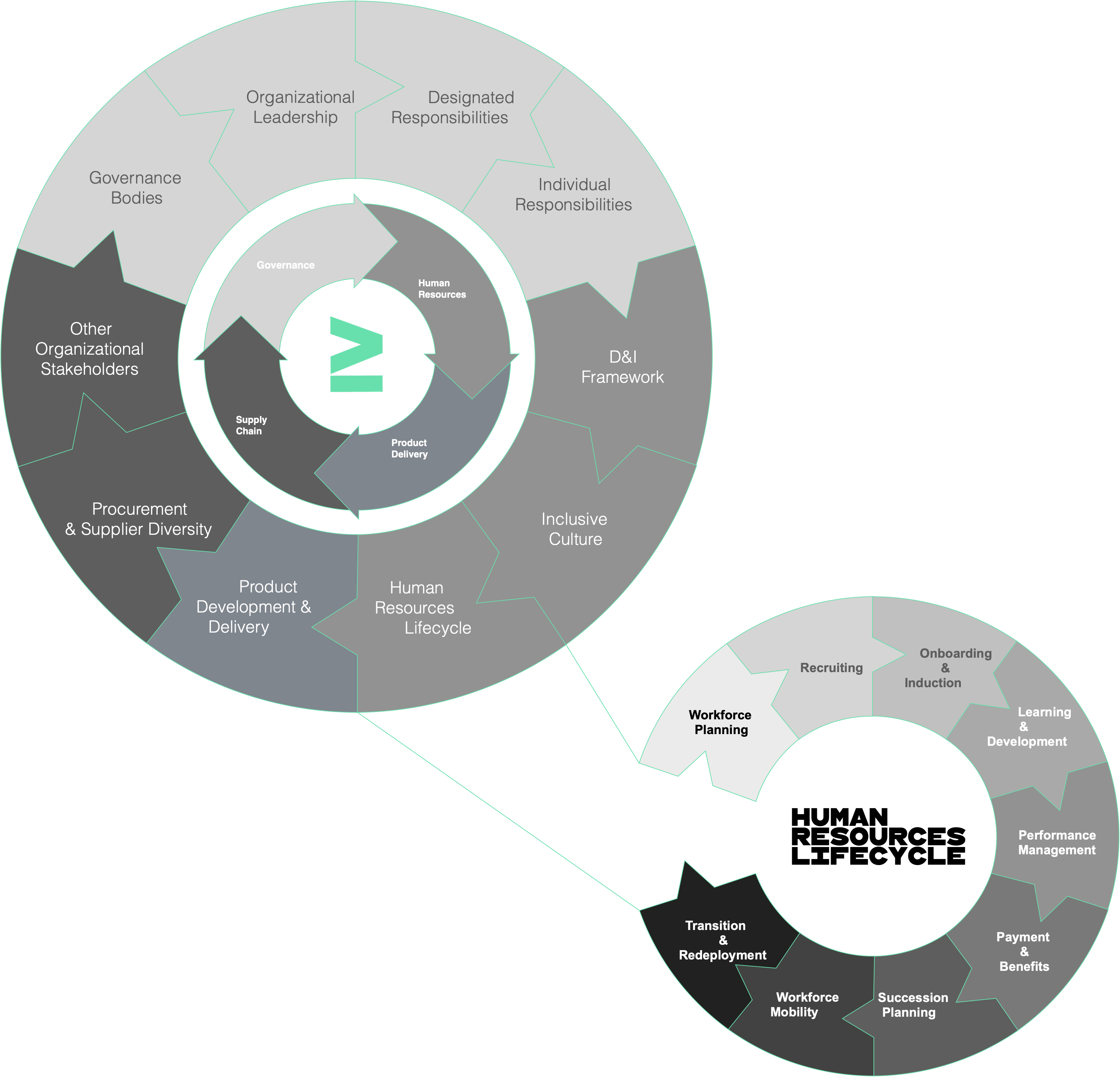

Regular self-assessment of actionable corporate inclusion policy reduces the cost of insurance policies. This new insurance gives the act of inclusion a tangible financial incentive. It is much broader than human resources lifecycle management and includes risk domains like: governance bodies, organizational leadership, designated responsibilities, individual responsibilities, the D&I framework, inclusive culture, product development, supplier diversity and other stakeholders.

Regular self-assessment of actionable corporate inclusion policy reduces the cost of insurance policies. This new insurance gives the act of inclusion a tangible financial incentive. It is much broader than human resources lifecycle management and includes risk domains like: governance bodies, organizational leadership, designated responsibilities, individual responsibilities, the D&I framework, inclusive culture, product development, supplier diversity and other stakeholders.

Let's not gloss over that last one. If your organization is one that relies on an increasingly complex supply chain of companies, you'll want to understand what that third-party risk is to your intangible reputation and to your ability to meet demand due to litigation and discrepancies in the changing corporate landscape.

When crises of diversity arise, the risk can be tied to one or more of the aforementioned domains. A fix-indemnity (or parametric) insurance is a new fixture in figuring out how to pay for either crisis management, which could mean staffing and consulting, or capital management, which could mean revenue loss or reduction in market capitalization. In a world where trending on Twitter can risk multiple percentage points of in market cap or failing to win a request for proposal (RFP) due to reputation, parametric triggers provide a more dynamic type of risk management.

Going forward inclusion ≥ diversity.

Meet James Felton Keith

Founder and CEO of Inclusion Score

Founder and CEO of Inclusion Score

James Felton Keith is an award-winning engineer and economist who was the first Black LGBTQ person to run for Federal Office in the USA. He lectures at New York University in the Big Ideas Course Series. As an activist, his Data Unions redefined the labor movement and personal-data as the natural resource driving all corporate productivity. As an entrepreneur, he established the first international diversity & inclusion certification and the first insurance for a lack-of-inclusion based on an "inclusion score". His bio-political philosophy, Inclusionism, is at the forefront of International Relations and Human Rights advocacy.

Inclusion Score (IS) holds the simple mission to standardize & incentivize corporate inclusion, with a vision of a time where corporate cultures consider a lack-of-inclusion as a risk. Its team of international relations & risk management pros are focused on demonstrating that inclusion ≥ diversity. IS was developed at Keith Institute in tandem with the development of the International Standards Organization (ISO) standard for Diversity Equity Inclusion and Belonging in 2018. IS helps clients of all size answer a simple question: Where do I start with D&I?

.png)