Preparing a Winning Underwriting Submission

While the reality of today’s underwriting is often, “Does this fit the box?” today’s hard market has caused many agents to scramble toward wholesalers and carriers with heartier appetites. However, submissions swamp today’s underwriters, and they may only scratch the surface of an application before responding, “No way!” How do you get your underwriting submission to the top of an underwriting stack? This article will explore how to present a solid underwriting submission for more complex risks that stand out from the pack.

|

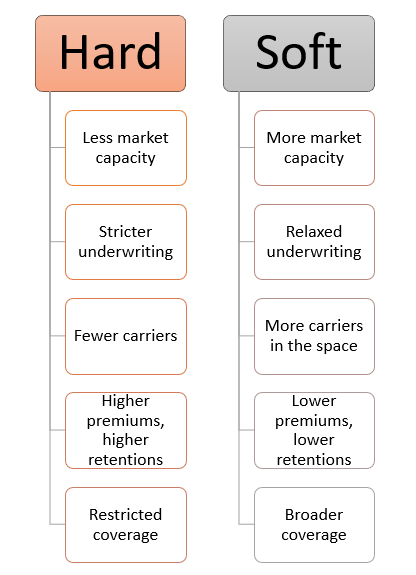

We know we’re in a hard market, and since so much has been written recently defining a hard market, I’ll simply post this graphic that outlines the differences between a hard and soft market.

While many submissions now go electronically, this article will explain more detailed risks that require more underwriting scrutiny. These include risks such as public agency risks where governmental entities require you to respond to their Requests for Proposal. It is these client arenas where your underwriting submission can set you apart from your peers. We’ll review recommended sections that can help sell even the most difficult-to-place accounts. Cover Letter – Every good submission should include a cover letter. The cover letter should not be generic; it should be an overview of the company you’re pitching to the underwriter. This is where you, in a few short paragraphs, “sell” your client to the underwriter. Outline the strengths of this particular insured, and why that account is a good fit for that carrier. Include items such as these.

In your cover letter, state your “need-by” date. Explain, as well, why you’re shopping the account. It could be many reasons, including any of the following.

Think of your cover letter as an executive summary similar to one you would find in a white paper. The Application – Your application must be account specific. Make sure you fill out the application completely, with the correct coding and clear explanation of the operations. Never rely on the underwriter to fill in the blanks, because this can lead to many problems down the road if the underwriter does not understand the account. Use your agency system to create ACORD apps. If you need to use a carrier’s supplemental apps and/or if you are submitting non-ACORD lines of business, be neat and clear. Be sure the Named Insured is verified with the state’s Attorney General’s website. Be extra sure that the named Insured personally reads, agrees with, and signs each application in the submission. According to one underwriting expert, underwriters work from the simplest to the hardest. The more organized and easier to understand your submission, the more likely an underwriter won’t set it aside for “later.” Narrative –Your narrative is an expanded executive summary. Here are some key points you can cover. However, you must be succinct because “tick tock,” right? Predict any, explain any red flags – things that might worry the underwriter, for example, an elderly business owner, and provide reassurances, that the risk will have longevity by showing that there is a perpetuation contract with a 42-year-old nephew.

With your succinct but thorough narrative, you are selling your client to that underwriter and carrier, because the account may need to go through several layers of underwriting approval before the carriers says, “Yes!” The Account’s Management Team – Here are some of the topics you want to cover about your client’s management team.

Premises – Here we’re back to COPE, so here are a few suggestions about account disclosures.

Location – Some thoughts about location can help, especially in harder-to-place exposures such as single-room occupancy, wildland urban interface areas, etc.

Employees – How the insurer manages its employees is an important part of enterprise risk management. Especially when submitting applications for employment liability or workers’ compensation, furnish these details.

Equipment – Equipment claims can impact the commercial general liability policy, the business auto and business owners policies. Here are a few items to cover in your submission.

Remember that many insurers will send an inspector to review at least the outside premises, and some now use drones. According to Deloitte, insurers use drones pre-loss for “risk engineering and pricing – Aerial site assessments can identify property features that allow the owner either to seek a reduced risk profile or to take appropriate actions to lower overall risk and justify premium discounts.” Warn your client that if they have clutter or their property appears unkempt, this can impact their acceptance. Safety Culture – Especially in construction, the safety culture of an organization is critical to reducing injuries and third-party liability claims. Is your potential insured addressing these key areas?

Classification Peculiarities – Explain anything that deviates from what you’d expect to find in that classification.

Dispersion or Concentration of Insured Values– Locations of buildings are important

If five or more buildings are not connected, there may be a commercial lines credit. Not all underwriters know about this credit. Remind underwriter in the narrative that the account qualifies for that credit. Loss Experience – The applicant’s loss history is especially important. Simply furnishing a recent loss run with losses may immediately rule out your applicant. Here are some steps you can take to present those losses in a broader light.

Agent’s Connection or Relationship with Applicant – How do you know the applicant? Have you handled their account for many years or was this the result of a cold call? Similarly, I’d always disclose if the client is a relative. Of course, the longer you’ve known the applicants or handled their insurance, the stronger your submission will be to most underwriters. Other Submission Items – Just when you thought we were through making suggestions, wait, this is important. Here are some other facts that can make your underwriting more likely to accept the risk.

Underwriters’ Top Ten Pet Peeves A few years ago, I surveyed underwriters to learn their top ten pet peeves. Here were their top pet peeves, and I only think in this current market, they have zero tolerance if finding any of these issues.

If you become known as a market burner in the industry, it will be harder for you to place difficult risks. Don’t waste an underwriter’s time. Send an email, call, but don’t burden underwriters or waste your time sending apps to companies that will not entertain that risk. Develop an Underwriting Submission Template Rather than recreating the wheel when working with complex clients, use this article’s main categories to develop a submission template. It will save you time if you start each large submission from a template. In Conclusion Your reputation depends on your honesty. When your client has some bumps in the organizational history, you need to be honest yet able to explain them. Every application should be all of the following because your reputation will follow you through the industry, even if you change agencies or venture out on your own.

Provide the underwriter with the “good, bad, and ugly,” no matter how it lands with the carrier. The more information you provide, the better the underwriter can accurately price the account. Virginia Bates, a Massachusetts-based national agency and brokerage consultant, points out that the recent soft market lasted almost twenty years. “Many producers never knew what a hard market was until it hit them between the eyes. Even tenured producers have a hard time remembering how to work in a hard market. “This is a timely article to acquaint and reacquaint the techniques to get accounts written and renewed in a hard market,” according to Bates. Build Relationships With more and more business going to surplus lines carriers and wholesale brokers, it’s more important now than ever to build strong relationships with underwriters. While we all strive to build our knowledge, we can’t know everything there is to know about coverage, especially coverage we don’t routinely place. Building strong relationships with underwriters who can guide you when asked will pay big dividends. While some of these may seem redundant or easily combined, these are the top areas you can address to sell your client to a perhaps reluctant underwriting team. For Big I members, our Hard Market Toolkit is available at this link. Know the Underwriting Red Flags for That Niche. As more and more agents specialize in various areas, here’s a tip I learned from an agent. He submitted an application for a non-profit that performed clinical trials. To the underwriter, this translated to “research” and all he received is declinations. Once he drilled down and understood the underwriters’ concerns and explained that “clinical trials did not include ‘research'” he received four quotes and was able to successfully place the business. Had he known that going in, his submission could have included in big bold letters in the cover letter: “This non-profit does not do research.” Knowing and explaining any potential red flags before the underwriter rejects the application can save you valuable time. I will end with this quote from one of our Ask an Experts. “Sometimes a submission is putting a bow on a quality package and sometimes it is about putting lipstick on a pig. Drawing the underwriter into the story to [build] a desire to write the account is an important step in the process.” Last Updated: March 25, 2024 |

Copyright © 2026, Big “I” Virtual University. All rights reserved. No part of this material may be used or reproduced in any manner without the prior written permission from Big “I” Virtual University. For further information, contact nancy.germond@iiaba.net.